Telecom Stocks Dividend Yields

Companies / Telecoms Jan 16, 2011 - 05:09 AM GMTBy: Richard_Shaw

Those investors who are skeptical about dividends from the major telecoms AT&T (T) and Verizon (VZ), point to the declining wireline revenues as a factor putting the sales growth and dividend stream at risk. Clearly, telecoms don't have the utility-like stability of decades past, but we think fears are overstated.

Those investors who are skeptical about dividends from the major telecoms AT&T (T) and Verizon (VZ), point to the declining wireline revenues as a factor putting the sales growth and dividend stream at risk. Clearly, telecoms don't have the utility-like stability of decades past, but we think fears are overstated.

Telecoms today are not just about phones, wired or wireless, but also about data delivery in competition with cable companies for internet and TV services. We think that provides an important revenue replacement source for the declining wireline business.

In this week's Kiplingers, they said "The popularity of TVs with Internet connectivity may cause big headaches. More than a fifth of the 210 million TV sets sold last year had built-in Internet access. By 2014, the share is likely to rise to 50%…adding up to about 122 million TVs a year.

That sets the stage for a bandwidth crunch." Kiplingers also says that Netflix currently generates 20% of peak internet traffic in the U.S.

The broadband shortage will require more investment in delivery capacity, as well as perhaps some new technologies to get more out of existing internet throughput capacity. That investment will be done by both cable companies and telecom companies, and will result in an important source of revenue growth for the telecoms.

Standard and Poor's currently feels that the dividend at T and VZ are not in great peril. They say "In our view, telecom providers are generating sufficient cash to support their dividends, although well-above-average dividend yields indicate that investors have concerns, which we view as largely unfounded."

Past is not the future, but it is encouraging to know that T and VZ have paid higher dividends each year during this difficult economy.

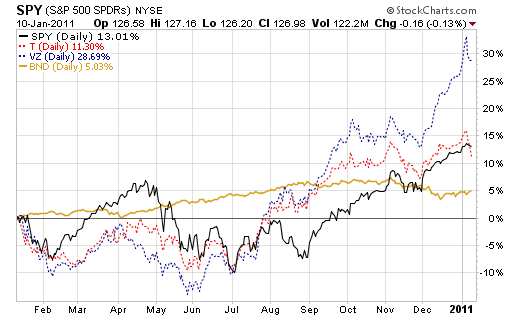

The downturn in the prices of VZ and T recently may have more to do with investors trying to figure out the impact of the Verizon iPhone than the long-term financial and dividend picture for those two companies.

We hold both T and VZ as long-term equity income components of our portfolios with income needs.

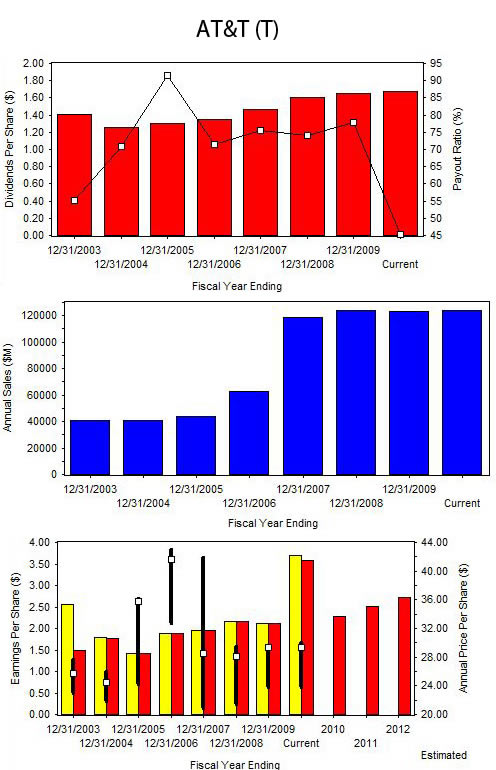

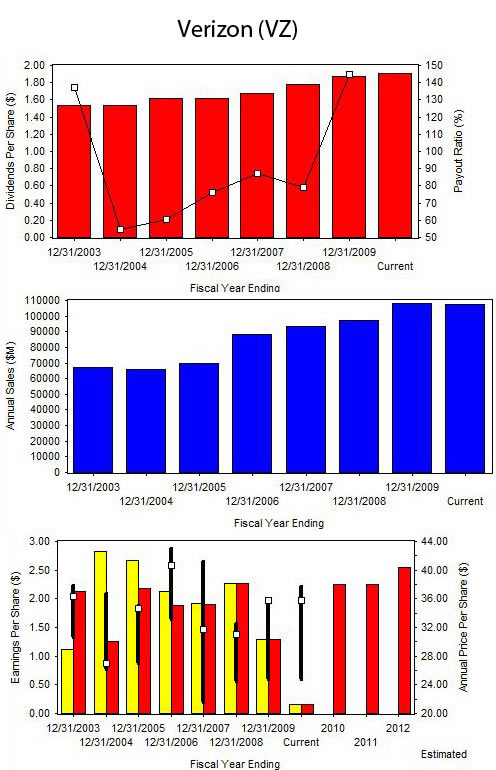

Their dividends have been stable or growing. Here are multi-year histograms of their dividends (red), sales (blue) and earnings (yellow for reported earnings, and red for continuing earnings):

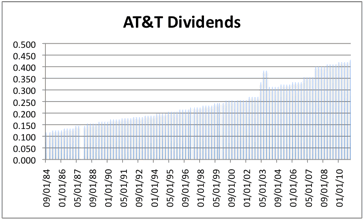

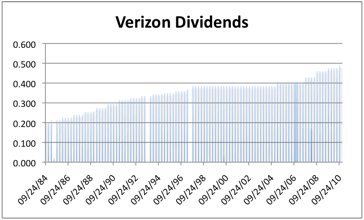

Each company has paid some level of dividends since 1984. The following charts of their dividends is taken from Yahoo Finance.

Note that dividend history from Yahoo is only semi-reliable (tendency to miss some payments or to sometimes include capital gains for investment funds, and perhaps sometimes just have a bad "print"), but the data is good enough for the big picture. For these two telecoms, the big picture is favorable with respect to dividends over a more than 25 year period.

While not a slam dunk, we think these two major telecoms present a reasonable equity income alternative.

Securities Symbols Mentioned In This Article:

T, VZ

Holdings Disclosure:

As of January 11, 2011 we hold positions in some but not all managed accounts for the following securities mentioned in this article: T and VZ

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2011 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.