Liquidity to drive global Bull Markets in 2007

Economics / Liquidity Bubble Jan 25, 2007 - 07:41 AM GMTBy: Clif_Droke

It may not be apparent yet, but the story of the next six months will be the improvement in monetary liquidity and the subsequent bull market in stocks that accompanies it.

The previous two years were notable for the decline in monetary liquidity as shown in the Federal Reserve money supply statistics. It almost seemed that the Fed wanted to bring the economy to the very brink of recession before priming the credit pump once again at the last possible minute. The Fed very nearly succeeded in bringing about a recession but thankfully this threat has now been averted. Listening to some mainstream economists and financial analysts talk, one gets the impression that the threat of a further economic slowdown is still a very real one. But such is not the case, a point we'll try to make in this commentary. Indeed, monetary liquidity hasn't looked this good in years.

Everyone knows that in the real estate business it's all about “location, location, location.” One of the first lessons a trader or investor must learn is that when it comes to the financial markets, it's all about “liquidity, liquidity, liquidity.” When liquidity expands it sooner or later translates into rising stock prices and a strong economy; when it contracts it eventually forces stock prices lower and, if the contraction continues long enough, it brings down the economy. The correlation between percentage changes in monetary liquidity and stock prices is so well documented it's amazing there are even today detractors of this truism.

Not only is domestic liquidity on the rise, but global liquidity is still at record levels and looking for somewhere to go. The two most likely candidates (in fact, the only major candidates) for this excess money are the U.S. stock market and the major global equities markets. Both have been obvious beneficiaries of the gradual re-emergence of the stock investor and both should continue to experience its positive effects further into 2007.

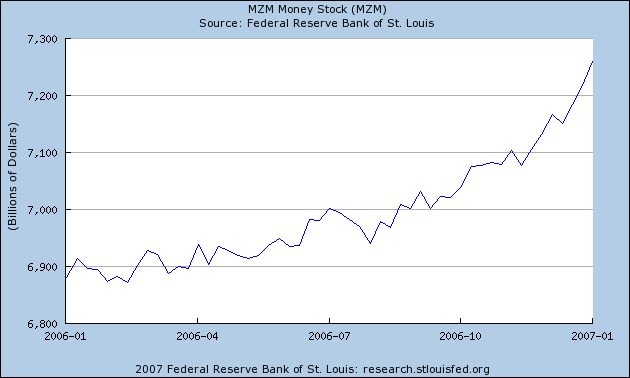

The increase in the M2 and MZM money supply measures continues to be the big story that hardly anyone is talking about entering 2007. It's one reason why growth stocks should make a comeback this year and why already growth stock mutual funds and ETFs have made quite a turnaround in the past few months. Speaking of growth stocks, the Russell 1000 Growth Index (RLG) closed Friday at a 5-year high of 568.25 and is picking up some upside momentum which is favorable for the interim outlook (see chart below).

Not only is money supply increasing but so is credit. An article in a recent edition of the Financial Times made mention of the surge in collateralized debt that is expected to prolong the “easy credit” boom. According to FT, the issuance of securities linked to debt portfolio debt “swelled dramatically” in 2006 and according to credit analysts is a trend that is expected to continue in 2007. FT noted that estimates of activity in this sector suggest that more than $2,500 billion of collateralized debt obligations (CDOs) were issued last year, more than six times higher than in 2004. FT noted that “The explosion of CDO issuance is fuelling demand for debt products, helping keep the cost of borrowing in markets relatively low.”

This low cost of borrowing and surge in credit will serve to extend the bull market in stocks in 2007. We're already seeing an early taste of a more generous securities lending stance on the part of the Federal Reserve as recent securities lending actions have shown. There was a very substantial increase in securities lending between Dec. 28 and Jan. 3 that paved the way for the recent rally in the NASDAQ, the financial, the healthcare, and growth stock sectors we've seen thus far in early 2007.

Earlier in this commentary we alluded to the real estate market. We've been hearing so much about the "death" of real estate for so long it's almost like a broken record. And like any proverbial broken record in the financial marketplace, it's a tune that's no longer current. Since last fall we've pointed out that the REITs, as represented by the Dow Jones REIT Index (DJR), were sending an undeniable signal that the real estate recession was going to end soon. The REIT stocks are a leading indicator for the actual real estate market and the screaming upside move in the DJR index from July until December was saying to all who would listen, "Real estate isn't in as bad a condition as most think!"

We've also been hearing quite a few commentators make statements to the effect that 2007 will witness an acceleration of the housing downtrend from 2006, or that the housing market recession hasn't bottomed yet. The leading indicators argue quite convincingly otherwise and the steady, impressive increase in monetary liquidity in the past few months will virtually assure a soft landing and probably even a mild upturn in the real estate broad market by no later than summer.

The increase in liquidity should definitely help out the real estate market in 2007. This much has already been made apparent by the stratospheric upside move of the REITs in the latter part of 2006. Lower interest rates, increased mortgage lending and the bottoming in lumber prices all point to the inescapable conclusion that reports of real estate's demise are entirely premature.

How much has the economy improved since the Fed began pumping M2 and MZM money not long ago? A lot more than mainstream analysts will admit. Here on Topsail Island, a second mini-building wave has started after a temporary lull of activity in 2006. Winter is the time of year when most realtors are busily engaged in mailing promotionals for beach cottage rentals for the upcoming summer tourist season. One local realtor recently received more than 200 deposits on summer rental houses just one week after sending out promos. This was his biggest response ever and it contrasts with lackluster returns a year ago. This isn't just an isolated incident and it shows the effects not only of increased money supply and improving economic conditions, but it also it shows an improvement in consumer sentiment in interim prospects for the economy.

If you listen to the bears you'd be under the impression that mortgage lending has all but dried up thanks to last year's spike in interest rates and declining in nationwide housing values. The always on-target Dr. Ed Yardeni has noted that not only is bank credit expanding rapidly, but it's being led by mortgage lending! According to Yardeni, even home equity loans are increasing again at the banks.

Yardeni notes that bank credit is up 9.4 percent year-over-year while bank loans are up 10.3 y/y. Mortgage loans at banks rose $373 billion over the past year and were up $589 billion through the third quarter of ‘06. He further points out that while home equity loans were flat through the first nine months of 2006, they suddenly rose $19 billion from mid-September through the week of November 22. "Real estate loans are rising at a record pace again," he writes. Bank deposits were up $454 billion, or 8 percent y/y, through November ‘06 according to Yardeni.

One more comment is worth re-printing from Yardeni and it should especially be noted by all the bears out there who are calling for a super crash in housing in the near future, yet who are still bullish on gold/oi/commodities. He writes: "...if the housing bubble bursts, so will the bubble in emerging economies, followed by the bubble in commodity markets, and so on. To me, it looks more like America is driving and benefiting from global prosperity. Our economy is one of the most capitalistic on earth. Capitalism creates prosperity and wealth mostly by creating capital gains. These gains are not ill-gotten. They are not bogus. They are not ephemeral – if they are based on incomes that are rising along with productivity."

The truth of the matter is that the prosperity of middle America is based largely on real estate wealth and there is no way the powers-that-be are going to let real estate collapse before the appointed time. The average American has more liquid assets and purchasing power today than ever before largely thanks to home values (recent setbacks notwithstanding) and that isn't going to change anytime soon. Until the global economy is completely and fully integrated it will continue to rely heavily on America's financial prosperity...and that means a buoyant real estate market. As noted in my book, "America's Housing Bubble," we have a few more years yet until real estate enters what could be a major malaise and that period isn't likely to begin before 2010-2011.

Stock markets worldwide are experiencing bull markets. This favorable group movement of the major stock market indices abroad is exceedingly bullish for the intermediate-term U.S. broad market outlook. Here at home, we also find that the major stock sectors and industry groups are participating in relative harmony on the upside. The Group Movement Index (GMI) which is comprised of eight major industry groups and which measures the extent to which sector rotation is taking place in the U.S. stock market is still in a bullish phase entering the first quarter of 2007. The GMI has been in a rising trend for the past few months and has made new highs for five of the last six weeks. The only laggard among the eight major industry groups in recent weeks has been the Utilities. Seven out of eight groups strongly participating in this bull market isn't bad and this tells us that higher prices can be expected in the coming weeks and months.

Most impressive among the major sectors has been the recent breakout among the financials. Led by Merrill Lynch (MER), one of the main leading indicators for the broad market, the financials are on a great footing entering the New Year and recently made all-time highs as measured by the Amex Broker/Dealer Index (XBD).

Another thing that should begin to happen in 2007 is the gradual abatement of the fear-and-terror plague that has dominated the landscape since 2004. Fear and worry have been rampant in the years since 2004 and not just in the financial markets. The mainstream media did much to stoke the fires of this fear (which is one of the primary reasons for the existence of the press, viz., to stoke fear and greed at various intervals). The press succeeded in inflaming the passions and fears of multitudes of investors in the past, and this explains the conspicuous buildup in the percentage of investors describing themselves as being “neutral” in the weekly AAII sentiment polls since 2004. This large contingency of fence sitters represent a massive amount of sideline cash and once these sideliners begin re-entering the stock market (they already have) we'll see a corresponding increase in both volumes and prices.

If 2005 and 2006 were collectively known as the “Years of Fear” then 2007 will probably be known as the year that fear dissipates, at least long enough to encourage the record amounts of sidelined capital back into the equities market. Extreme fear always gives way to extreme greed and the penultimate manifestation of greed is a spike in stock prices in which the public is heavily participating. We haven't yet arrived at that point but when we do we'll know the next market top is nigh at hand. Until then, investors should stay bullish and remain flexible to take advantage of the many opportunities the market presents in 2007.

By Clif Droke

www.clifdroke.com

Clif Droke is editor of the 3-times weekly Momentum Strategies Report which covers U.S. equities and forecasts individual stocks, short- and intermediate-term, using unique proprietary analytical methods and securities lending analysis. He is also the author of numerous books, including most recently "Turnaround Trading & Investing." For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.