U.S. Dollar, Gold, & Silver Were Down on Thursday – Really?

Commodities / Gold and Silver 2011 Jan 14, 2011 - 11:09 AM GMTBy: J_W_Jones

The U.S. Dollar Index Futures have been sold heavily and interestingly enough, gold and silver have not rallied. In fact, gold and silver have sold off while the dollar experienced downward price action as well. How does that whole scenario make any sense? I do not fancy myself as an expert in the area of reasoning why a stock or commodity rises or falls. I firmly believe that the media is nearly always wrong as to the real reasons stocks and commodities are rallying or falling.

The U.S. Dollar Index Futures have been sold heavily and interestingly enough, gold and silver have not rallied. In fact, gold and silver have sold off while the dollar experienced downward price action as well. How does that whole scenario make any sense? I do not fancy myself as an expert in the area of reasoning why a stock or commodity rises or falls. I firmly believe that the media is nearly always wrong as to the real reasons stocks and commodities are rallying or falling.

I believe that the market is a giant discounting mechanism. The market discounts news, political variables, and the future supposedly. It is hard to know if the future is actually priced in, but the experts say that it is as do the academics, therefore we might as well consider it fact else be thrown to the proverbial wolves. The point in all of this is that I have no earthly idea why the U.S. Dollar, gold, and silver were all sold on Thursday. I would also point out that light sweet crude oil futures closed the day lower.

I can't believe I am about to say this, but I believe the U.S. Dollar Index may be setting up to rally here. If we take a look at the daily chart of the U.S. Dollar Index Futures we can see that the dollar has been under serious selling pressure accompanied with high volume. However the price action represented on the chart below illustrates that support is located around its 50 period moving average. It might take several days before the U.S. Dollar forms a bottom, but should it start to rally it may attempt to break out over recent highs.

Time will tell, but the U.S. Dollar has several support levels that should help support the price action and push prices higher. A rally in the U.S. Dollar would be somewhat contrarian as most people are expecting a pullback. I am not trying to imply that the U.S. Dollar is going to rally for the next 5 years. I am trying to point out a short term rally in the dollar is possible right now based on the daily chart. I would urge caution for those who are leaning heavily into shorting the dollar as it could backfire, particularly if gold, silver, and oil are unable to rally on dollar weakness.

The U.S. Dollar Index futures (/DX) traded lower on heavy volume today yet gold futures (/GC) closed the trading session down around $11.70 / an ounce or (0.83%). We have all been conditioned to believe that the U.S. Dollar Index and gold move inversely with one another. For those of you that say this inverse relationship is constant I would love an explanation of how this happened. I have been ridiculed for discussing the possibility that gold and silver could go through a correction. When we look at the gold futures daily chart, the price action is ominous as it is currently trading below its 50 period moving average while it has put in a lower high.

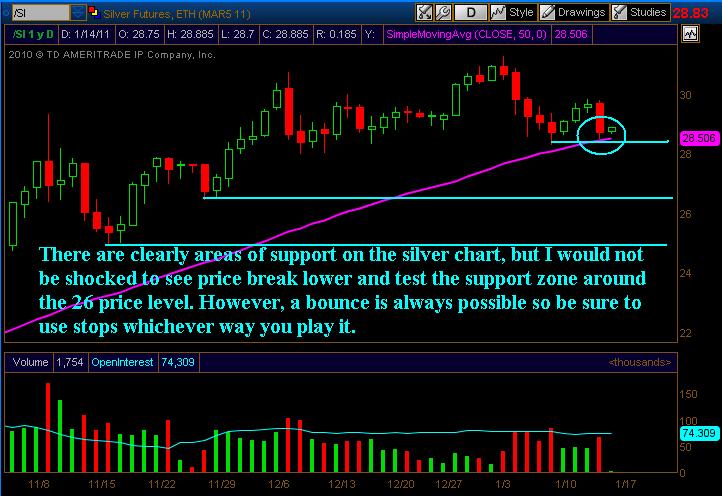

In addition to the selling pressure in gold, silver futures were unable to move higher on the lower dollar. In fact, silver futures closed trading down by nearly $0.42 an ounce, or (1.45%). Silver performed worse on a lower dollar than gold. The daily chart of silver futures (/SI) reveals that price is testing the 50 period moving average and at this point a rally is still possible. The daily silver futures chart is shown below:

Another reason to be cautious of precious metals in the short run is the price action in the gold miners ETF GDX. The daily chart of GDX leaves little to the imagination as it was sold off heavily on Thursday. GDX traded lower by $1.85 / share or (3.20%) which is not exactly a great way to demonstrate relative strength in the marketplace. The action in GDX on Thursday was quite simply ugly and more selling could transpire in coming days. The daily chart of GDX is illustrated down below.

It remains to be seen if the price action today in the U.S. Dollar, precious metals, and the miners really means much of anything. However, it would be foolish to ignore the price action in the metals and the U.S. Dollar Index. The divergence from the norm could be a warning that gold and silver are about to go through a correction. The price action in GDX would be supportive of that conclusion and the dollar trading down near a support level where a bounce higher is likely also point to potentially lower prices in the precious metals complex.

In the short term I am very cautious with regards to precious metals and the miners, while I am cautiously bullish about the U.S. Dollar Index in the short run. For those trading precious metals, the U.S. Dollar, and the gold miners risk is excruciatingly high.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.