Rising Consumer Inflation: The New World Order By Commodity

Economics / Inflation Jan 13, 2011 - 05:36 AM GMTBy: Dian_L_Chu

Ever since the Great Recession, inflation has been put on the back burner, and deflation is seen as the greatest risk to the U.S. economy. Even as recent as Friday, Jan 7, Federal Reserve Chairman Bernanke told the Senate Budget Committee that low inflation/deflation was a concern, as well as unemployment (more on the jobs situation here.)

Ever since the Great Recession, inflation has been put on the back burner, and deflation is seen as the greatest risk to the U.S. economy. Even as recent as Friday, Jan 7, Federal Reserve Chairman Bernanke told the Senate Budget Committee that low inflation/deflation was a concern, as well as unemployment (more on the jobs situation here.)

Deflation Concern Lead To QE2

In fact, Bernanke said the continuing high unemployment and low inflation had prompted the Fed's decision to purchase another $600 billion of U.S. government debt (QE2) to further stimulate the economy.

So far, the two inflation measures—Consumer Price Index (CPI) and Producer Price Index (PPI)—have not proven him wrong yet, as both indexes have been subdued in recent months.

Well, expect this nice peaceful trend to change as early as the December CPI and PPI releases this week.

Pent-Up Inflation Pressure Up The Supply Chain

During the past decade, Finished Goods PPI has risen roughly 35% while the CPI was up about 30%, which seems to suggest producers typically pass through most of the cost increases to the end market.

And news such as the following could only mean that there’s pent-up inflation pressure up the supply chain just waiting to be passed through:

- Commodity prices jumped to two-year high on expectations for global economic growth and lower U.S. forecasts for agricultural inventories.

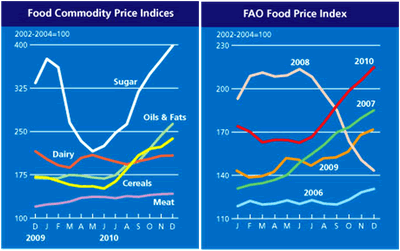

- The Food Price Index (See Charts Below) compiled by the U.N. Food and Agriculture Organization (FAO) surged 25% in 2010 and hit an all time high in December, at the level even worse than the food crisis in 2008. FAO acknowledged that this is unlikely the peak yet.

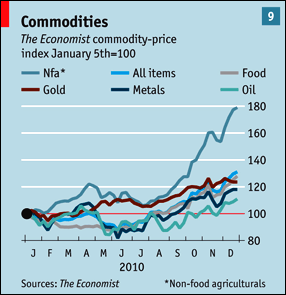

And if you think the 25% spike in food prices seems extreme, wait till you check out the Non-Food Agriculture (NFA) prices. The chart below from The Economist shows that the NFA prices were up almost 80% in 2010! NFAs are agricultural materials with heavy industrial applications such as cotton and rubber.

Fixed-Price Terms Gone For Good

Now, many (including Bernanke) posit that since raw materials now account for a smaller percentage of input costs, the record commodity price inflation will not necessary translate into price increases in end markets.

However, I believe that argument was valid in the pre-China era when commodity prices were relatively predictable, easier to hedge, labor costs were low in the developing countries where most of the manufacturing activity took place, and fixed-price and/or fixed-escalation clauses were the norm in contract terms.

Commodities Weigh on Cost Structure

With record surging commodity prices, raw materials are becoming a bigger component of company’s cost structure. Many goods and services producers are now starting to index their supply contracts to input materials to adapt to this New World Order of Commodity.

For example, the latest such movement involved rare earth metals, which are key materials in Fluid Cracking Catalysts (FCC) used in the refining process to produce gasoline.

WSJ reported that due to the skyrocketing rare earth metals prices, chemical companies have started indexing the cost of their catalysts to rare-earth price movements. WSJ further noted that the added costs from rare earth metals, although not significant to make consumer notice, is enough to make some refiners to think about cutting production.

This just illustrates either the cost gets passed through, or there could be production cuts as a result--both translate into higher prices for consumers. .

Raising Prices Could Mean Losing Business

Basically, Fed’s QE has devalued the dollar while propping up everything from stocks to commodities, but with very little impact on the labor market. This has resulted in two totally disjoint pictures between the corporate profit and the general consumer/labor market.

The Standard & Poor’s GSCI Spot Index of 24 commodities has rallied 21% in the past year, and is expected to stay on the uptrend partly on expectations for global economic growth. Meanwhile, the spread between the 10-year note and Treasury Inflation Protected Securities (TIPS) which represents expectations for consumer prices, widened to 2.40%, near an eight-month high.

As inflation expectations and commodity prices are rising, corporations could face headwinds when they need to start raising prices, and lose business, due to a still weak consumer market, or face margin and the subsquent stock price pressure.

Respect the New World Order By Commodity

In today’s environment, the best way to hedge inflation is probably to invest--through patience and discipline--in commodities (See here for investment options) and stocks (via a broad index fund such as SPX) on pullbacks.

And keep in mind there are two things for certain--inflation will be steadily rising no matter what time frame you are looking at...and prices of commodity and stock will have pullbacks.

Disclosure: No Postions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.