Krugman's Straw-Man Market System

Economics / Economic Theory Jan 12, 2011 - 12:21 PM GMTBy: William_Anderson

A friend of mine a decade ago was looking to do doctoral work in economics, and one of the places where he inquired was his state's flagship university. But he decided not to seek his doctorate at that particular place after he spoke to someone who was just about to defend his economics dissertation there.

A friend of mine a decade ago was looking to do doctoral work in economics, and one of the places where he inquired was his state's flagship university. But he decided not to seek his doctorate at that particular place after he spoke to someone who was just about to defend his economics dissertation there.

This soon-to-be PhD, it seems, was not familiar with the term "opportunity cost." (He was specializing in so-called macroeconomics, which tends to embrace every Keynesian fallacy and a few extras, so perhaps it should surprise no one that this person was not familiar with concepts of scarcity: Keynesians believe that governments create wealth by fiat.)

I recount this story after reading a recent post by Paul Krugman on his New York Times blog, in which he claims that free markets are responsible for the bad food in Great Britain and the lack of central heating in Mexico City. He writes,

Felix Salmon marvels at the absence of central heating in Mexico City, and suggests that the city is trapped in a bad equilibrium: nobody has heat because nobody has heat.

This reminds me of a piece I had fun with many years ago, on the stubborn persistence of bad food in England. My hypothesis was that too-early urbanization, taking place before it was possible to bring lots of fresh food in from the countryside, established dismal dietary habits that were hard to break.

Of course, if you take such things seriously, they are bad news for the notion that markets maximize utility, even in fairly trivial matters. Or maybe not so trivial: it's hard to overstate just how bad English food was in the early 80s. (emphasis added)

Like the economics graduate student who could not comprehend the economic equivalent of 1 + 1 = 2, Krugman has not so much debunked free markets as he has demonstrated his own economic ignorance. If there is a failure here, it is not with free markets as such, but rather with what is taught in modern academic economics, which has managed to replace a logical system of thought with mathematical mishmash that claims its own "market test."

First, and most important, I have never read anywhere (at least in the Austrian literature) that "markets maximize utility." What Krugman is saying — and what Austrians debunk — is that one's "utility" can be subjected to cardinal measurements, and that it is theoretically possible to compare one person's "utility function" with that of another person.

While Krugman's point is consistent with the claims of Jeremy Bentham, nonetheless the notion of "cardinal utility" was long ago rejected by thinking economists. That does not prevent academic economists from creating "utility functions" and Lagrange multipliers using goods, their given prices, and an income restraint as the mechanisms for measuring such "utility maximization." (Technically, one is supposed to maximize the "optimal" combination of goods as opposed to actual utility, but often that point gets lost in the translation.)

Second, Krugman is claiming that markets actually foster a "path dependency" in which people are led via market mechanisms to an "equilibrium" in which people could be made better off if only they could shake off the chains with which free markets have bound them. The claim is that people already "know" what would be a better product and also the path to going there, but free markets won't permit them that option.

This is curious logic, but nonetheless it is part of the current curriculum at "elite" academic economics programs. There is no end to "market failures" if one employs such thinking. For example, I would love for a high-speed railway to stop right in front of my house in rural Garrett County, but I doubt such a railway would come to fruition.

Heck, I would like for one of the telephone companies to be willing to run a high-speed Internet cable past my house so that I could do away with the satellite Internet system I currently have, and no doubt Krugman would claim that this situation is another example of market failure. (I am not willing to pay Comcast or Verizon the $2,000 or more in up-front costs to string a line to my house.) The problem, however, is not the nature of markets per se, but rather how Krugman and modern academic economists define them.

Typical college economics textbooks do not explain markets so much as they set up straw men that supposedly represent markets. After setting up their straw man, the textbook authors (usually well-known academic economists such as Krugman) then tear down the example by showing how the "perfect competition" hypothesis "fails" if an individual firm faces anything close to a downward-sloping demand curve.

These might be clever academic exercises, but they tell us nothing about markets and even less about the concept of "market failure." I will give an alternative example, but I won't go to Mexico City. In fact, I won't even leave my house.

My family and I live on a rural road in Garrett County, Maryland. Because we are located on the Allegheny Plateau (the average elevation of Garrett County is about 2,300 feet, making it one of the highest counties in the Eastern United States), we tend to have cool summers and cold, snowy winters.

Few homes in Garrett County have central heating and air conditioning, except for the "McMansions" that are built by very wealthy people near Deep Creek Lake in the western portion of the county. Many new houses here (including mine) are modular, which means they were built in a factory and then shipped here in large, ready-to-assemble pieces.

If I wanted to install a heat pump (given that there are no natural-gas lines out here and I have not opted for propane-gas heat), I could do so, but I believe it would be a waste of time and resources. First, we don't really need it in the winter; we already have good heat with small electric heaters and a wood stove. Second, we don't really need it in the summer; our average high then is 78 degrees.

We do have air-conditioning window units, but during the past two summers we have run our unit only once. That is correct: we have turned the AC on only once in two summers, electing to use window fans instead on those days when temperatures creep above 80.

Furthermore, we are hardly alone in this matter. Some people in Garrett County have less heat tolerance than do we, but nonetheless very few people are willing to opt for a central, forced-air system that would cost considerably more to create and maintain than what we currently choose.

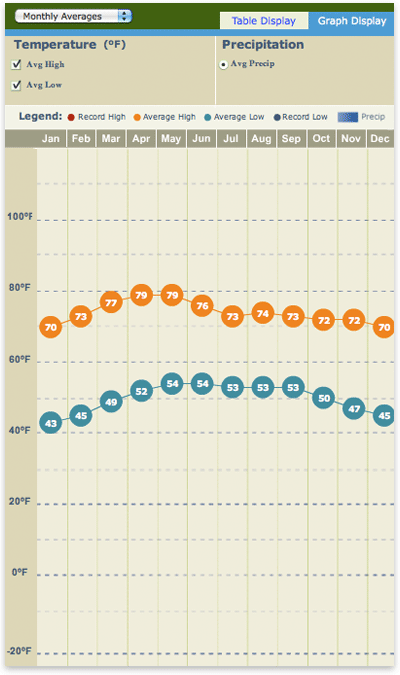

To put it another way, the heating and cooling systems used by people in Garrett County are adapted to the climate of the area. Likewise, we see the same thing in Mexico City, which has average monthly high (in orange) and low (in blue) temperatures as follows, according to Weather.com:

From this data, it is obvious that few people would find a need for central heating (or cooling) in Mexico City, given that it has highly consistent year-round temperatures. (That also is the case in other Latin American cities that are located at high altitudes and have consistent — and comfortable — temperatures.)

I am not sure how one can fashion a "market-failure" interpretation out of Mexico City's lack of central heat any more than one could declare that the dearth of heat-pump systems in Garrett County is the result of a "failure" of the market system. In fact, one can better argue that markets have created a wonderful system of alternatives to the forced-air central systems that Krugman apparently believes are the only acceptable means of heating and cooling.

During cold winter days, we burn wood that I can purchase from a neighbor who can cut, deliver, and stack a cord much less expensively than it would be for me to do the same, given my own opportunity costs. When summer temperatures move into the high 80s (once in a very long while, the mercury hits or goes above 90 here), we can use our window units, which we purchased much more cheaply than we could a central system, or we can tough out a very temporary situation with just our window fans.

Our modular house not only is well insulated but also has energy-efficient, double-pane windows that keep out the cold and wind (especially the wind, given that we are regularly hit with big blasts from November to March). In other words, the market has created wonderful ways for my family and me to reside in a lovely rural setting and yet mitigate the higher opportunity costs that come as a result of living away from a town or city.

I am not surprised that these things are lost on someone like Krugman, or most mainstream academic economists. Once one chases down the rabbit trails of "utility maximization" and the esoteric notions of "market failure," it is doubtful that one is going to understand simple opportunity cost.

Krugman's foray into British cuisine is even more bizarre than his claim that market failure is responsible for the lack of central heat in Mexico City. As a number of people have commented on his post, Great Britain has a wealth of ethnic-food restaurants that offer a wonderful alternative to the more bland fare of traditional British eating.

Again, this is lost on "economists" who insist on seeing the world in a highly stylized, mechanistic way. While Austrians see how individuals working through free markets have bettered their life situations, Krugman and his colleagues see only chaos, failure, and bad food.

William Anderson, an adjunct scholar of the Mises Institute, teaches economics at Frostburg State University. Send him mail. See William L. Anderson's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.