Gold Bullion Demand Surges in Middle East and Asia

Commodities / Gold and Silver 2011 Jan 12, 2011 - 06:28 AM GMTBy: GoldCore

Gold is marginally higher in US dollars while silver has risen by nearly 1% in all major currencies this morning. Risk appetite remains highs as seen in higher Asian and European bourses today. The US, Hong Kong and New Zealand dollar are weaker as are Australian and German government bonds (which rose 6 basis points and 4 basis points to 5.51% and 2.96% respectively).

Gold is marginally higher in US dollars while silver has risen by nearly 1% in all major currencies this morning. Risk appetite remains highs as seen in higher Asian and European bourses today. The US, Hong Kong and New Zealand dollar are weaker as are Australian and German government bonds (which rose 6 basis points and 4 basis points to 5.51% and 2.96% respectively).

Gold is currently trading at $1,383.29/oz, €1,065.88/oz and £887.27/oz.

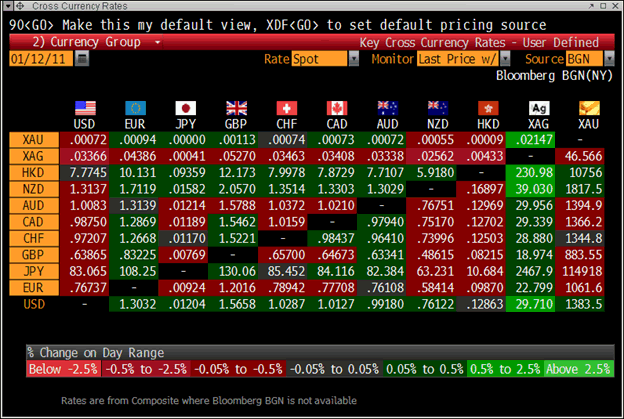

Cross Currency Table

The Portuguese bond auction today and Spain’s bond auction tomorrow is the focus of markets. Gold at EUR 1,062/oz remains only 1% below its nominal high and looks like it is consolidating in the increasingly non single currency prior to moving higher again. While Japan’s pledge to buy European bonds is soothing, it should be remembered that Japan’s fiscal position is far from sound and as one of the largest debtor nations in the world they are in no position to support European bond markets in any meaningful way.

Demand for gold and silver bullion internationally is surging (see news below). This is particularly the case in Asia where there are increasing inflation concerns. Reuters reports overnight of shortages of gold bars and premiums have risen to two year highs in Singapore and Hong Kong. The Perth Mint is struggling to keep up with unrelenting physical demand for gold coins, medallions and especially one kilo gold bars used in India and China. The demand has been extremely strong below $1,400/oz and the Perth Mint said that premiums had doubled.

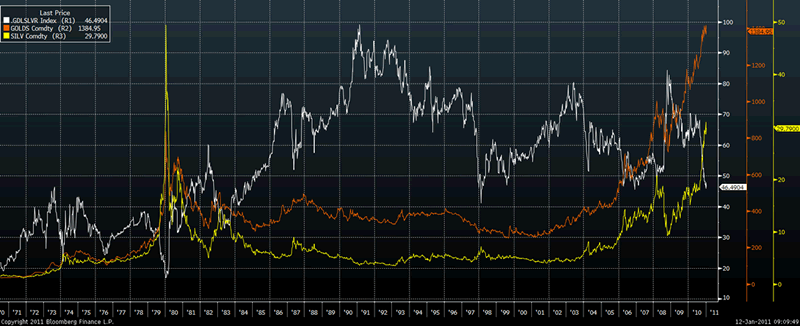

Gold to Silver Ratio – 1971 to Today Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white)

Indian gold demand is forecast to be a record again this year (see news below) as is Chinese demand. Those who have been wrongly bearish on gold in recent months (and years) have claimed that Indian demand would fall sharply due to higher prices. This is clearly not happening and Indian demand for gold remains robust and silver demand has surged.

Inflation has risen sharply in recent months and Indian households are keenly aware of how the buying power of their paper rupee is being diluted.

Turkey, one of the entry points for gold into the Middle East had total gold imports for 2010 of 42.49 tons, up from 37.59 tons in 2009, according to the Istanbul Gold Exchange.

Silver imports into Turkey rose more than 3-fold from 2009 to 2010. Imports were 91 kilograms in December, bringing the 2010 total to 19.69 tons compared with 5.59 tons in 2009.

The gradual shift from gold to the more inexpensive silver (inexpensive when compared to gold and its historical nominal high) continues internationally. This, and the massive industrial demand of the last 100 years, should see the gold/silver ratio continue to fall to the levels seen in the 1970s and see poor man’s gold continue to play catch up with its yellow sister (see chart above) .

The Australian newspaper reported how questions are being asked about the prudence of selling Australian gold reserves. This is similar to Gordon Brown’s decision to sell the UK’s national patrimony at the very bottom of the gold bear market. Gold sales by central banks are gradually being seen as extraordinarily imprudent decisions with ramifications for the international monetary system.

The article is also noteworthy as it points out how Australian unmined gold reserves will be exhausted geologically within 30 years. We have for some time pointed out how “peak gold” was as real if not more real than “peak oil” but this important concept has yet to be explored or acknowledged by analysts.

SILVER

Silver is currently trading $29.63/oz, €22.82/oz and £19.01/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,781.00, palladium at $800.50/oz and rhodium at $2,375/oz.

NEWS

(The Australian) Australian Reserve Bank's gold sale cost us $5bn

The Reserve Bank sold most of the nation's gold reserves more than a decade ago because the board believed its price would remain flat

They believed also the commodity would not play a role in a future financial crisis.

The decision to sell 167 tonnes of the bank's reserves has cost the nation about $5 billion based on today's soaring price of almost $1400 an ounce.

A board paper recommending the decision to sell conceded that gold served as "insurance against a breakdown in the international financial system", but it then dismissed the need for holding this valuable asset. The paper has been obtained by The Australian under Freedom of Information laws.

The paper also said Australia need not worry about selling the assets because it had vast reserves of the commodity, yet the latest figures from Geoscience Australia show that known reserves will be exhausted with 30 years.

(Bloomberg) India 2010 Gold Imports Likely Reached Record, WGC's Mitra Says

Gold imports by India, the biggest bullion consumer, likely reached a record last year driven by investment demand, according to the World Gold Council.

Purchases were about 800 metric tons, compared with 557 tons in 2009, Ajay Mitra, managing director for India and the Middle East at the producer-funded group, said today in a telephone interview from Dubai.

Imports at that level “would be the highest for India in its history,” he said. The group hasn’t released final data for 2010. Purchases in 2010 may exceed 750 tons, Mitra said Nov. 17.

Gold for immediate delivery rallied 30 percent last year to reach a record $1,431.25 an ounce on Dec. 7 as investors bought the metal as a protector of wealth. Demand for bullion as an investment in India surged 73 percent in the year ended Sept. 30, according to World Gold Council data. Purchases by the Asian country this year will remain “strong,” Mitra said.

“Price is no longer a factor,” he said.

Futures for delivery in February on the Multi Commodity Exchange of India Ltd. rose as much as 0.2 percent to 20,470 rupees ($453) per 10 grams in Mumbai. Prices reached an all-time high of 20,924 rupees on Dec. 7. Gold for immediate delivery rose 0.3 percent to $1,385.10 an ounce at 12:15 p.m. in Mumbai

(Bloomberg) Turkey imported 700 kilograms of gold last month, down from 3.03 metric tons in November, the Istanbul Gold Exchange said in a report on its website.

The total gold imports for the year was 42.49 tons, up from 37.59 tons in 2009, according to the exchange. Silver imports were 91 kilograms in December, bringing the 2010 total to 19.69 tons compared with 5.59 tons in 2009.

(FT Alphaville) Gold in Turkey: souk or ATM?

Turkey is about to join the select group of countries where cashpoint machines dispense solid gold.

Pioneered in Switzerland and introduced elsewhere last year including the Gulf, the gold coin machine is about to make its Turkish debut – courtesy of Islamic lender Kuveyt Turk Bank. So investors will have a choice – the souk or the ATM.

Kuveyt Turk, owned by Kuwait Finance House, will upgrade its ATMs to dispense gold coins that customers can draw from gold deposit accounts, or buy with a card or cash, according to a report by Bloomberg.

It could prove an astute marketing tool, aimed at the more conservative sections of Turkish society. Gold coins, sold at different weights, are the standard gift throughout Turkey at births and weddings, and are also a popular form of saving among older Turks - whose distrust of more formal investments may be founded in Turkey’s history of banking crises and runaway inflation.

Many mainstream banks are marketing gold funds, but the so-called “participation banks” – which comply with Islamic principles – have gone further by accepting deposits of physical gold, in a drive to bring new customers into the financial system.

Kuveyt Turk has a market share of less than 1 per cent of banking assets, but it has won about $300m worth of gold deposits, a market share of almost 20 per cent.

Its success in this area is symptomatic of the rising profile of Islamic finance in Turkey, where the four participation banks have a small but fast-growing share of banking assets – and can count on government support to expand the sector.

Last year, Kuveyt Turk also issued Turkey’s first interest-free ‘sukuk’ bond – celebrating the event, during the holy month of Ramadan, with a dinner at Istanbul’s swanky Les Ottomans hotel , a venue more accustomed to celebrity weddings.

The government has also begun small-scale issuance of Islamic-style revenue-linked bonds, and last week the Istanbul Stock Exchange launched a “participation” index of shariah-compliant companies, including the participation banks and companies such as BIM – a discount retailer that avoids selling alcohol or tobacco.

Some see these developments as part of a trend towards greater conservatism in Turkish society – as a rising middle class of businessmen from provincial cities prospers under the rule of the Islamist-rooted Justice & Development Party. Others take a more pragmatic view: Turkey, reliant on external funding to sustain rapid economic growth, will open every channel possible to attract Gulf investors.

(Reuters) Why 2011 looks bullish for palladium, platinum

Supportive fundamentals have made palladium the favored metal among speculative investors over the past two years. Continued strong vehicle sales in China, improving US car numbers and increasing usage in diesel converters in Europe have buoyed commercial demand for the metal, according to PGMs marketer A-1 Specialized Services & Supplies. Based on the market's assessment of a potential deficit in palladium supplies, firming global auto sales and significant fund buying, palladium prices may be expected to rise further in 2011, possibly testing $850-$900/oz according to Ashok Kumar, director of the Pennsylvania-based company. Just before the New Year break Kumar sent Platts a report laying out A-1's views on the market. At that point the price of palladium had risen to its highest level in 10 years, "when [10 years ago] the metal spiked to over $1,100/oz on an unexpected temporary halt to supply shipments from Norilsk," he said. "The market's assessment of a potential supply loss this year [2010], with estimates as high as 1 million ounces of palladium each year from the Russian central bank, may have resulted in a similar supply shock to the marketplace as that recorded in 2000-01," Kumar told Platts. A-1 Specialized is a global leader in recycling PGMs from salvage catalytic converters, and a marketer of platinum, palladium and rhodium to consumers. "US car sales do appear to be recovering, albeit slowly, along with the sluggish growth expected in the US economy," he added. Vehicle sales in the US were higher than expected in December coming in at a seasonally adjusted annual rate of 12.53 million, compared with 12.26 million in November. RBS analysts wrote of auto sales: "Overall industry incentives in the US were up 12% year on year for the month of December, with incentives on light truck up 15% year on year and for passenger cars up 7%, same basis."

(Bloomberg) Gold ETF Flows to Jump to Record in India on Rising Demand, Funds Predict

Assets held in gold-backed exchange traded funds in India may surge to a record for a second year as demand gains, investor awareness spreads and more products are introduced, according to managers in the largest bullion user.

“It’s definitely possible to double,” said Rajan Mehta, executive director at Benchmark Asset Management Co., which runs the nation’s biggest gold exchange-traded fund, or ETF. Money managed by Indian gold funds climbed to a record 35.2 billion rupees ($780 million) last year from 13.5 billion rupees in 2009, according to Association of Mutual Funds in India data.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.