The Ruling Clan of India Has Lost the Plot on Inflation

Economics / India Jan 12, 2011 - 04:36 AM GMTBy: Justin_John

THE PERILOUS COURSE

THE PERILOUS COURSE

THE 2008 credit crisis exposed the financial

whizkids on the Wall Street who hardly had an idea on where their acts were taking the financial markets

. Years of booming markets made them complacent to risks that were building up in the system. Few saw the apocalypse that collapsed many venerable institutions.

Indian policy makers’ forecast of the situation, especially inflation, turns out to be more of a guesswork than scientific analysis. While many blame mismanagement for soaring prices, be it food or otherwise, a revisit to what many masters have said, shows they failed to forecast accurately. Many a jargon were used to explain it at different times, including: it is supply side factors; it is cyclical, it is seasonal, it is structural, demand-pull, cost-push and many more.

None of these matter to an autorickshaw driver on the roads of Chennai, or a panwala in a dirty Kolkata bylane. All that matters to them is that they are forced to consume less and sacrifice festivities. How much does the rupee note buy for me now is the question on everyone’s mind. Its value has been sliding and there are no signs of that stopping anytime soon. Much of it was masked by record growth, but Indian voters are unforgiving when it comes to inflation, which everyone knows.

Inflation has shot through the roof, pinching the common man budget beyond what most can imagine. Not that the government has not tried to bring it down, but it is the sheer mediocrity of the men involved that worries me. Supposedly Montek Singh Ahluwali is considered to be among the best brains in India when it comes to policy planning and yet these are his quotes at various points of time in 2010.

MONTEK SINGH AHLUWALIA

APRIL 2010

India’s inflation rate may decline in two to three months

JULY 2010

Inflation may return to a comfortable level by the end of the year (December)

AUGUST 2010

There is a moderation in the rate of inflation under way and it will become quite comfortable by December …The movement is in line with what we have been arguing

Without understanding the dynamics of the current inflation, Ahluwalia has been shooting his mouth over about prophetic movement of prices. That was enough for him to be fired if he was in a corporate setup. Well he is not and he lives another day given mediocrity of such nature is welcomed in the government.

Manmohan Singh

PRIME MINISTER

JULY 2009

India’s inflation rate will ease to 6% by December 2009 as normal monsoon helps moderate food prices

Manmohan Singh has been a bit better than Ahluwalia in terms of blurting out stuff he should not be. But he too has no idea what to do about Inflation. One cant blame him can we? After all he presides a set of idiots as council of ministers who are better off tending cattle than shepherding a billion people.

Pranab Mukherjee:Inflation control not at the cost of growth

SEP 2009

We need not be unusually worried over the availability of food grains

MAY 2010

Inflation is an area of concern, but I’m not pressing the panic button AUGUST 2010 If interest rates are hiked abnormally, there will be no investment, there will be no growth… If I compromise my economic growth, I can surely control inflation

Pranab Mukherjee, is a huge liability. He was well described as Socialistic era archaic piece of furniture which best fits in a city museum. His only purpose is to advertise Rahul as the next PM.

ASHOK CHAWLA

ECONOMIC AFFAIRS SECRETARY, FINANCE MINISTRY

MAY 2010

We hope to get back to average inflation of about 5% to 5.5% by the end of 2010

NOV 2010

Overall inflation is likely to fall below 6% by March from 8.62%..It is falling and definitely headed to where RBI has projected it would be by March 2011 (5.5%)

DUVVURI SUBBARAO GOVERNOR, RBI

OCTOBER 2009

July 2009 review projected WPI inflation for March 2010 at around 5%

JANUARY 2010

In view of the global trend in commodity prices and domestic demand-supply balance, inflation projection for March 2010 is raised to 8.5%

JULY 2010

The baseline projection for WPI inflation for March 2011 is raised to 6% from 5.5%

KAUSHIK BASU: Price rise way beyond the script

CHIEF ECONOMIC ADVISOR, FINMIN

MAY 2010

The rise in prices will likely be around 6% to 7% in the next three months

JANUARY 2011

We want to roll back the stimulus… So you will see steps being taken this year, next year and maybe, the year after

SUBIR GOKARN DEPUTY GOVERNOR, RBI: The lag effect just doesn’t seem to work

JUNE 2010

Reasonable rains this year will slow food-price inflation, which has remained above 15% since November

AUGUST 2010

We think we have done enough to manage inflation and we expect to see the effects of this in the second half of the year, because actions act with a lag

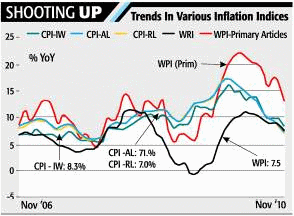

And supposedly India had the best set of ministers and yet they have no idea on how to monitor prices. RBI has allowed negative rates to flourish in India for over 6 months which is a crime in a growing economy. Suberao and Pranab Mukherjee needs to be tried for decisions which have left this country gaping in hunger as inflation reaches levels unseen in the past 5 years.

Sasha

Editor

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2010 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.