Silver Demand Surges 6 Fold in India and World's Richest Man Enters the Silver Market

Commodities / Gold and Silver 2011 Jan 10, 2011 - 08:19 AM GMTBy: GoldCore

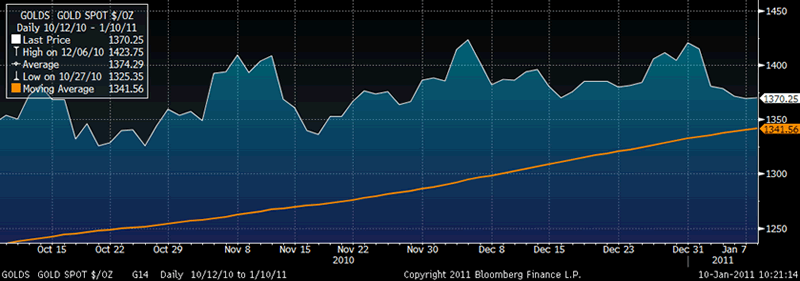

Gold is marginally lower today despite EU sovereign debt issues again being focused on. Gold should be well supported at the 100 day moving average and some analysts are saying that last Friday’s sell off may mark the low for the year.

Gold is marginally lower today despite EU sovereign debt issues again being focused on. Gold should be well supported at the 100 day moving average and some analysts are saying that last Friday’s sell off may mark the low for the year.

Gold is currently trading at $1,367.25/oz, €1,060.72/oz and £881.26/oz.

Gold in USD – 1 Year (Daily)

Demand remains robust due to the threat of rising inflation and concerns about currency manipulation and the risk of trade wars.

Value buyers, especially in Asia, see this as another buying opportunity and are continuing to buy on the dips.

Investors should as ever focus on gold in their local currency. Gold’s sell off last week was dollar strength related and gold remained robust in sterling and particularly the euro. Euro denominated gold at €1,060/oz is less than 1% from its record nominal high of €1066.80/oz.

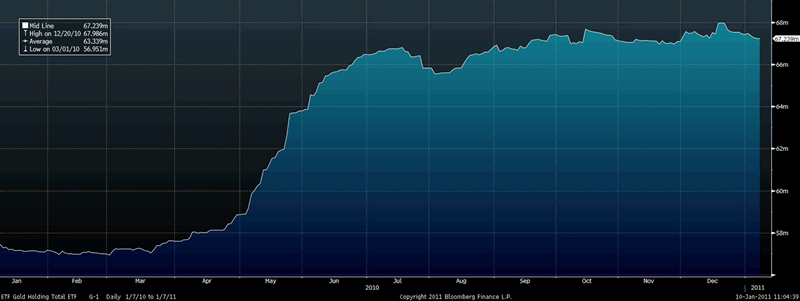

Total Gold ETF Holdings

Skepticism and the assumption that gold is a bubble, is “overvalued” and “risky” continues and remains prevalent in much of the mainstream press (see News below). The smart money is as ever more informed and knows the actual fundamentals of the market which is one of anaemic supply (declining mine production, central banks becoming buyers rather than sellers and significant demand for gold internationally – both investment demand and jewellery demand from China, India and wider Asia).

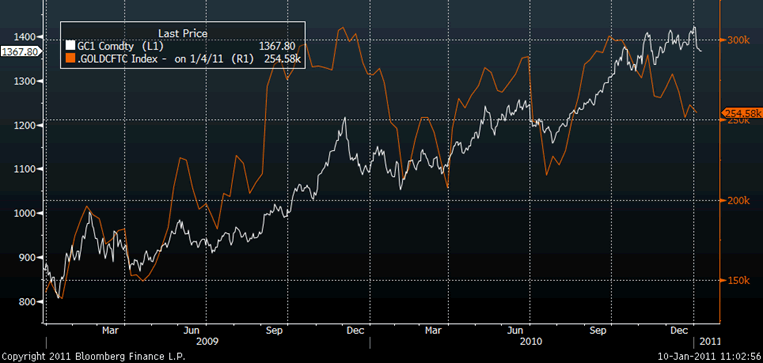

Two leading indicators that gold is far from mania levels is seen in the total gold ETF holdings (see above) and the recent CFTC data (see below). Both show that far from “piling into” gold, speculators and investors have been net sellers in the futures market and have been buying and selling and net neutral in the ETFs. The ETFs saw a sharp increase in holdings in the first half of 2010 and since then buyers have matched sellers and holdings appear to have consolidated at these levels.

CFTC Open Interest and Gold Price

SILVER

Silver is currently trading $28.74/oz, €22.29/oz and £18.52/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,731.00, palladium at $748.50/oz and rhodium at $2,375/oz.

NEWS

(Reuters) Gold Could Have Seen Its 2011 Low - MKS Finance

Gold could have already seen it's low for the year when it dipped to $1,353/oz Friday, before rebounding after the weaker-than-expected U.S. non-farm payrolls data. "With the U.S. economy recovering slower than expected, and worries over (sovereign debt problems in) the euro-zone back on the front line, it seems that we have seen the year low," says MKS Finance. Spot gold is at $1,371.20/oz, up $1.40 since Friday's New York close.

(Bloomberg) India May Pay for Iran Oil With Gold, Economic Times Says

India may use gold to settle payments for crude oil from Iran until the countries agree on a currency and a bank to clear the transactions, the Economic Times newspaper said, citing an Indian government official it didn’t identify.

(Bloomberg) LGT Raises Palladium, Platinum, Silver Forecasts for This Year

Palladium will average $888 an ounce this year, higher than previously forecast, on greater investor demand and usage in car pollution-control devices, LGT Capital Management said. It also raised platinum and silver estimates. Palladium may climb as high as $1,111 an ounce, LGT analyst Bayram incer said in a report today as he lifted his forecast for average prices by 35 percent. Dincer increased his 2011 average estimates for platinum by 3.5 percent to $1,888 an ounce and for silver by 14 percent to $33.33 an ounce, while his gold forecast was little changed at $1,499 an ounce. “Strong global fundamental demand, especially from the automotive sector, aligned with higher investment demand” will drive palladium, Pfaeffikon, Switzerland-based LGT said. “Supply-constraint issues from major producing countries combined with ongoing speculation about the low Russian state stock levels could induce an overreaction.” Palladium and platinum are mainly used in jewellery and autocatalysts in vehicles. Researcher Johnson Matthey Plc estimates that government stockpiles of palladium in Russia are the third-biggest source of supply. Those inventories may be near exhaustion, according to OAO GMK Norilsk Nickel, the largest Russian mining company. Palladium for immediate delivery traded at $752.25 an ounce at 2:23 p.m. in London today after reaching a nine-year high of $807.75 on Jan. 3. Platinum was at $1,734.25 an ounce, silver was at $28.935 an ounce and gold was at $1,367.88 an ounce.

(Bloomberg) Gold Will Average $1,457 an Ounce This Year, LBMA Survey Shows

Gold will average $1,457 an ounce this year and climb as much as 19 percent, as the metal extends a 10-year rally, according to a London Bullion Market Association survey of 24 traders and analysts. The metal will trade as high as $1,632, according to the average response by participants, the LBMA said today in an e- mailed report. Bullion for immediate delivery traded at $1,366.15 at 2 p.m. in London today. Silver will average $29.88 an ounce, platinum will average $1,813 an ounce and palladium will average $814.65 an ounce in 2011, the LBMA said. Gold jumped 30 percent last year, extending the longest winning streak since at least 1920, after governments spent trillions of dollars and kept interest rates low to bolster economies following the worst global recession since World War II. Prices reached a record $1,431.25 on Dec. 7 as investors lost confidence in currencies and became more concerned about the fiscal health of euro-region countries including Ireland. “Recent optimism regarding the U.S. recovery is not a permanent change in investor thinking,” Edel Tully, an analyst at UBS AG in London, said today in a report. “Ongoing pressure- points such as the unresolved European debt problems and growing inflation fears across emerging markets will be positive gold drivers this year.” Gold’s gain last year beat the 9.6 percent increase in the MSCI World Index of equities and the 5.9 percent return on a Bank of America Merrill Lynch index of Treasuries. Gold assets in exchange-traded products from 10 providers tracked by Bloomberg jumped to a record 2,114.6 metric tons last month as investors piled into instruments physically backed by precious metals. That’s equal to about 82 percent of annual mine output.

(Bloomberg) Gold Advances as European Concern Spurs Haven Demand After Drop

Spot gold rallied from the biggest weekly drop since May as concerns that Europe’s sovereign-debt crisis may worsen spurred demand for a haven. Silver and palladium climbed by the most in a week. Platinum also gained. Bullion for immediate delivery climbed as much as 0.5 percent to $1,376.10 an ounce before trading at $1,374.45 an ounce at 12:25 p.m. in Seoul. The price lost 3.6 percent last week, the most since May 21, on speculation that the U.S. economy’s recovery will erode demand for the metal. The February-delivery contract increased 0.4 percent to $1,373.80 an ounce on the Comex in New York. “As soon as we get more talk of problems within Europe, we are going to see some more safe-haven buying,” Darren Heathcote, head of trading at Investec Bank (Australia) Ltd., said today from Sydney. The euro traded near its lowest level in almost four months against the dollar on speculation European nations will struggle to raise funds. Portugal will sell 2014 and 2020 bonds on Jan.12. Italy will offer 2014 bonds and Spain will auction 2016 debt on Jan. 13, according to data compiled by Bloomberg. The dollar was little changed against a basket of six major currencies after rising 2.5 percent last week, the biggest gain since August. Reports last week signalled an improving U.S. labor market and expansion in manufacturing and services. Spot gold advanced 30 percent in 2010 and climbed to a record $1,431.25 an ounce last month on concern that purchases of assets by governments to stimulate their economies would potentially debase the value of currencies.

(Sunday Independent) Louise McBride - Investments You Should Steer Clear of in 2011 - Gold

This year could mark the last of the heydays for gold, warns the wealth managers, Barclays Bank Ireland.

“We wouldn’t suggest investing in gold in 2011,” says Pat McCormack, head of wealth management at Barclays Bank Ireland. “The dollar is not about to collapse, hyperinflation is not lurking around the corner, the gold price has already risen a long way and there is no yield, nor any prospect of one soon. It wouldn’t be a surprise to see gold at some satge fall by 20 to 30 percent if investors wwere to regain confidence in other assets.”

(The Independent) Stephen King: A question of faith: Will the dollar escape unscathed from QE2?

This act of faith will be sorely tested in 2011, not so much because the eurozone will resolve its problems (although I think it will, eventually) but, instead, because America's creditors will slowly recognise that their money isn't really safe in the US. The danger comes not from the remote possibility of an outright sovereign default, but rather from the increased probability of a major dollar collapse. The Federal Reserve is, after all, printing lots of extra dollars in a bid to kick-start the US economy recovery. All those extra dollars will serve only to depress its value, underlining the risks foreign creditors are taking in holding Treasuries and other US dollar assets.

(Bloomberg) Gold in Euros to Outperform Gold in Dollars

Gold priced in Euros will do better than the metal denominated in U.S. dollars this year, ABN Amro Bank NV said, citing trading patterns. Gold in Euros surged 39 percent in 2010 compared with a 30 percent increase in bullion in dollar terms, according to Bloomberg data. While both are in a short-term correction phase, gold in Euros tends to be more resilient when under stress, said Wallace Ng, executive director at the bank in Hong Kong. “I believe it will run faster once the upside momentum picks up,” he said in an e-mail. “On the charts, gold in Euros is showing a better outlook.” Gold priced in dollars is forming a big rounding-top, Ng said, referring to a slowdown of an uptrend that eventually turns into a downtrend, touching its 16-week moving average. The metal denominated in Euros, on the other hand, is not forming any big top yet, said Ng, and is trading “well above” the 16-week moving average, a sign that prices may rally further. “For the time being, gold is having a correction on the recent improving job data out of the U.S. and some people are calling a top,” said Ng. “However, I still see it as a minor correction within an uptrend and expect this upswing momentum to come back in the middle of February.” Gold in euro terms had its best year in 2010 since the currency started in 1999 as investors sought the precious metal to protect their wealth against financial turmoil and declining currencies. The euro tumbled 6.6 percent against the dollar last year, the biggest annual decline since 2005, as the fiscal crisis in Europe reduced confidence in the currency.

(Bloomberg) Silver is `common man's gold' in India as bullion expensive

The metal is still 48 times cheaper than gold per ounce.

Demand for silver in India, where imports of the metal surged more than sixfold in the first half of 2010, is increasing as investors seek an alternative to higher-priced gold, according to a trader.

“It is increasing day by day,” Ketan Shroff, Managing Director of Pushpak Bullions Pvt, said in a phone interview. Demand probably climbed at least 20% to 30% in the past six months, he said.

Silver futures in New York reached a three-decade high of $31.275 an ounce on Jan. 3, after rallying 84% in 2010. The metal is still 48 times cheaper than gold per ounce, data on the Bloomberg show. Gold for immediate delivery reached a record $1,431.25 an ounce on Dec. 7.

“People are accumulating silver since gold is getting unaffordable to the common man,” Shroff said in an interview on Jan. 7. Silver “has become the common man’s gold.”

Weddings and festivals, and higher gold prices will likely fuel demand for silver in the medium term, broker Karvy Comtrade Ltd said in a report Nov. 2. Imports surged more than six times to $1.7 billion in the first-half of 2010, according to Karvy.

(FT Alphaville) World’s Richest Man Enters the Silver Market

Here’s some juicy stock market RAW to kick off 2011 — Carlos Slim, the world’s richest man is looking to enter the silver market in a big way.

And that big way, according to KingWorldNews, is a bid for Fresnillo, the Mexican based mining company that is poised to become the world’s biggest silver producer. This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.