U.S. Real GDP vs. Potential GDP – Time to Assess this Yardstick

Economics / US Economy Jan 07, 2011 - 02:36 AM GMTBy: Asha_Bangalore

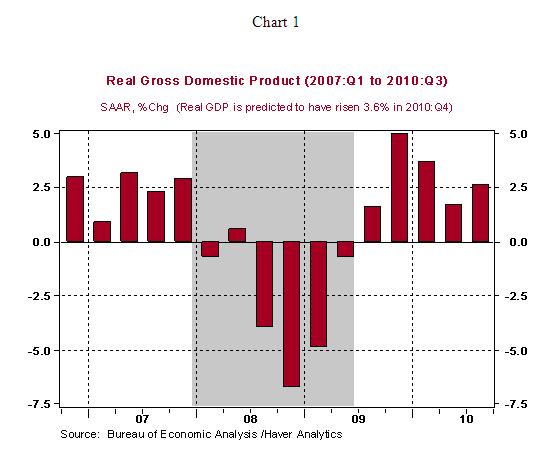

The U.S economy has registered six quarters of economic growth, inclusive of the projected increase in real GDP during the fourth quarter of 2010 (see Chart 1).

The U.S economy has registered six quarters of economic growth, inclusive of the projected increase in real GDP during the fourth quarter of 2010 (see Chart 1).

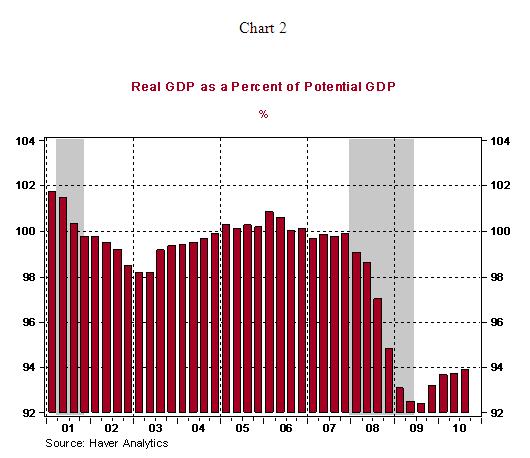

However, real GDP in the third quarter of 2010 was 6.0% below potential GDP. The Congressional Budget Office's estimates of potential GDP are used in Chart 2. Our forecast for the fourth quarter implies that 2010 ended with real GDP 5.4% below potential GDP. The apparent conclusion from these numbers is that there is enormous room for growth before inflation becomes a concern.

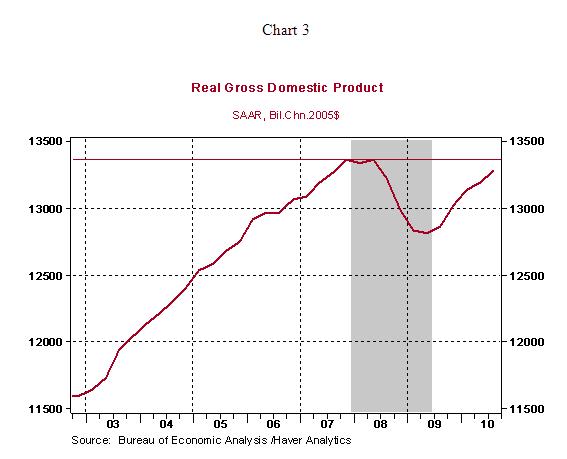

The next question is if real GDP has crossed the peak registered prior to the onset of the recession in December 2007. The last data point of real GDP in Chart 3 is the third quarter of 2010, with the level of real GDP at $13.278.5 trillion. The peak of real GDP in the prior business cycle was in the fourth quarter of 2007 ($13.363 trillion). Real GDP would exceed this peak in the fourth quarter, if our forecast is accurate. In other words, the recovery phase ends in 2010 and expansionary phase of the current business cycle should commence in 2011. Cognizant of this information, markets will evaluate the performance of the economy in a different light going forward.

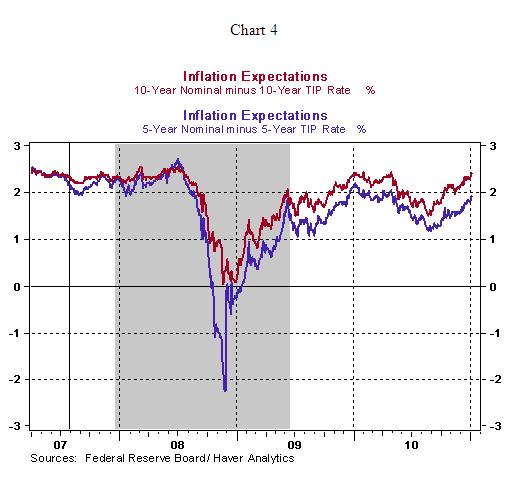

Recent movements of inflation expectations, as measured by the difference between nominal yields and real yields of corresponding Treasury securities, are indicative of the change in market evaluation of the economy (see Chart 4). There has been an increase of nearly 30bps in inflation expectations since the lows seen on December 10. These readings are close to levels seen prior to the onset of the financial crisis in August 2007 (see Chart 4).

There are two major market moving events scheduled for tomorrow. In addition to the publication of the December employment report, Chairman Bernanke will testify at the Senate Budget Committee. The topic of the testimony is: "The U.S Economic Outlook: Challenges for Monetary and Fiscal Policy." Stay tuned for an analysis of these events.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.