Spanish and Portuguese Bonds Hit Hard on Sovereign Debt Financing Concerns

Interest-Rates / Global Debt Crisis Jan 06, 2011 - 01:59 PM GMTBy: Mike_Shedlock

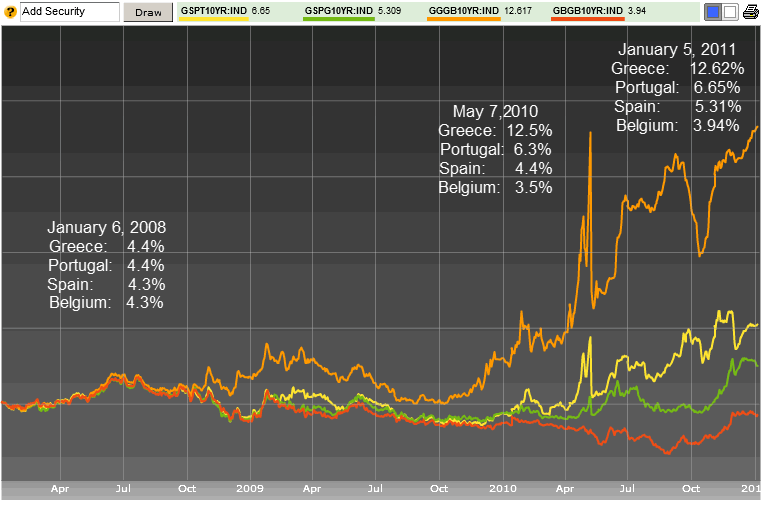

Portuguese and Spanish 10-year bonds are getting smacked hard as refinancing needs mount. Greek yields are at all-time highs and a milder (for now) selloff continues on Belgian and Italian bonds as well. A flight to safety on German bonds is again in play, with German 10-year yields dropping slightly. The Euro once again flirts with December and Mid-September lows.

Portuguese and Spanish 10-year bonds are getting smacked hard as refinancing needs mount. Greek yields are at all-time highs and a milder (for now) selloff continues on Belgian and Italian bonds as well. A flight to safety on German bonds is again in play, with German 10-year yields dropping slightly. The Euro once again flirts with December and Mid-September lows.

Bloomberg reports Portuguese, Spanish Bonds Decline Amid Debt-Auction Speculation

The extra yield investors demand to hold Portuguese securities rather than benchmark German bunds widened to the most in a month as the IGCP debt office announced the sale of 2014 and 2020 debt, scheduled for Jan. 12. Belgian bonds tumbled after the nation’s political leaders failed to restart seven- party negotiations to form a government. German bunds rose.

“The underlying story behind this slide in Portuguese government bonds is supply-related,” said David Schnautz, a fixed-income strategist at Commerzbank AG in London, who said he had heard speculation about the Portuguese sale before it was announced. “Next week we will keep on running at full steam in the primary market with supply from Spain and Italy,” he said.

The yield on 10-year Portuguese bonds jumped 26 basis points to 7.17 percent as of 4:40 p.m. in London. The yield premium to bunds widened to 404 basis points, the most since Dec. 1. The 4.8 percent bond due in June 2020 fell 1.57, or 15.70 euros per 1,000-euro ($1,301) face amount, to 84.12.

Portugal is raising taxes and cutting wages to convince investors it can narrow its budget gap after the Greek debt crisis led to a surge in bond yields for euro nations last year. The Portuguese government said today it met its target for a budget deficit of 7.3 percent of gross domestic product in 2010.

The nation, which intends to sell as much as 20 billion euros in bonds to finance its budget and redemptions this year, auctioned 500 million euros of bills yesterday at a yield of 3.686 percent, up from 2.045 percent at a sale of similar- maturity securities in September.

Spain is due to sell debt maturing in 2016 on Jan. 13, the same day as Italian bond auctions for 2015 and 2026 securities. The Spanish 10-year yield rose 16 basis points to 5.49 percent. The equivalent-maturity Italian yield increased 11 basis points to 4.77 percent.

Belgian bonds tumbled, sending the 10-year yield 13 basis points higher to 4.07 percent, after politicians failed to break the political deadlock in Europe’s third-most-indebted country. The extra yield over German bonds widened to 115 basis points, the most since Dec. 1. The spread, a gauge of the risk of investing in Belgium, has risen from 79 basis points before the nation’s June 13 election.

The yield on German bunds, Europe’s benchmark debt securities, fell three basis points to 2.91 percent.Sovereign Debt Yields Greece, Portugal, Spain, Belgium

That chart is as of yesterday. The Portuguese 10-year yield has since widened to as much as 7.17% (quite a sharp selloff). Spanish 10-year yields are now 5.49% and Belgium 10-year yields are 4.07%.

Euro Weekly Chart

The sovereign debt crisis in Europe as well as recent job reports in the US are both US dollar friendly. For more on the European debt crisis including a look at a pending German court review of the constitutionality of the bailouts, please see EU Commission Plans Haircuts on Bank Debt; Greek Yields Hit New Record; China Buys Spanish Debt; German Courts to Decide Bailout Constitutionality.

For a look at the mess in Japan, please see Japan's Finances "Approach Edge of Cliff", Prime Minister Calls For Sales Tax Hike.

The potential for a substantial US dollar rally is staring dollar bears and US hyperinflationists smack in the face.

Click Here To Scroll Thru My Recent Post ListBy Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.