On the Brink of Catastrophic Economic Collapse

Politics / US Politics Jan 06, 2011 - 12:50 PM GMTBy: Mac_Slavo

We’ve been told a lot of things since the global economic crisis first became apparent in 2007. In March of that year Federal Reserve Chairman Ben Bernanke said, “the impact on the broader economy and financial markets of the problems in the sub-prime markets seems likely to be contained.” Clearly, Mr. Bernanke’s assessment was incorrect and the sub-prime real estate issues were only part of a broader, systemic issue.

We’ve been told a lot of things since the global economic crisis first became apparent in 2007. In March of that year Federal Reserve Chairman Ben Bernanke said, “the impact on the broader economy and financial markets of the problems in the sub-prime markets seems likely to be contained.” Clearly, Mr. Bernanke’s assessment was incorrect and the sub-prime real estate issues were only part of a broader, systemic issue.

The fundamental problems within our economy became mainstream news in the latter part of 2008 when stock markets around the world were in free fall and most major financial institutions were on the cusp of insolvency. In response, our government, with the full support and confidence of Congress, took unprecedented steps to save the system by injecting, first billions, and then trillions of dollars to bailout failed companies, stabilize deflationary price collapses and stimulate the economy.

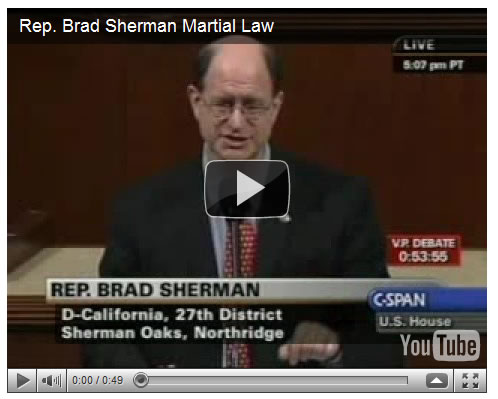

Treasury Secretary Henry Paulson eventually wrote a book about the crisis, aptly titled On the Brink. But how close to the brink were we? If Representative Brad Sherman is to be believed, we were close. So close, in fact, that according to Sherman, Congressional members were told that if the bailout was not authorized by Congress the collapse would be so severe that martial law may have to be declared - basically, tanks in the streets. The following short video is Brad Sherman discussing the situation on the House floor:

Are we now to believe that the actions taken by Congress, The President, US Treasury and The Federal Reserve have resolved the fundamental problems facing our nation?

For those 17% of people who think the economy is in recovery and the other 33% who believe it will happen soon, we point you to the latest statement from current Treasury Secretary Timothy Geitherner, who outlines the severity of the problem in a January 6, 2011 letter to Congress writes:

I am writing in response to your request for an estimate by the Treasury Department of when the statutory debt limit will be reached, and for a description of the consequences of default by the United States.

Never in our history has Congress failed to increase the debt limit when necessary. Failure to raise the limit would precipitate a default by the United States. Default would effectively impose a significant and long-lasting tax on all Americans and all American businesses and could lead to the loss of millions of American jobs. Even a very short-term or limited default would have catastrophic economic consequences that would last for decades. Failure to increase the limit would be deeply irresponsible. For these reasons, I am requesting that Congress act to increase the limit early this year, well before the threat of default becomes imminent.

…

Treasury would prefer not to have to engage again in any of these extraordinary measures [suspension of the issuance of certain types of government debt and government investment vehicles]. If we are forced to do so again, these measures could delay the date by which the limit is reached by several weeks. Once these steps have been taken, no remaining legal and prudent measures would be available to create additional headroom under the debt limit, and the United States would begin to default on its obligations.

The Treasury Secretary of The United States of America just said that if we don’t get another $1 trillion or so dollars by March of this year then this country will begin to default on its debt obligations. These remarks are extremely serious and should be understood for what they are.

We are, literally and without mixing words, on the brink of economic catastrophe.

The scary thing is, according to Mr. Geithner and the many supporters of raising our debt ceiling, that borrowing more money is the only solution available.

In a recent commentary we pointed out the opposing view from Karl Denninger of Market Ticker, who said that raising the debt ceiling would essentially lead to the very same consequence as leaving it as is:

Let me be clear: If you extend the debt ceiling and by doing so allow deficits of this sort to continue for another year, say much less two, you will have placed a loaded shotgun in the mouth of this nation and pulled the trigger.

It will go off, and you will splatter this nations’ economic and political system all over the wall.

It’s a Catch 22 and there’s no way out.

Defaulting on or inflating away our debt are the only viable solutions. Both of these will lead to the same end - a complete and total collapse of the way of life Americans have become used to.

Just as Henry Paulson, President Bush, et. al. warned of economic collapse and depression in 2008, Mr. Geithner warns of the very same today. All of the trillions spent, all of the laws passed, and all of the manipulations of global asset markets, have done absolutely nothing to resolve the fundamental systemic problems we faced prior to the onset of the crisis.

It is, quite literally, going to be the end of the world as we know it - and it cannot be stopped.

It’s time for each individual to take steps to prepare for a national debt default and a complete debasement of the US dollar. It won’t be long before we either can’t meet our debt obligations or our creditors finally put a stop to our out of control borrowing. And when they do, the chances are high that we will experience a hyperinflationary monetary collapse, complete with disruptions to the normal flow of commerce, food shortages and out of control prices. The only refuge will be to understand what is money when the system collapses and start preparing now. The government is getting ready for it, so should you.

By Mac Slavo

http://www.shtfplan.com/

Mac Slavo is a small business owner and independent investor focusing on global strategies to protect, preserve and increase wealth during times of economic distress and uncertainty. To read our commentary, news reports and strategies, please visit www.SHTFplan.com

© 2010 Copyright Mac Slavo - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.