A Long Year Ahead for Netflix: A Not So Bold Prediction for 2011

Companies / Tech Stocks Jan 04, 2011 - 03:07 AM GMTBy: Q1_Publishing

“We think the U.S. economy will slow [next year] but narrowly miss an outright recession. We expect the overall stock market to bounce around, as it did this year, and deliver anemic single-digit returns.”

“We think the U.S. economy will slow [next year] but narrowly miss an outright recession. We expect the overall stock market to bounce around, as it did this year, and deliver anemic single-digit returns.”

Sound like a reasonable prediction for the 2011?

It would, but it’s not. That was a prediction from Fortune magazine’s The Best Stocks for 2008.

The “best” stocks for 2008 included Merrill Lynch which was rescued by/merged with Bank of America (NYSE:BAC) hours before it went bankrupt.

General Electric (NYSE:GE) made the list too. It only remains a conglomerate because of multi-billion dollar behind-the-scenes Fed bailout. Its shares fell nearly 80% after that prediction.

Red-hot Brazilian oil company Petrobras (NYSE:PBR) was the “best” energy play for 2008. That year its shares actually managed to outpace the 70% drop in oil prices.

- Making predictions is tough. That’s why we’ve learned the fundamental principles of risk and reward are the key to investment success rather than predicting the near-term future.

This year, however, we are willing to venture one prediction. It’s one that’s a bit contrarian, goes against a very popular trend, and the rewards will far outweigh the risks as this story plays out in the next few weeks.

The Big Bust of 2011

Another “micro bubble” has formed.

Netflix (NASDAQ:NFLX) has become a Wall Street darling and, the way things are shaping up, it won’t be for much longer.

Founded upon the idea that consumers don’t want to drive to a rental store, worry about painfully pricey late fees, and have movies just a few clicks away, Netflix has found its stride.

The Netflix subscriber base has grown from three million in 2006 to more than 19 million today.

Shares have climbed to nearly $180 today after falling below $20 at the height of the credit crunch.

The “good times” were recently extended when Netflix announced it was offering a streaming-only service to customers at a discounted price.

The 100% online option has kept Wall Street’s interest in the stock high.

It’s a full blown micro-bubble and, as always, an enticing profit opportunity is being created as a result.

When Everyone Says Buy, It’s (Almost) Time to Sell

Netflix has been on a good run of late. Its business model had a tough time getting started, but now that it has hit a critical mass, Wall Street believes the sky’s the limit.

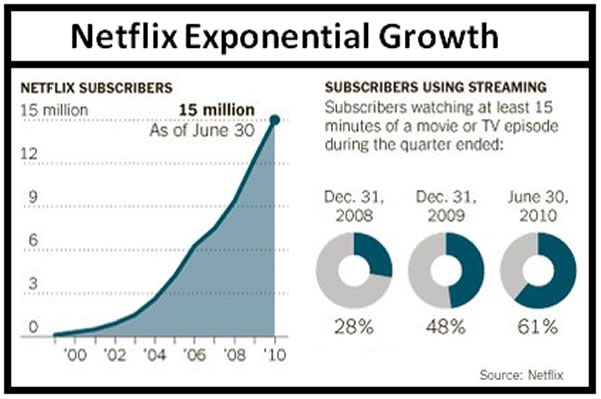

The New York Times put together this chart to show how incredible Netflix’ growth has been:

The trajectory is staggering. It shows how Netflix has trounced its direct competition to dominate the market. Netflix successfully sunk Blockbuster (NASDAQ:BLOBQ) and has Movie Gallery Inc (NASDAQ:MOVIQ). Movie Gallery shares have fallen from $1 per share two years ago to less than two tenths of a cent today.

The major analysts have fallen in love with the stock. Jefferies & Company has it rated a “Buy.” Oppenheimer recently upgraded it from “Underperform” to “Outperform.” Citigroup upgraded it to “Buy” last April and has kept the rating.

All seems good. But there are some very strong headwinds gaining strength.

Another Case of Great Expectations

The growth, although impressive, presents a trap that most investors and Wall Street analysts have fallen into time and time again.

The trap is the trend. The great value investor Seth Klarman brilliantly summed up the trap when he said, “Most investors tend to project near-term trends—both favorable and adverse—indefinitely into the future.”

Now it appears that’s exactly what they’re doing. And it will end the same as dozens of exponential growth trends like these do - badly.

As we know, great expectations inevitably lead to great disappointments.

In the last few years, it has happened time and time again.

Remember the widely predicted infrastructure stock boom that would follow the American Recovery and Reinvestment Act debate? It only took a few months for investors to realize how much permitting and bureaucratic hoops had to be jumped through before government construction projects could break ground. The president himself has disavowed the term “shovel ready.” That micro-bubble has faded.

Around the same time, for-profit college stocks were all the rage too. This micro-bubble was based on the idea that newly unemployed people will go back to school and the government would foot the bill. It made sense on paper, but didn’t pay off nearly as well. Apollo Group (NASDAQ:APOL) has fallen more than 50% since we warned about the flawed story.

Netflix is likely the next great disappointment for a lot of reasons.

Its shares have soared. All of the fundamental ratios like price-to-earnings and price-to-book have reached extreme highs. Most importantly, Netflix’s success has brought a lot of margin-squeezing, market-share-stealing competition.

For example:

Hulu.com – was initially formed between NBC, Fox, Disney (ABC/ESPN) to provide streaming TV to online viewers. It has partnerships with Facebook, Yahoo, and some of the most-trafficked web sites in the world. It has recently launched a subscription service with including access to movies.

Google TV – was launched on just over three months ago. Its efforts have made an un-Google-like start as the system and hardware have been hampered by numerous problems. But with $24 billion cash and short-term investments in the war chest and a stated goal to dominate the Internet, I’m sure these problems are merely speed bumps yet to be steamrolled into oblivion (reference to Microsoft’s Xbox project - the ultimate “if you throw enough money at it, it will work” project).

Apple TV – Apple threw its hat in the online video world with this service. It’s basically a box which allows owners to watch TV, movies, and videos through any number of online content providers. Yes, this includes Netflix, but it also includes the other big competitors and Apple’s own iTunes. Sales of the device have just passed one million this year.

Deep-pocketed competition that already has a beachhead (Google, iPod, etc.) in the hands of Netflix’s shrinking base of potential customers won’t help Netflix keep up its torrid growth rate or live up to Wall Street’s growing expectations.

And that’s going to be big problem for Netflix. But there’s one more consideration to make before betting against the Netflix Juggernaut – Wall Street’s short-term thinking.

When the Last Buyer Buys

Given the situation, there are a lot of analysts and traders ready to pounce on any weakness in Netflix shares. They’re the reason we’re going to have to wait a few weeks for this one to play out.

Last weekend Barron’s asked whether it’s Time to Hit the Eject Button on Netflix. The answer was a roundabout yes. And that’s why we’re willing to make the downfall of Netflix shares one prediction for 2011.

You see, there are still a lot of investors who have not bought Netflix yet. They see what we see. Competition, an overvalued stock, an unsustainable growth trajectory, and plenty of other reasons not to buy. They, however, will likely be disappointed very soon.

Over the last few weeks Netflix has launched what I believe will be an extremely successful campaign to add more subscribers.

Netflix has made itself into a top gift for 2010. And in an era where more people shop online, Netflix already has a captive audience of more than 19 million current subscribers to advertise to, and people still have to come up with good/useful gift ideas, this effort should be a massive success.

If the campaign works, Netflix will have hit a growth wall. Netflix already has 19 million subscribers. It’s not like millions of consumers are just learning about Netflix. If somebody wants it, chances are they have it.

Netflix as a gift will create a situation where millions of subscribers who want it have it and hundreds of thousands who don’t want it have it too.

That’s a very tough spot to grow from. The odds of keeping up the exponential subscriber growth (and subsequent exponential increase in earnings) are increasingly slim.

Meanwhile, if the promotion is as successful as we think it will be, Netflix will post some blow-out results on January 24th when it announces its latest financial results.

That’s why we expect Netflix shares to rise significantly after the news. If the Netflix posts an exceptionally strong quarter from the promotional campaign, Wall Street will reward it once again.

We could see Netflix shares rise from $180 to $220, $240 or more as the positive “surprise” will turn the final non-believers into believers. A majority of them will capitulate and race into shares.

Analysts will start trying to top each other with higher price targets. Brokers around the country will be hitting the phones. “You’ve got to get in Netflix now, it’s the next Google, Microsoft, and Apple all rolled into one.”

Waiting for True Extremes

Although a quick gain sounds enticing, it’s best to bide your time.

The expected rise is based on a hunch. We expect the holiday promotion to do very well. We don’t know.

But we do know is that if it works, Netflix is going to have a tough time meeting up to even greater expectations the market will have for it throughout the rest of 2011. And from a very rich valuation of more than $200 per share, the risks will be much lower and upside potential greater for a bet against Netflix shares.

From that level Netflix any decline in the growth rate (we expect Netflix will continue to grow, just not fast enough for Wall Street) could send Netflix shares that walked up stairs down an elevator with little warning.

So with that in mind, we expect the Netflix trade to be one of many opportunities in the New Year for investors who are willing to wait for the most extreme extremes, anticipate them so they’re prepared mentally to capitalize, and keep a tight focus on risk and reward.

So while most everyone is walking out farther and farther on the proverbial limb to get the most attention for their predictions which odds say will be embarrassingly wrong, we’ll go out on the shortest limb and predict that the same investing principles that have delivered centuries of speculation and investment success will hold true in 2011.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2010 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.