Gold Consolidates Over $1400/oz - CFTC Data Bullish - Silver Nominal 30 Year High

Commodities / Gold and Silver 2010 Dec 30, 2010 - 06:18 AM GMTBy: GoldCore

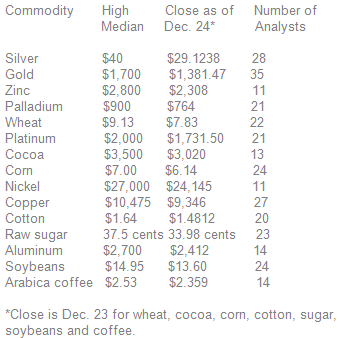

The final week of 2010 has seen a continuation of trends seen in markets throughout the year with equities and commodities continuing to rise. Investors increasingly wary of inflation are pushing commodity prices - particularly metals - higher, with copper hitting a new record nominal high, palladium reaching a nine-year high and silver at a new 30-year record nominal high at $30.90/oz (€23.25/oz and £19.86/oz).

The final week of 2010 has seen a continuation of trends seen in markets throughout the year with equities and commodities continuing to rise. Investors increasingly wary of inflation are pushing commodity prices - particularly metals - higher, with copper hitting a new record nominal high, palladium reaching a nine-year high and silver at a new 30-year record nominal high at $30.90/oz (€23.25/oz and £19.86/oz).

Gold is currently trading at $1,411.15/oz, €1,064.62/oz and £913.90/oz.

Silver's technicals remain strong with the trend remaining firmly up and the fundamentals remain sound with buyers eagerly accumulating on pullbacks and with investment demand set to continue in 2011. Traders with a long term view continue to focus on the 1980 nominal high of $50/oz as a likely long term price target.

Gold prices look set to end the month of December higher which is a bullish omen for 2011 - especially as most commentators had expected profit taking and a year end pull back. Gold is only 1.3% below its recent record nominal high of $1,431/oz.

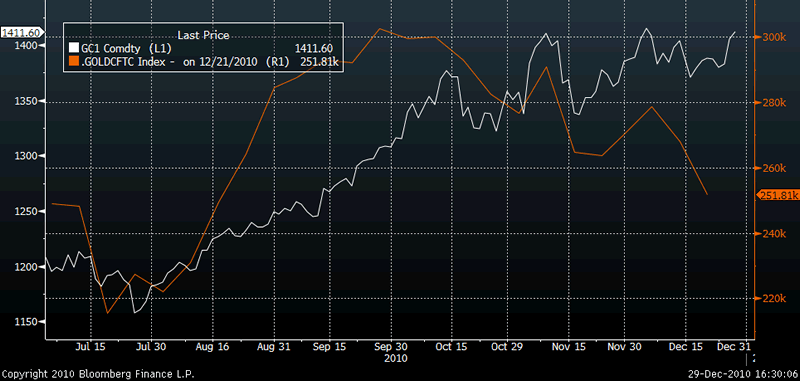

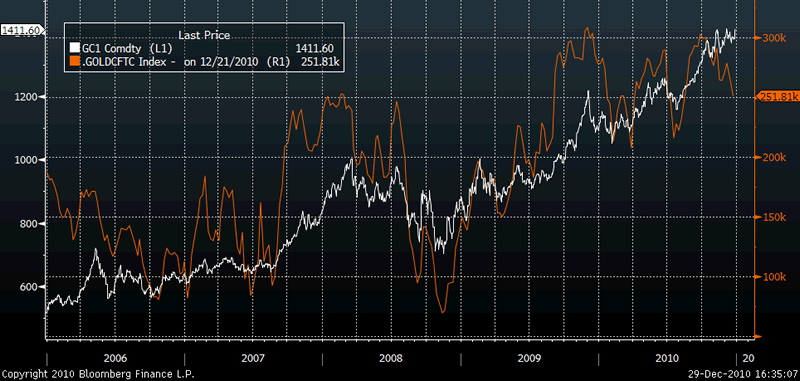

A further indication of how gold's fundamentals remain sound at the $1400/oz level and may be getting ready for a push to $1500/oz sooner than even many bulls expect is the recently released CFTC data. The charts below show how speculators have again cut exposure in their long future and options positions.

For the second week in a row, speculators cut exposure to bullish gold futures and options positions on the Comex division of the New York Mercantile Exchange. For the week ended Dec. 21, speculators in the Commodity Futures Trading Commission's weekly commitment of traders report saw their net-long positions drop in both the legacy and disaggregated reports. Net long positions also fell in October and November and look set to fall again in December.

It is important to note that net long gold positions levels are back at those seen in early 2008 and well below the 300,000 plus seen in December 2009 and at the end of September this year.

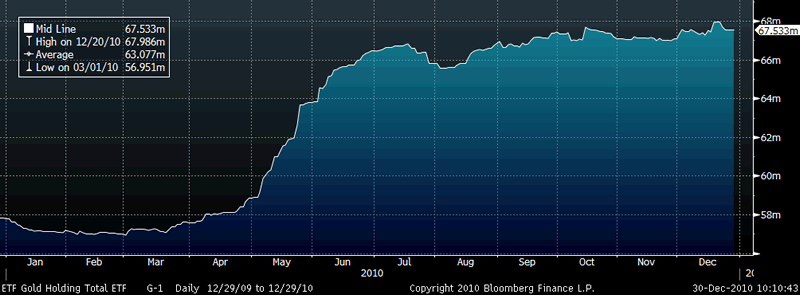

Far from "piling into gold", many traders have taken profits or exited positions in recent months and both the CFTC and Total Known Gold ETF Holdings data clearly show that.

SILVER

Silver is currently trading $30.70/oz, €23.16/oz and £19.88/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,752.25, palladium at $791.00/oz and rhodium at $2,400/oz.

NEWS

(Bloomberg) -- Preference for holding gold as a form of savings in Turkey surged to the highest level since at least 1998, Hurriyet newspaper reported, citing a Mastercard survey in the country.

Gold was the most-preferred savings vehicle among Turks, at 22 percent, followed by savings of Turkish lira “stuffed under the pillow” in second at 21 percent and bank deposits in third at 15 percent, Hurriyet said, citing Mastercard’s survey in 11 Turkish provinces. Foreign-currency savings were preferred by around 8 percent of the population, while bond purchases and stocks each accounted for 6 percent, it said.

(Bloomberg) -- Silver will lead gains in commodities next year, comparing closing prices last week to the high forecasts, based on the median estimate of more than 100 analysts, traders and investors surveyed by Bloomberg News.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.