Aussie Dollar, the Japanese Yen, Euro and Cable all have a different story to tell

Currencies / Forex Trading Dec 29, 2010 - 01:54 AM GMTBy: Bari_Baig

First up we look at USD/JPY: The economic data out from Japan was encouraging today as Industrial production as well as retail sales both exceeded the streets guesstimates. This further put a bid on Japanese Yen and prices tumbled to just below 82. This is the region where Bank of Japan first started to tout that it would intervene in the market and as we have said before now that BoJ has made its mark on the market by actually intervening therefore it is high time that it should continue to weaken Yen. We went buyers of the pair at 82 flat and we intend on holding the position.

First up we look at USD/JPY: The economic data out from Japan was encouraging today as Industrial production as well as retail sales both exceeded the streets guesstimates. This further put a bid on Japanese Yen and prices tumbled to just below 82. This is the region where Bank of Japan first started to tout that it would intervene in the market and as we have said before now that BoJ has made its mark on the market by actually intervening therefore it is high time that it should continue to weaken Yen. We went buyers of the pair at 82 flat and we intend on holding the position.

The coming days and weeks could be shifty for the Japanese Political circle as Mr. Kan the Prime Minister is thinking of making some changes in his Cabinet. We can expect a sizeable shake down of the cabinet especially keeping in view the standoff between Mr. Ozawa and Mr. Kan. As we wrote on Dec 22nd in our article [The difficult Japanese Politics] that “The new scandal doesn’t only revolve around Mr. Ozawa but also Mr. Kan which is new as we’ve known Mr. Ozawa has had many “Funding” related scandals in the past.”

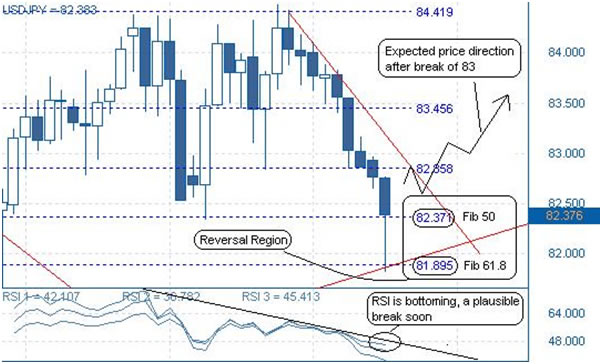

Now looking at the chart below we can see, that since price bottomed out at 80.322 and since then the high has been of 84.508. The currency markets might be thin but between Fibonacci 61 and 50 is where most of the reversals take place. Relative Strength Index [RSI] is also edging towards the oversold territory on the daily chart which further signifies that a bottom is nearing.

Looking at the chart above we can surely expect someone from Japan to voice their views regarding intervention and rest we believe the market shall do all by itself.

The Aussie Dollar and Green Back: Even before China embarked on interest rate hikes there was one school of thought which believed that as China would take action to curb the inflation Australian economy which is amongst the best at the moment in all developed countries would feel the pinch. Now, that China has started to fight inflation by tightening the policy the same group sees “doomsday” scenario for Australian economy.

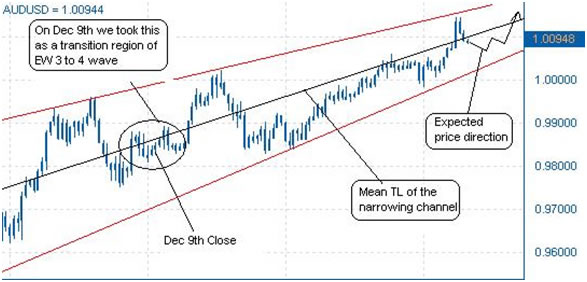

Well, we just have one thing to say to [them] had the effects of tightening or easing would be this quick to reflect in the economy the central bankers would perhaps hold meetings a lot sooner, perhaps every alternate week [But] the word of focus here is “But” that is not how things work. It takes a lot longer for this very reason we remain bullish of Aussie Dollar as we wrote in our article [Will Aussie Dollar Overtake Green back] dated December 9th that “Pace at which the Australian economy is heating up Reserve Bank of Australia “RBA” which only now seemed to be tending towards softening of the policy would need to revisit their decision as therefore we see RBA once again leaning towards tighter policies and that would only put a bid in Aussie Dollar”. That said on December 9th Aussie Dollar closed at 0.98682 and as we write the pair trades at 1.0094 and today’s high 1.01534.

Looking at the chart above as we wrote on December 9th that to us the pair is transitioning from Elliot wave 3rd to 4th therefore with 5th leg forming we can be sure that Aussie dollar would have past the par for good. From the chart we can see that at par the pair has considerable support and the price movement is clearly from the lower left to top right on the chart. We maintain our long term bullish call on Aussie Dollar.

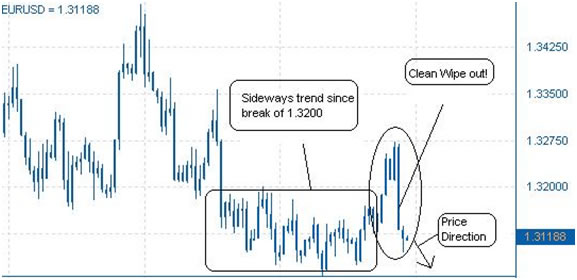

Euro and British Pound both felt a serious knee jerk after a good day yesterday: Yesterday it seemed all of a sudden world did not want the green back and it found Euro and Pound as good substitute but a lot has happened today. Firstly we were taken aback when Euro traded through 1.3200 as that had kept Euro from pushing upward since it broke below but it did and there is no denying. We took it as a bitter pill and got over it but what further surprised us and it shouldn’t have keeping in view the extremely thin market conditions Euro pressed on higher to 1.327s at which point whatever little number of Euro bulls were present in the market, they managed to convince the short sellers that they truly were on the wrong side of the market and shift in the sentiment became visible. The speculation went off the roof so to speak and even before the supposedly weak U.S Economic data of Conference Board Consumer Confidence it further weighed on not just Euro but also Cable as euro collapsed from 1.322s and made a new low of 1.3093s, Cable did the same as it melted from 1.548s to1.5344s also making a new low.

Now, this is what is most interesting. Street identified the collapse of euro and cable to be riskier than U.S Dollar and as global economic outlook looks darker thus U.S Dollar is the first preference! This is utter nonsense and nothing more. Is the street oblivious to Euro Zone problems, have they disappeared all of a sudden? Is PIIGS not a concern anymore? Has Ireland seen the last of Banking Crisis? Or the most important factor is Germany agreeing to all terms and conditions without any say? No! Nothing has happened and therefore we totally disagree with street’s reasoning.

Looking at the chart below of Euro and GBP we can see one thing in common and that is both wiped out all gains of last day and a half and at this point we say just one thing which we’ve said many times before but here goes “when you can’t rise on bullish news you’re not bullish at all”. Euro and GBP both crashed on U.S Dollar bear news and Bull for the other two but the opposite of that happened.

As stated above, almost the exact same thing is visible in the 4 hourly Chart of GBP. We at take simple moving average very seriously and 200-d sma trumps 100-d sma and as we write Cable has broken below the 200-d sma and this we take very serious note of. The chart and the indicators all are pointing to just one direction and that is down south. Cable might find some support at 1.5300 or September support but that won’t hold for long as we eye 1.515s before Cable finds some relief rally. We remain bear of Cable and maintain our short position.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.