Second Global Financial Crisis Shoe 2011

Stock-Markets / Stocks Bear Market Dec 28, 2010 - 01:45 PM GMTBy: Brian_Bloom

Summary: The probability of second down leg in the Global Financial Crisis is rising. Three charts tell the story on a world-wide basis

Summary: The probability of second down leg in the Global Financial Crisis is rising. Three charts tell the story on a world-wide basis

1. Standard and Poor Industrial Index – 85 Year Chart

2. Volatility Index Chart (of Standard and Poor)

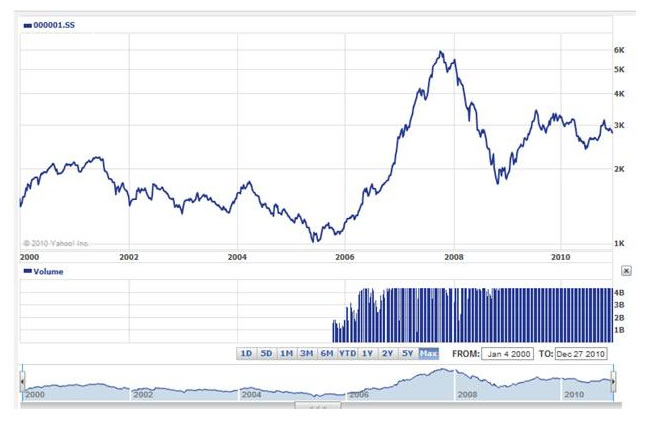

3. Shanghai Index Chart

Analysis:

The 86 year stock market chart is back in overbought territory

The only alternatives available to authorities are:

1. Allow market to breathe out

2. Rampant inflation

Q: Are our authorities stupid?

A: No. They understand as well as you and I that rampant inflation will rupture the entire system

Interim Conclusion: The market is edging closer to a second down leg

Note from the Volatility Index Chart below just how complacent investors have become – against a background of 9.8% US employment, falling house prices in October 2010 and Brent Crude Index showing weakness in freight prices against background of rising oil price.

Note falling bottoms in PMO of 86 year chart. (Momentum of price rises is slowing)

Only “reasonable” outcome might be sideways movement in stock prices for 10-15 years.

(Chart source: decisionpoint.com)

Q: How will a second down leg in GFC affect China?

A: Shanghai Chart at a decision point. Only if $SPX rises in face of rampant inflation will Shanghai Index break up. If $SPX pulls back, Shanghai Index will undoubtedly break down.

Overall Conclusion

Pure logic dictates that it is not possible to pull the world economy up by its own bootstraps. Wealth is created by value add, not by an avalanche of money and credit.

We need to start the healing process by rebuilding infrastructure in the industrialised nations – an infrastructure that is geared to support a new (base load) energy paradigm.

But this time around, the “structure” of the energy industry needs to be carefully considered. The process of rebuilding will take 10-15 years.

Author Comment:

Because of the structure of the oil and coal industries, the failure of the USA and Australia to ratify the Kyoto protocols in 1998 blocked the March to Market of new energy paradigms for a decade. That is why it will be so important to get the structure right of the next energy paradigm.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.