Have Events During 2010 Vindicated Keynesian Economic Models?

Economics / Economic Theory Dec 27, 2010 - 08:23 AM GMTBy: Robert_Murphy

In last Monday's article I discussed Jim Manzi's debate with economist Karl Smith. I pointed out that Smith's evidence in favor of mainstream macroeconomic models was actually consistent with the view that fiscal and monetary "stimulus" policies only stoke economic crises.

In last Monday's article I discussed Jim Manzi's debate with economist Karl Smith. I pointed out that Smith's evidence in favor of mainstream macroeconomic models was actually consistent with the view that fiscal and monetary "stimulus" policies only stoke economic crises.

In the present article, I'll show a different example of this same pattern. Specifically, Paul Krugman took a macro forecast from Mark Zandi, and then after the fact compared it to the actual trajectory of GDP. Krugman concluded that Keynesian theory was vindicated, when in fact the results are more in line with what the critics predicted would happen.

Krugman's Victory Lap

Last August, in a post sarcastically titled, "Nobody Could Have Predicted," Krugman writes,

One point I haven't seen made about the troubles of the US economy is that the timing of [this summer's] growth tells you a lot about what was — and what wasn't — wrong with economic policy.

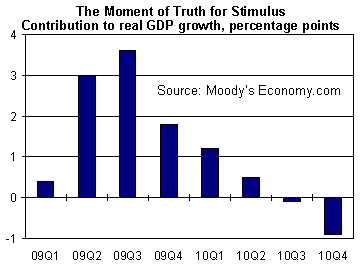

After all, we had more or less a consensus view about when the stimulus would kick in, and how much effect it would have. Here, for example, was Mark Zandi's estimate:

If you follow Krugman's link, you'll see that Mark Zandi — the chief economist for Moody's Analytics — generated the above chart in June, 2009, based on simulations his team performed on the impact of the Obama fiscal stimulus package (which, remember, had gone into effect in January of that year).

Because of the timing of the specific tax cuts and spending hikes in the stimulus package, the chart above shows that (according to Zandi's team) its maximum contribution to economic growth would kick in by the third quarter of 2009, after which it would fade away.

So what does a forecast made in June, 2009 have to do with the validity of Keynesian models? Don't worry, Krugman is only too happy to tell us:

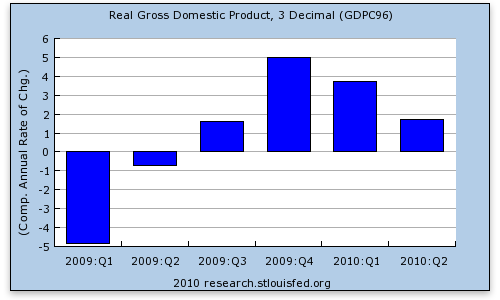

And how did things actually turn out? Like this:

It's not a perfect correspondence, nor would you expect one — other factors, especially inventory swings, were bound to make the timing of actual growth different from that of stimulus. Still, the two pictures support the view that stimulus worked as long as it lasted, boosting the economy. … Fiscal policy works when it is tried.

Ironically, even at first glance it seems that the actual path of the economy offers a stunning rejection of Zandi's forecast. After all, the economy shrank early on, when the stimulus was most intense, and then began growing as the stimulus faded. So someone who held the theory, "When politicians spend money they don't have, it drags on economic growth," could look at the above two charts and say, "I told you so!"

"But c'mon," the perplexed reader might object, "surely Krugman isn't that crazy! Why does he think those charts vindicate Zandi's Keynesian forecast?"

The explanation is that Krugman is looking at the change in the growth rate of the economy (i.e., the second derivative of GDP), rather than the change in GDP itself. Because Krugman "knows," deep in his bones, that additional government spending boosted GDP relative to what it otherwise would have been, he looks at the above charts and "sees" the vindication of his theory.

Specifically, the economy shrank at a horrible clip in the first quarter of 2009, but things had improved markedly by the next quarter. Things got even better by the third quarter of 2009, when the economy actually started expanding again. Krugman credits this sharp turnaround to the massive stimulus that kicked in precisely during these quarters, as Zandi's original chart predicted.

Now it's true, even on Krugman's own terms, his story doesn't quite work because the economy improved even more by the 4th quarter of 2009, even if we are looking at the "increase in the increase." In other words, if we look at the second chart, we can see that the rate of actual GDP growth in the 3rd quarter was about 2.5 percentage points higher than the rate in the 2nd quarter, yet the rate of growth in the 4th quarter was about 3.5 percentage points higher than it was in the 3rd quarter.

This is a problem for Krugman, because Zandi's model had predicted that the stimulus package's boost to GDP growth should have fallen by more than 1.5 percentage points, going from 3rd quarter to 4th quarter (as the first chart shows). It would have been far better for Krugman if the chart of actual GDP growth showed a huge bump in the 3rd quarter, rather than the 4th.

But hey, Krugman says, we've got inventory adjustments that can mess up the precise timing, and of course economies are very complex. The basic pattern still holds up, he thinks, because we saw economic growth pick up generally in the period when the stimulus really kicked in, and we saw economic growth taper off generally in the period when the stimulus began to fade.

To sum up: Even if we restrict ourselves to the evidence Krugman himself provides in their defense, it's not clear that we should acquit the Keynesian models of murdering the economy. If we had reason to suppose that the economy's awful performance in the first quarter of 2009 was an indication of how it would have proceeded in the absence of stimulus, then Krugman's story broadly makes sense.

On the other hand, what if the critics of stimulus are right? Then their story too fits the very facts that Krugman offers. Specifically, when news of the stimulus first hit, the economy fell horribly, and then only really recovered as the stimulus faded away.

If Krugman's two charts were the only information we had available, it would be hard to judge between the two rival interpretations. Yet there is one more thing we can do to test the validity of Zandi's Keynesian forecasting model. Rather than simply looking at how much Zandi thought the stimulus would boost GDP growth in each quarter, let's also take into account what Zandi forecasted as the original level of GDP, without the stimulus.

Once we incorporate this crucial element, we see that the claimed success of Zandi's forecasting falls away completely, and the critics of Keynesianism emerge victorious.

Looking at Levels, Not Just Changes

If we want to figure out what Zandi's model projected for 2009 in the absence of stimulus, we can simply go to his November 3, 2008 paper on the financial crisis, presumably written as a recommendation for the newly elected Obama administration.

Near the end of paper, Zandi discusses his team's simulation of two different scenarios. First, they project what real GDP and unemployment will be if the government does nothing. Then, they project these economic statistics in the case where the government implements a $300 billion stimulus, coming in bursts in January and then May. Here's the takeaway warning from Zandi:

The $300 billion stimulus plan adds nearly 2 percentage points to annualized read GDP growth in 2009. Even with the stimulus, real GDP is expected to fall by 0.3% next year [i.e., in 2009], but without the stimulus GDP plunges a stunning 2.2%. … Some 4 million jobs will be lost peak to trough without government stimulus, pushing the unemployment rate above 9%. Even with the stimulus, some 1.8 million jobs will be lost, with unemployment peaking near 8%. (Zandi p. 21)

If we want the specific predictions on unemployment, we can look at Table 2 (page 21) to see that with no stimulus, unemployment would top out at 8.94 percent in October 2009.[1] But with the stimulus, unemployment would top out at 7.71 percent in the same month.

So how did Zandi's projections hold up? In fairness, we should point out that the actual Obama stimulus package was not as potent (in Keynesian terms) as the hypothetical $300 billion package that Zandi simulated for his November 2008 paper. However, the CBO analysis (see page 3 of this pdf) of the actual Obama stimulus scored it as having about a $250 billion increase in the federal budget deficit in calendar year 2009, which isn't as much as Zandi's hypothetical $300 billion stimulus but is nonetheless fairly sizable.[2]

If the actual numbers fell in between the two extremes of Zandi's projections — one set of numbers for the no-stimulus case, and the other for his hypothetical $300-billion-stimulus case — then we could give Zandi the benefit of the doubt, because the actual Obama stimulus was not as good from a Keynesian perspective.

Fortunately, we don't have to make such a judgment call. In reality, the actual unemployment rate hit 10.1 percent in October 2009, which was not only higher than Zandi's prediction in the stimulus case, but was more than a full point higher than Zandi's do-nothing scenario.

Turning to GDP performance, it's even worse. Zandi had forecast a slight 0.3 percent drop in real GDP, if the government wisely implemented his suggested stimulus. Zandi had warned that if the government did nothing, then 2009 GDP might fall a "stunning" 2.2 percent in a single year — the horrors!

Well, with the actual Obama stimulus that passed early in the year, real GDP in 2009 fell 2.6 percent compared to the previous year, i.e., a worse decline than Zandi's projection for a no-stimulus scenario.

We are not picking on Zandi here; his projections were in line with what other forecasters (themselves relying on Keynesian models) projected at the time. Indeed, the incoming Obama team famously made the same mistake, by predicting that unemployment without the stimulus would peak at a lower level than what the actual unemployment rate hit with the stimulus. (To his credit, Krugman's analysis at the time was much better than his peers'.)

Tweaking the Swimming-Pool Analogy

When the stimulus was a hot topic, conservative and libertarian opponents often invoked a swimming-pool analogy. They would point out that every dollar the government spent, it had to first get from the private sector through taxing or borrowing (we'll ignore inflation). With this insight, the critics said that trying to boost the economy with stimulus spending was like trying to raise the water level in a swimming pool by taking buckets of water from the deep end and dumping them in the shallow end.

Now it's true, things are a bit more complicated than this. An extra dollar spent by the government doesn't necessarily translate into a dollar less spent by the private sector, because of issues of expectations and how a private household or firm adjusts its present spending in light of permanently higher future taxes. (That's why Brad DeLong expressed disagreement — in his usual way — with what he viewed as an improper oversimplification by Steve Horwitz.)

Even so, let's take the swimming-pool analogy as a good proxy for the free-market view, but with a tweak: because the people carrying the buckets will inevitably let some of the water spill out onto the patio, in practice the plan of redistributing water from the deep to the shallow end will actually lower the level of the pool.

In this context, what would be the analog of Paul Krugman's defense of Keynesian stimulus policies, when he relied on the two charts above? It would look something like this: Krugman would look at the level of the pool right before someone dumped in a bucket. He would exclaim, "Aha! When someone empties a bucket into the pool, the level goes up, just as I predicted. And what's more, when they empty a big bucket, the water level rises more than when they empty a little bucket."

The critics of course come back with this retort: "Hold on a second, Dr. Krugman. After implementing your bucket plan all afternoon, the water level is lower than when we started — just like we predicted!"

To this, Krugman could only reply, "Nonsense! You Neanderthals need to study your fluid dynamics; I can write some differential equations if you want. Obviously what is happening is that there is a leak somewhere in the pool. If it hadn't been for my bucket plan, the water would be three feet lower right now than it is. If only we had had the willpower to go find bigger buckets this morning, like I suggested …"

Conclusion

As Jim Manzi has been repeatedly arguing — echoing the writings of Mises — it is impossible to conduct a truly controlled experiment in the social sciences. Often without realizing it, economists interpret the data as confirming their preferred theories, even when those same data give stronger support to their ideological opponents.

As I have said repeatedly myself, the basic intuition of Keynesianism is crazy: You don't help a depressed economy by giving control of its resources to politicians. An open-minded look at the raw facts confirms this commonsense critique.

Notes

[1] It's true, in the text Zandi said unemployment without stimulus would be pushed "above 9%," but according to Table 2, its highest value is 8.94 percent. Presumably Zandi rounded up to 9 percent, and then wrote a bit inaccurately when all he meant to say was "it breaks 9 percent."

[2] The CBO analysis is broken down by fiscal year, not calendar year. To arrive at the $250 billion figure, I took the actual FY 2009 score of $169.5 billion, added one-fourth of the FY 2010 score of $356 billion, and rounded down to $250 billion. (Fiscal Year 2010 runs from October 1, 2009 through September 30, 2010.) Also note that from a Keynesian perspective, the actual Obama stimulus package was less effective because it didn't kick in as early as Zandi's hypothetical $300 billion package.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.