Global Stocks and Commodities Trotting

Stock-Markets / Financial Markets 2010 Dec 26, 2010 - 05:11 AM GMTBy: Piazzi

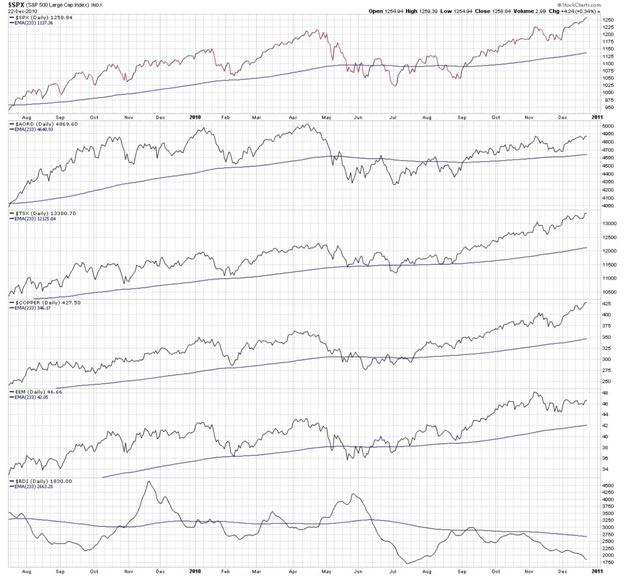

Let’s take a look at a variety of indexes, one commodity, and one commodity-related index

Let’s take a look at a variety of indexes, one commodity, and one commodity-related index

Copper , TSX, S&P and, to a muted extend, Australia have kept pace making new highs.

Copper has been a hell of leading indicator so far during the grand reflation endeavour that started 2009.

We see that the Baltic Dry Index (BDI) has not been doing all that well. There has been a significant drop in the amount of shipping. Can it be that most of the rise of commodity prices are because of monetary reasons and not necessarily because of economic reasons? Is that why the emerging market EEM has been lagging the performance of TSX (Canada) and AORD (Australia)?

I mean, two commodity centric indexes have been doing well, but, a major group of commodity consumers are not looking all that strong.

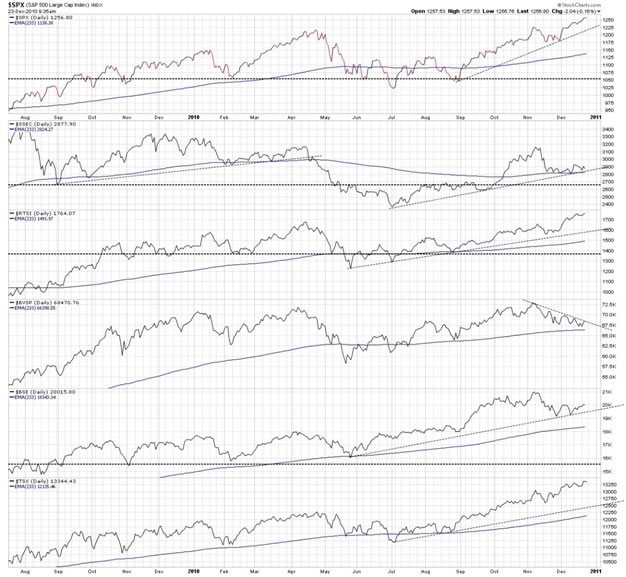

Let’s take a look at a bunch of other indexes

Brazil, India and China all lag the recent highs by S&P, Copper and TSX

So, is the recent high a North American phenomena?

Russian (RTSI) index is doing fine, but I continue to refuse to regard the Russian index as an index of a free (whatever that might mean) market. Nadeem has a detailed write-up on the subject at http://www.marketoracle.co.uk/Article24961.html

Overall, it’s a non-uniform picture. Different countries, or securities go through different cycles. The important thing is the long-term trend that is still up for all of them, and flat for China.

Long term trend is down for BDI (Baltic Dry Index)

Copper may still stay an important indicator. It has responded well to economic conditions (good or bad). It has responded well to monetary conditions (tight or loose).

As I mentioned some posts ago, money (liquidity?) drives the capital markets. Favorable economic conditions may persuade money to stay in the capital markets.

A better global economy should see the Baltic index improve and the emerging markets improve. Without that, IMHO, we will be at the mercy, and the largesse of monetary policies for continued strength in major indexes.

By Piazzi

http://markettime.blogspot.com/

http://markettime.wordpress.com/

I am a self taught market participant with more than 12 years of managing my own money. My main approach is to study macro level conditions affecting the markets, and then use technical analysis to either find opportunities or stay out of trouble. Staying out of trouble (a.k.a Loss) is more important to me than making profits. In addition to my self studies of the markets, I have studied Objective Elliott Wave (OEW) under tutorship of Tony Caldaro.

© 2009 Copyright Piazzi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.