Stock Market Technical Outlook 2011

Stock-Markets / Stock Markets 2011 Dec 26, 2010 - 04:59 AM GMTBy: Chris_Ciovacco

As we kick off 2011, there are plenty of things for investors to worry about, including budget imbalances in developed nations, high levels of bullish sentiment, and a fear of rising interest rates. As of late December 2010, the market’s technical profile remains healthy relative to the outlook for the next few months, something we expand on in the video below.

As we kick off 2011, there are plenty of things for investors to worry about, including budget imbalances in developed nations, high levels of bullish sentiment, and a fear of rising interest rates. As of late December 2010, the market’s technical profile remains healthy relative to the outlook for the next few months, something we expand on in the video below.

From Wall Street’s perspective, the positive drivers for stocks in 2011 include:

- The recent extension of the Bush Tax Cuts.

- Little in the way of double-dip talk.

- Positive outlook for the economy and earnings.

- Favorable market seasonals and cycles.

- Many companies have large stores of cash.

- Consumer confidence is picking up.

- The Fed’s desire to inflate asset prices.

- Consumer balance sheets have improved a bit.

- Stock valuations are not excessive (from the perspective of many).

- Low CPI inflation.

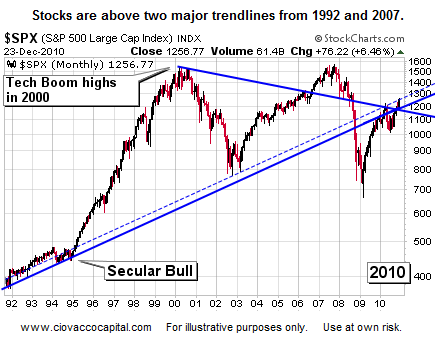

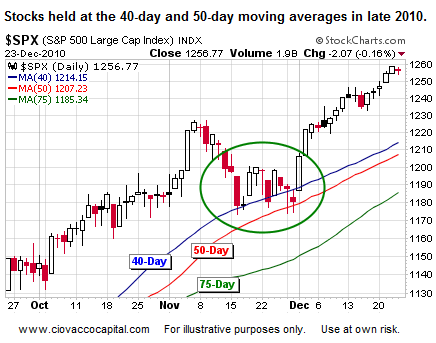

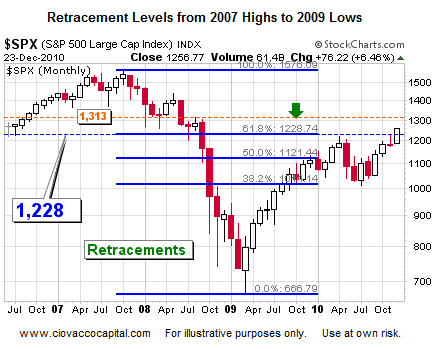

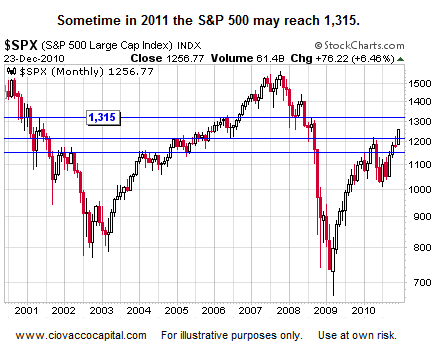

Part II of our 2011 stock market outlook expands on some of the concepts above with an emphasis on (a) what could derail the bull, and (b) the S&P 500’s technical profile. The technicals are discussed in a manner that can be understood by both professionals and investors who have limited experience with market charts. Copies of the charts reviewed in the video, as of December 23, 2010, are below the video player. A larger version of the video player can be found here.

Part I of II can be found in Risk Assets Respond to Quantitative Easing.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2010 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.