FedWatch: Who's Going to Buy the Structured Investment Vehicle Asset Junk?

Interest-Rates / Credit Crunch Oct 21, 2007 - 08:57 PM GMT

The backers of the proposed superfund being set up to buy assets from cash strapped structured investment vehicles (owned by banks) met last night. The presence of some $280 billion in leveraged debt vehicles is not only the source of new potential losses, but ties up funds from being lent in new, more profitable loans. These numbers are pretty much in line with the $251 billion of maturing asset backed commercial paper this week. In essence, these banks wish to slough off their mistakes and start afresh. But who's going to buy the stuff?

The backers of the proposed superfund being set up to buy assets from cash strapped structured investment vehicles (owned by banks) met last night. The presence of some $280 billion in leveraged debt vehicles is not only the source of new potential losses, but ties up funds from being lent in new, more profitable loans. These numbers are pretty much in line with the $251 billion of maturing asset backed commercial paper this week. In essence, these banks wish to slough off their mistakes and start afresh. But who's going to buy the stuff?

Of all people, Alan Greenspan is not convinced that the “Super SIV” fund is a good idea, either.

Sharing the pain with others.

Wall Street and the Bankers have generously decided to share the pain of their subprime mess through the superfund mentioned above. But investors are not sure the plan will work. There are several unanswered questions about the new superfund. The first question is, why do we need a superfund that will only buy AA and AAA debt? ( See an earlier NY Times article ) We already have mutual funds that sell different types of debt securities. Why another? The next question is, who will certify the creditworthiness of this debt? Will the same credit rating agencies that gave a pass on the subprime debt before it blew up tell us it is different this time? Who benefits? Will the banks that collect the fees to manage this fund also share in the liabilities? Finally, how will this investment vehicle help the banks offload their toxic waste? I see a lot of smoke and mirrors, here.

Japan 's Nikkei starting next phase…

…as the Nikkei 225 fell over 292 points last night (not shown). Last week I warned that the final corrective rally was in. The falling dollar hit Japanese exporters whose major market was the United States especially hard. Shippers also tanked on higher fuel prices. This could be the start of the next leg down…

…as the Nikkei 225 fell over 292 points last night (not shown). Last week I warned that the final corrective rally was in. The falling dollar hit Japanese exporters whose major market was the United States especially hard. Shippers also tanked on higher fuel prices. This could be the start of the next leg down…

.

Financial news hits Shanghai .

Could it be the news about Bank of America's losses that tipped the Chinese market? After all, Bank of America had its beginnings in San Francisco and appealed heavily to the ethnic immigrants from Europe and China . Or could it be the proposed merger of the Shanghai and Hong Kong markets? There is an approximate 50% premium between the two markets that could be erased overnight in the merger.

Could it be the news about Bank of America's losses that tipped the Chinese market? After all, Bank of America had its beginnings in San Francisco and appealed heavily to the ethnic immigrants from Europe and China . Or could it be the proposed merger of the Shanghai and Hong Kong markets? There is an approximate 50% premium between the two markets that could be erased overnight in the merger.

Or is it simply done going up?

Crash Alert!

The highly emotional and out of control S&P 500 index is indicative of the irrational behavior of investors. It's as if we are in a theater, watching one of the most thrilling movies we've seen in a long time. There's a whiff of smoke (Greenspan warning, Bernanke warning , corporate earnings warning s), but no one else is heading for the exits. Maybe we'll stay just a while longer…Whoops!

The highly emotional and out of control S&P 500 index is indicative of the irrational behavior of investors. It's as if we are in a theater, watching one of the most thrilling movies we've seen in a long time. There's a whiff of smoke (Greenspan warning, Bernanke warning , corporate earnings warning s), but no one else is heading for the exits. Maybe we'll stay just a while longer…Whoops!

The rally in bonds suggests a move to a safer haven.

The poor behavior of U.S. Stocks is sending investors fleeing to a safer investment vehicle – Treasury bonds. Tame inflation data and a weak housing market lead investors to believe yet another rate cut is in store. The fact is, since 1947, the Federal Reserve has followed the interest rates in the 90-day treasury rate . The drop in the 90-day rate signals that the Fed will also drop rates very soon. But will it help the markets?

The poor behavior of U.S. Stocks is sending investors fleeing to a safer investment vehicle – Treasury bonds. Tame inflation data and a weak housing market lead investors to believe yet another rate cut is in store. The fact is, since 1947, the Federal Reserve has followed the interest rates in the 90-day treasury rate . The drop in the 90-day rate signals that the Fed will also drop rates very soon. But will it help the markets?

Dream house turned nightmare.

For years Americans custom-built homes with pricey extras expecting high returns on their investment. They're in for a letdown. The reason is that a sinking economy is shrinking the number of people who can afford these homes. In addition, rising property taxes, utilities and maintenance are often stretching budgets already constrained by high mortgage payments.

The greenback is still weakening.

The US dollar extended losses against major currencies in midmorning trade Friday after significantly higher than expected weekly jobless claims and disappointing corporate earnings. This triggered heavy selling in the greenback, as investors switched to safer assets. But bad news can be overdone. Lets see where this takes us, since commodities may be topping. There is an inverse relationship between the U.S. Dollar and commodities that must be respected.

The US dollar extended losses against major currencies in midmorning trade Friday after significantly higher than expected weekly jobless claims and disappointing corporate earnings. This triggered heavy selling in the greenback, as investors switched to safer assets. But bad news can be overdone. Lets see where this takes us, since commodities may be topping. There is an inverse relationship between the U.S. Dollar and commodities that must be respected.

Gold prices reached a 27-year high.

Last week I illustrated some contrarian principles about investing. When everyone is piled on to an investment, there is no one left to buy more. That is why when investor bullish sentiment climbs over 90%, smart investors should start dancing near the door, if not leaving the party altogether. Recently, investor sentiment toward gold reached over 93% according to Investors Intelligence. In addition, a non-financial paper, The L.A. Times, published a piece with the headline captioned above the chart. Psst! The door is over here.

Last week I illustrated some contrarian principles about investing. When everyone is piled on to an investment, there is no one left to buy more. That is why when investor bullish sentiment climbs over 90%, smart investors should start dancing near the door, if not leaving the party altogether. Recently, investor sentiment toward gold reached over 93% according to Investors Intelligence. In addition, a non-financial paper, The L.A. Times, published a piece with the headline captioned above the chart. Psst! The door is over here.

Crude oil prices hit $90, then retreat.

Crude oil prices took a breather from rising prices today. Speculators had driven up oil prices based on the prior OPEC production cuts as well as the notion that the invasion of northern Iraq by Turkey might disrupt supplies in the Middle East . Gasoline prices have not followed as dramatically, however. The pattern suggests that rising prices may give way very soon. The Energy Information's “ This Week In Petroleum ” has some interesting observations.

Crude oil prices took a breather from rising prices today. Speculators had driven up oil prices based on the prior OPEC production cuts as well as the notion that the invasion of northern Iraq by Turkey might disrupt supplies in the Middle East . Gasoline prices have not followed as dramatically, however. The pattern suggests that rising prices may give way very soon. The Energy Information's “ This Week In Petroleum ” has some interesting observations.

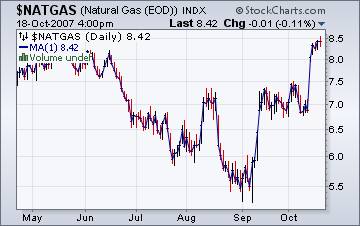

Natural gas supplies are in good shape.

“Despite the seemingly favorable supply conditions and little weather-related natural gas demand, natural gas prices continued their upward movement of the past 6 weeks.” Says the EIA Natural Gas Weekly Update . Since the amount of natural gas in storage is 6.7% above its 5-year average and there is no disruption in supply, it could be ascertained that the spike in prices may be attributed to speculation based on the trend of oil prices, for example.

How did we get here, anyway?

Mike Hewitt, in his article entitled, “ America's Forgotten War Against The Central Banks ” gives us a lesson in history that we should all know about our banking system. Here is an exerpt;

"By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens...There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose." (John Maynard Keynes)

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.