Gold Rises as UK Finances Deteriorate and IMF Gold Sales End

Commodities / Gold and Silver 2010 Dec 22, 2010 - 09:00 AM GMTBy: GoldCore

Gold Rises as UK Finances Deteriorate and IMF Gold Sales End

Gold and silver edged moderately higher again yesterday in most currencies. Profit taking and book squaring prior to year end have led to lacklustre range bound price action. News that the IMF gold sales to central banks has been completed, saw gold prices rise slightly. Despite the gold sales being off market - directly from the IMF to creditor nation central banks diversifying monetary reserves - the potential overhang of IMF gold supply and perceived risk was one of the few bearish factors in the gold market.

Gold and silver edged moderately higher again yesterday in most currencies. Profit taking and book squaring prior to year end have led to lacklustre range bound price action. News that the IMF gold sales to central banks has been completed, saw gold prices rise slightly. Despite the gold sales being off market - directly from the IMF to creditor nation central banks diversifying monetary reserves - the potential overhang of IMF gold supply and perceived risk was one of the few bearish factors in the gold market.

Gold is currently trading at $1,389.32/oz, €1,057.08/oz and £898.31/oz.

Gold is currently trading at $1,389.32/oz, €1,057.08/oz and £898.31/oz.

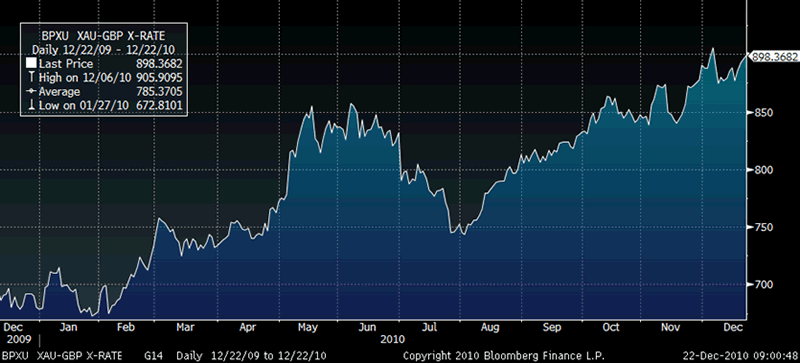

GBP Down 24.5% Against Gold - YTD (Daily)

Sterling fell against gold and other currencies yesterday as the UK budget deficit and public borrowing surged to record highs (£23 billion) in November. The UK's fiscal position remains very precarious and the UK's overall deficit position is worsening. This does not bode well for the outlook for sterling in 2011 and some commentators are actually warning of sharp falls in the value of sterling in 2011.

(see News and Commentary).

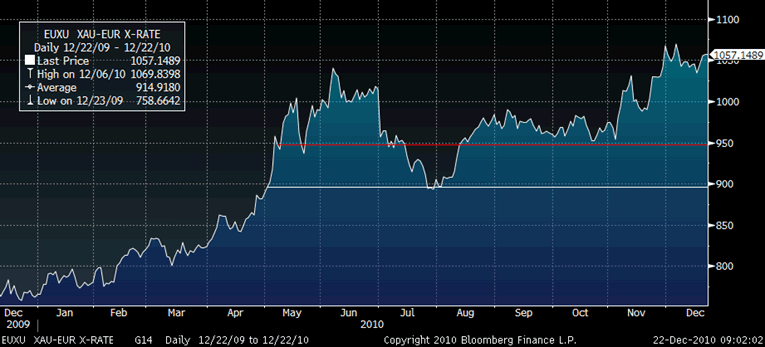

EUR Down 27.5% against Gold - YTD (Daily)

With all the talk of a crisis in the Eurozone and the risks posed to the euro single currency, it is interested to see that the euro has fallen against gold (-27.5%) only slightly more than sterling (-24.5%) and the dollar (-26.6%) so far in 2010. This clearly shows that the era of quantitative easing and competitive currency devaluations is seeing all fiat currencies be debased and consequently fall against the finite monetary reserve that is gold.

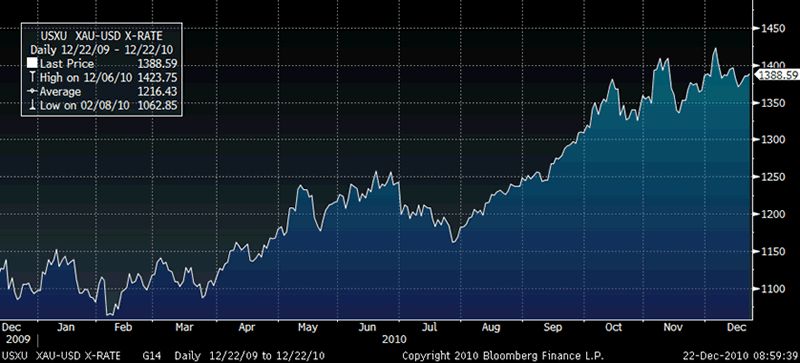

USD Down 26.6% Against Gold - YTD (Daily)

In Japanese yen, Australian dollar and Swiss franc, three of the better performing currencies in the world, gold rose 12.2%, 12.5% and 14.1% respectively. This shows how the price of gold is not rising per se rather fiat currencies are losing purchasing power and being devalued internationally. This increases the attraction of precious metals and hard assets that are finite and cannot be debased as inflation hedges.

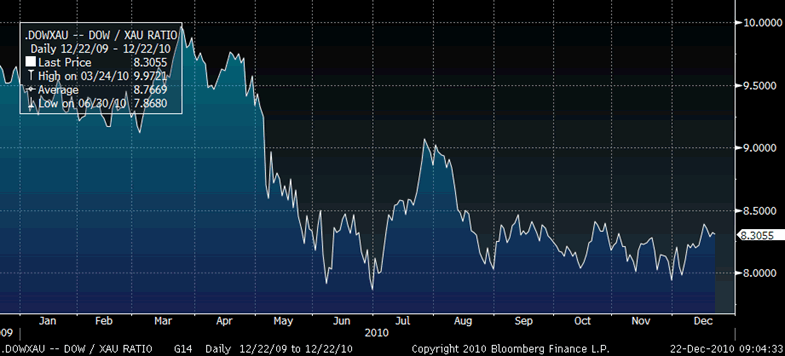

DJIA/GOLD Ratio

Interestingly, while the Dow Jones Industrial Average is up on the year in dollar terms, in gold terms the DJIA was down 12.6%. The record lows on the DJIA/GOLD ratio of below 2 seen in the Wall Street Crash in 1929 and the final days of stagflation in 1980 may be possible, should there be another deflationary spiral leading to further sell offs in stock markets.

SILVER

Silver is currently trading $29.39/oz, €22.36/oz and £19.00/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,722.75, palladium at $756.00/oz and rhodium at $2,400/oz.

NEWS

(Bloomberg) -- Gold may climb to $1,480 an ounce, after breaking through record levels set this month, according to technical analysis by Barclays Capital. A recent dip was a "healthy correction" and levels above the $1,350 area provided a base for gains to initial targets of $1,460 to $1,480 an ounce based on Fibonacci projections and rising trendline resistance, Barclays analysts wrote in a report dated Dec. 17.

(Bloomberg) -- Gold Rises on Demand for Haven Amid Mounting European Debt Woes

Gold prices rose for the third straight session on speculation that Europe's debt woes will spread, boosting demand for the precious metal as a store of value.

(Bloomberg) -- The International Monetary Fund said it concluded the planned sale of about 13 percent of its gold reserves to central banks and to market participants.

The institution agreed in September 2009 to dispose of 403.3 metric tons of bullion as part of a plan to shore up its finances and lend at reduced rates to low-income countries. More than half of the gold amount was acquired by the central banks of India, Mauritius, Sri Lanka and Bangladesh, according to past announcements.

(Bloomberg) -- Cotton Prices Jump to Record for Second Day on Supply Shortfall

Cotton futures jumped to a record for the second straight day on speculation that global supplies will fail to keep pace with rising demand in China, the world’s largest user.

(Bloomberg) -- Coffee Price Rises to 13-Year High; Cocoa, Orange Juice Gain

Coffee futures extended a rally to a 13-year high on speculation that supplies may be reduced because of adverse weather in Brazil and India. Cocoa and orange-juice prices climbed.

(Bloomberg) -- Sugar Extends Rally to 29-Year High on Brazilian Supply Concern

Sugar futures rose in New York, extending a rally to a 29- year high, on speculation that supplies will start running low from Brazil, the world’s largest producer.

(Bloomberg) -- Baltic Index Falls an 11th Day on Dearth of Cargoes, Holidays

The Baltic Dry Index, a measure of commodity-shipping costs, fell for an 11th straight day to the lowest level in almost five months on a lack of cargoes and winding down of business before Christmas and New Year holidays.

(Telegraph) -- A businessman whose ex-wife claimed he had hidden three bars of gold bullion smuggled out of Nazi Austria to conceal his wealth was ordered by a court to pay her £2.5 million on Friday.

Peter Brandon said the ruling at the Court of Appeal in London would leave him "impoverished".

However, the judges' decision settles the long-standing debate about what has happened to the gold bars.

(Financial Times) -- Copper prices hit an all-time high on Tuesday well above the key $9,000 a tonne level, after the world's third largest mine of the red metal halted exports after an accident. The jump in copper prices came amid a broader rally in commodities prices, with the cost of cotton hitting a fresh all-time high and the price of high quality coffee surging to a 13 1/2-year peak

(Financial Times) -- US steps up Iran sanctions ahead of talks

The US has unveiled new sanctions against Iran, in a move that highlights Washington's drive to keep pressure on the Islamic Republic ahead of a new round of negotiations with Tehran next month. Tuesday's announcement by the Treasury department, targeted at Iran's main shipping line and its Revolutionary Guard Corps, also marks the way US and international sanctions now hit Iran's overall economy.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.