Is this the week which brings “bad” fortune to Euro?

Currencies / Euro Dec 20, 2010 - 03:11 PM GMTBy: Bari_Baig

It seems just about everyone has forgotten about the EU Debt Crisis which couldn’t get enough air time several weeks ago. Now, all of a sudden everyone’s attention is towards U.S or as the holiday season is approaching no one wants to look at the bad side of the picture [But] does that mean all is well?

It seems just about everyone has forgotten about the EU Debt Crisis which couldn’t get enough air time several weeks ago. Now, all of a sudden everyone’s attention is towards U.S or as the holiday season is approaching no one wants to look at the bad side of the picture [But] does that mean all is well?

No, it doesn’t mean that from anywhere. The European Economic Summit held last week in Brussels which to us was of great importance went by rather too quietly. Summits of such stature or should we say something which takes the “MAASTRICHT TREATY” into account do not go by this quietly. There should be lots of media coverage but whatever “air” it got, wasn’t enough to suffice the meeting. Before the Summit began everyone’s eyes were on the German’s that what would they do. We have mentioned this before and we state this even now that during the time of Greece Bailout Ms. Merkel faced lots of resistance from the German Public and not much has changed even now. The hard working Germans do not want to keep bailing out the PIIGS. The PIIGS take more holidays each year; they have lesser pension age and other benefits and the list goes on. So, how is that all of a sudden everything seems fine? How would Ms. Merkel have the German public to agree upon the “stability mechanism” in which the bond holders would share the cost of debt restricting and what is of even more interest is how would this “Stability Mechanism” get the people convinced that all is fine now and therefore it is “Safe” to take Portugal, Ireland, Italy, Greece and Spain’s debt? It is a difficult task, it is a task which makes the job of politicians that much more difficult. We can say one thing at this point, we are glad we are not in Ms. Merkel shoes.

To us the “street” isn’t clear about the outcome of the Summit and therefore we are seeing a rather settled Euro today. In last few days Euro has defied Fundamentals, it has defied “techies” calls and it has conformed to a sideways trend which at best raised my “upside” signals by “techies”. As we wrote on December 8th in our article [The green back and the falling Euro] on www.marketprojection.net that “We maintain our bearish stance on Euro and nothing material has changed that we’d change our target of below 1.25s for that matter.” That holds true even now as we write as nothing material has changed that we’d need to revise our downside price target.

What we find even more interesting is that credit rating agencies are raising a flag after a flag of rating cuts of PIIGS however, that is something which is something which is perhaps already priced into Euro but what is not assimilated in the price is a possible downgrade of France losing its AAA rating. The rumors are now circulating around France and this could very well be the news which gets the ball rolling and prices finally start to move from upper left to lower right corner.

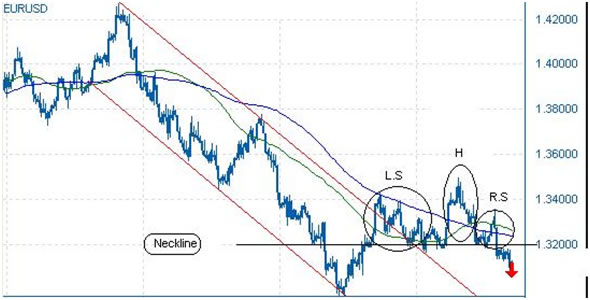

Looking at the 4 hourly chart above we see Euro after managing to clearly break the downward channel has been moving sideways. What is even more interesting is a possible HnS formation with a neckline already broken on Friday as the neckline stood at 1.3200 and the pair closed at 1.3185s which to us a confirmation in itself. If the formation fully executes itself we should see Euro trading all the way down to last week of November lows.

Let’s give Euro Bulls benefit of the doubt for a minute as they are touting about a possible bottom formation in Euro thus see prices move upward. But at the same time looking at the U.S Dollar Index chart below we can clearly see that Green Back index which might have not fully cleared the peak of 2nd leg but has now successfully cleared the downside risk is on its way upwards. The RSI maintains a nice upward slope with plenty of room on the upside. The article mentioned above [The Green back and the Falling Euro] we stated that we find DXY index to have completed two upward legs and was in a phase of consolidation after which the index should move upwards to low 83s. What we can also see from the chart that during the consolidation phase the lows of 79 were only broken on an intra-session basis and the index managed to close well above the low of 79 further adding more credence in the DXY trend.

I believe the Dollar Index chart takes away the benefit of the doubt that we gave to Euro bulls for a minute as the upside probability of the index seems equally matched with the downside in Euro thus we stay bulls of Green back and Bears of Euro and mince our words at that.

The U.S Equities: Before we write anything else, let us first quote what we wrote in our article on Dec 13th [The stock markets are celebrating but commodities are clueless] that “So, for now it seems Dow has broken free of the consolidation phase and could very well post a new high for 2010. Would we be surprised? Not at all, a bull run upwards after clearing the plausible jitters between the previous peak and 11,550 could give way to new highs of mid 11,700s.” What we find of interest is that almost a week has gone by and DJIA seems to be held rather firmly in the jitter zone therefore raising cautionary flags of many that perhaps the top is now nearing. We’d argue with the cautionary flags that are rising for we have envisioned this before it happened and the ones which were first reluctant to declare a break after the break expected the index to shoot up like a canon fired. That is where we differ and we maintain our view.

That said, we are not awfully bullish for this week as the liquidity has now started to slowly make its way out of the market and the economic stage seems quiet too for this week in U.S therefore the driving factors are missing thus a calmer week for the U.S Equities.

The problematic Korean Peninsula is again trying to take centre stage which would further drive out the left over liquidity from the market rather quickly but with that one could expect a more violent move in either of the direction with bias towards the downside. Looking at the chart below we can see the “jitter” zone is now littered with supportive regions.

One more interesting fact is now equities globally are much more used to the “routine” rating cut of European countries therefore to assume that “Next” cut would put a dent into the equities is somewhat unrealistic as many cuts have gone by and equities have [Not] paid much heed. We then stick to the upside and maintain 11,700 target for Dow for the end of the year.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.