Carl Icahn's Dynegy Power Struggle and Coming Showdown at Chesapeak Energy

Companies / Natural Gas Dec 19, 2010 - 12:33 PM GMTBy: Dian_L_Chu

It has been a literal power struggle between Dynegy, Inc. (DNY) -- the third-largest U.S. independent power producer--and its investors. With weak natural gas prices dragging down power prices, Dynegy booked a net loss of $1.25 billion in 2009 and another $70 million loss in the first nine months of this year.

It has been a literal power struggle between Dynegy, Inc. (DNY) -- the third-largest U.S. independent power producer--and its investors. With weak natural gas prices dragging down power prices, Dynegy booked a net loss of $1.25 billion in 2009 and another $70 million loss in the first nine months of this year.

Natgas Kills The Power

On top of the losses already incurred, Dynegy also holds $3.95 billion in debt, with over $1.7 billion maturing in 2015 and 2016. The company now expects to have a cash shortfall of $1.6 billion over the next five years. FT.com quoted Dynegy management that its portfolio makes or loses $165m for every $1 movement in natural gas prices.

Diverging Forward Views

For the past few months, Dynegy has been telling investors to accept a buyout offer from Blackstone Group or the company would face dire consequences. However, Dynegy’s investors have a drastic different view about the company’s future.

Billionaire financier Carl Icahn and hedge fund Seneca Capital, two biggest stakeholders of Dynegy, had rejected Blackstone’s original offer of $603 million or $4.50 a share citing gross undervaluation, and that the company is very well positioned to reap benefits of a recovery in electricity price.

Icahn Deal at 10% Premium

The climax came on Wed. Dec. 15, when Dynegy said it accepted a buyout offer of $665 million, excluding debt, from Carl Icahn, while Blackstone Group signaled that the private-equity firm won't seek to top Icahn's offer. The offer from Icahn Enterprises, valued at round $5.50 a share, represents a 10% premium to Dynegy’s average closing price over the past 30 trading days.

Dynegy – An Enron Clone

You might recall that Dynegy, along with Enron, was among several energy companies accused of price manipulation and other fraudulent practices during the California electricity crisis.

In the late 90’s, Dynegy, like many other energy players, had structured its business similar to Enron, including an online trading platform, and broadband communication. Then in 2000, Dynegy was on the verge of taking over Enron before backing out of the deal at the last minute due to Enron’s massive accounting fraud and write offs. Dynegy was awarded Enron’s crown jewel--Northern Natural Gas Company pipeline—after Enron’s bankruptcy.

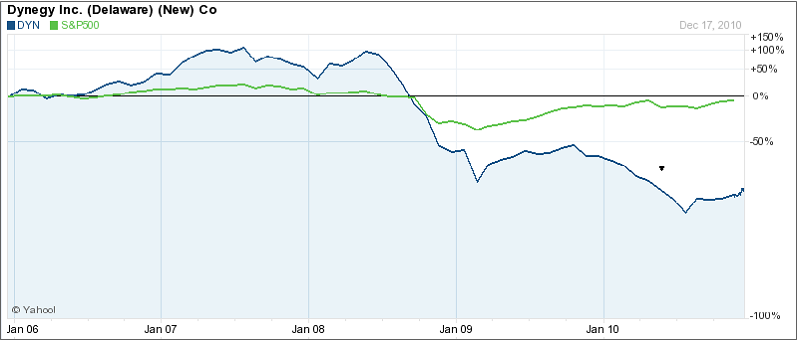

The company later had to sell the pipeline to a consortium of investors led by Warren Buffett for a bailout, as the energy recession following Enron’s collapse, and its own accounting scandal pushed Dynegy on the brink of bankruptcy in late 2002. Dynegy has been going through restructure, piecemeal selling off assets and on a steady decline ever since (see chart).

To Hold or Sell Off?

Right now, it is still unclear what Icahn's intentions are for Dynegy. One play is to hold and bet on economic growth. Meanwhile, Carl Icahn, corporate raider turned investor rights advocate, is no stranger to the energy sector dating back to the 80’s when he was involved in the nasty feud between Pennzoil and Texaco over Getty Oil takeover.

Bloomberg reported Icahn’s hedge funds put almost $1 billion into energy stocks during the second quarter as the BP Macondo incident pushed prices lower, according to a regulatory filing. As a result, energy stocks accounted for 18% of the hedge-fund group’s stock investments, which helped the funds record an 8% gain in July. Since Icahn’s holdings are heavier on oil than coal or natural gas, Dynegy would round up the power sector in his portfolio.

However, a meaningful economic recovery could take longer than Icahn’s typical holding period of one to two years. Moreover, according to Fortune, Icahn made the offer using just public information without the normal due diligence process, which seems uncharacteristic of Icahn.

Orchestrating an “Value Event”

Icahn's investing history has been to buy low, orchestrate some “value event” (e.g., his Dynegy offer), before hitting his pay day. So, these indications suggest it is more likely that Icahn is trying to flush out a higher bid. Under the Dynegy-Icahn deal, Dynegy may go-shop until Jan. 24 to seek better offers.

Nevertheless, other suitors are very hard to come by since Dynegy had been on the block for nearly two years without takers mainly due to concern about the company’s crushing debt load....unless either Blackstone, or Seneca could come up with new bid(s).

NRG – A Potential Asset Buyer

On the other hand, breaking up and selling off Dynegy seems much easier as there’s one potential buyer already lined up. NRG Energy—the second largest power producer in the nation—was set to buy four power plants from Dynegy for $1.36 billion as a side deal of the original Blackstone proposal.

Although NRG indicated it would pay less for these assets if the Blackstone deal were voted down, the lure of a quick and still subtantial cash inflow probably prompted Icahn’s last minute and somewhat a surprise bid for Dynegy.

But It is not a done deal for Icahn yet as there’s no indication that Seneca Capital, which bought 9.3% of Dynegy in order to frustrate the Blackstone deal, and other investors, would support this new offer from Icahn.

Showdown at Chesapeake

While Dynegy continues its power struggle, Icahn has apparently picked out his next target. In a regulatory filing, Carl Icahn has raised his stake in Chesapeake (CHK) to 5.8% of the company, or 38.6 million shares, saying that the stock is undervalued. About 12 million shares of Chesapeake were purchased earlier in December, at prices ranging from $22.72 to $22.89.

Reportedly, the Icahn filling also said “there were plans to speak with the [Chesapeake] management about ways to maximize the value of the company. So, we could expect a showdown in the near future between Carl Icahn, and the equally outspoken, if not more arrogant, Aubrey McClendon, the Chairman and CEO of Chesapeake.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.