America’s Second Great Depression 2010 Year-end Update (Part 1)

Economics / Great Depression II Dec 18, 2010 - 11:24 AM GMTBy: Mike_Stathis

“Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” [1]

“Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” [1]

That quote was taken from a speech made by then Board of Governors member Ben Bernanke in 2002 to the Federal Reserve. Unfortunately, Bernanke’s pledge has been broken.

As clueless as Bernanke has been, if you follow what he says closely, on occasion you will see his own admission that the U.S. is either in a depression or is certainly headed for one.

For instance, on Tuesday November 30, 2010, as Bernanke attempted to defend his recent decision to buy $600 billion of U.S. Treasuries, he made ridiculous claims that this quantitative easing would lead to more jobs. He then used the often used scare tactic to justify this move by saying that a long period of high unemployment could exact a steep social cost.

"There are obviously very severe economic and social consequences from this level of unemployment," so getting new jobs, getting unemployment down is of an incredible importance."

“The unemployment rate is still going to be high for a while, and that means that a lot of people are going to be under financial stress.”

Recently, Bernanke predicted unemployment will remain high for "four or five years." [2]

So what is Bernanke trying to say? Read between the lines for yourself. First, he has said that there will be very severe social and economic consequences from this high level of unemployment. What does “Very severe social and economic consequences” mean? Quite simply, it means a depression.

Then, on December 5, 2010, Bernanke stated that unemployment will remain high for four or five years. By now I’m sure you realize any estimate that sides with optimism by the Fed is a severe understatement. What that means is that high unemployment will last much longer.

But this by no means provides any useful guidance by Bernanke. It should be obvious to any rational adult that we are in a depression. I detailed the causes and effects of this depression in America’s Financial Apocalypse four years ago.

My track record can be found here: http://www.avaresearch.com/article_details-341.html

So who should you be listening to? Ben Bernanke? The hacks in the media? You can decide for yourself.

Now if you’ve decided to listen to me, I’m going to tell you why the unemployment rate is so high and will remain high for many years to come. But you’ll have to wait for Part 2 of this article.

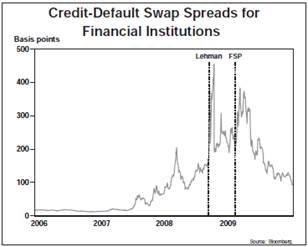

First, let’s summarize what has happened. Over the past two years we have seen some of the worlds strongest, oldest, most successful financial institutions file for bankruptcy or participate in forced buy outs to avoid further crisis.

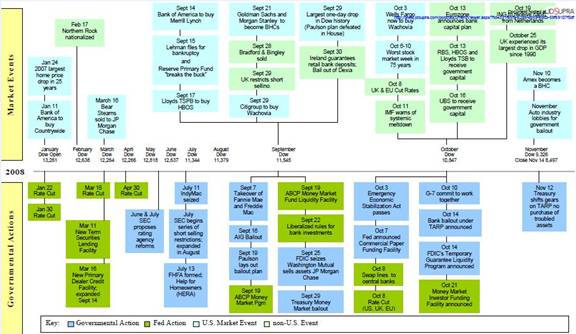

First, in early March 2008 Bear Stearns collapsed due to lack of confidence from investors. By the summer, Indy Mac had failed and Fannie Mae and Freddie Mac were insolvent. [3] [4]

Throughout 2007 and 2008, many investors were told by the hacks on TV that the financials represented a “great value.” As a result, the sheep piled in. Thereafter, they watched shares collapse. [5]

By the first week of August 2008, everyone else was fixated on Fannie and Freddie. But I already knew their fate, as I had previously instructed investors to short Fannie and Freddie and many other mortgage and bank stocks in my 2007 book, Cashing in on the Real Estate Bubble.

I was already looking ahead. I warned readers we would see an earnings meltdown. I advised investors to sell, and aggressive investors to short the market.

"Standard & Poor’s earnings estimates for Q2, Q3, and Q4 of 2008 are -11%, 40%, and 60% respectively. Remember, this the same S&P that rated the mortgage junk AAA. It will also be the same S&P that will end up issuing drastic revisions in earnings once the bottom falls out. But that won’t help investors after the fact."

"Sure, it’s possible that we will see the market rally over the next couple of months. If so, you would be wise to sell. More aggressive traders might consider shorting it entirely once it tops out based on the 1-year resistance trend line."

Source: http://www.avaresearch.com/article_details-84.html

During the first week of September, Fannie and Freddie were placed into government conservatorship to prevent each from failing. Eight days later, Lehman Brothers filed for bankruptcy protection. [6] [7]

On the same day, Bank of America announced it would purchase Merrill Lynch at a huge premium. Immediately after the deal was announced I discussed that this was one of many bailouts disguised as a buyout arranged by the Federal Reserve and the Treasury Department. [8]

The following day, AIG received a government bailout to the tune of $85 billion. This would be the first of more installments to come. Of course, the only reason AIG was bailed out was because Goldman Sachs stood to lose $20 to $30 billion. [9]

Understand that Bernanke was directly responsible for these deals, and each one was littered with fraud.

Less than two weeks later, Washington Mutual was suddenly seized despite having received a clean bill of health through at least the rest of the year by the Office of Thrift Supervision.

Over the next two weeks I would submit a draft to the SEC discussing that the seize of Washington Mutual was unnecessary and involved back room dealings between the Federal Reserve, JP Morgan and the FDIC. I also showed evidence of insider trading. The SEC denied my request for data on short positions for Washington Mutual. Soon after, I was interrogated by federal agents, courtesy of the FDIC. [10] [11]

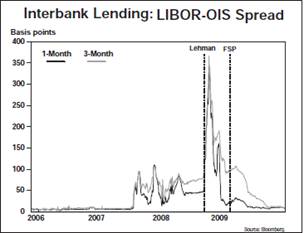

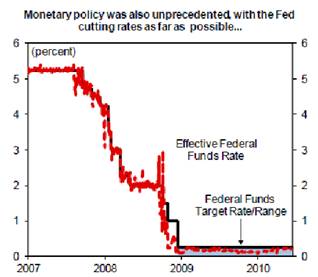

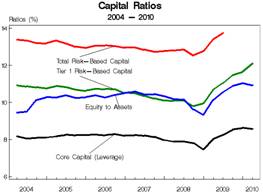

As you will recall, Fed Chairman Bernanke collapsed short-term interest rates from 5.25% in late 2007, all the way down to about 0.25% over the next 12 months. This provided another bailout to the banks because it enables them to borrow at close to nothing and buy U.S. Treasuries.

The end result is that banks have been able to collect about 300 basis points in risk-free profits using money they wouldn’t otherwise have. But these near-zero interest rates are taking a large toll on pension funds. So what we have is an interest rate bailout at the expense of pension plans. This is absolutely criminal. Furthermore, the interest rates banks are charging consumers for auto loans and credit cards implies that the current short-term interest rate is 300 to 400 basis points higher; another count of fraud by the banks. And Americans stand by doing nothing.

Over a span of a few months, the house of cards collapsed, taking down with it virtually every U.S. financial firm, as well as many others throughout the globe.

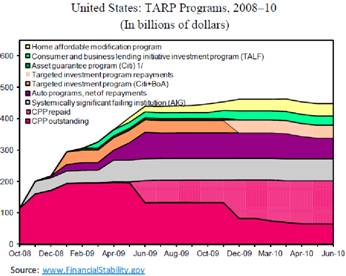

One week after Washington Mutual was seized, TARP was shoved down the throat of tax payers, using scare tactics by U.S. Secretary of Treasury Paulson. This bailout represented yet another unconstitutional action taken by Washington.

By November, I reminded investors of my warnings first made in 2006 with the release of America’s Financial Apocalypse, stating the Dow could reach the low 6000s as earnings collapsed. I also expected 15-20% upside through January prior to the market collapse.

"I have cautioned investors many times about a collapse down to the 9000 then 8000 and finally 7800 levels. Now I am telling you to watch out below. As you will see shortly, I expect considerable short-term upside before reaching new lows."

"With the Dow hovering around 8000, the problem is that there have been absolutely no signs of capitulation whatsoever. What that means is that the Dow could fall much lower from current levels. Even worse, we are still at the early stages of the economic fallout. Consumers have not fallen yet and hedge funds have only begun to fail. Hundreds of corporations will file for bankruptcy and thousands of banks will fail. The results of the holiday season should begin another downward turn.”

"So is this 5500-6200 level possible? Certainly.”

"On the bright side of things, I am becoming increasingly optimistic of short-term upside of around 15-20% through the end of January. If this rally does materialize, you should expect it to be erased shortly thereafter once Christmas earnings are reported."

Source: http://www.avaresearch.com/article_details-334.html

Despite continued destruction of the U.S. Constitution, Americans remain contempt, so long as they have their trash TV, sports, Brittney Spears, Paris Hilton, gangster rap, Dr. Phil, Oprah, credit cards, Twitter, Facebook, MySpace and iPods. Americans are obsessed with the lives of others because they realize their own lives suck. They spend countless time on social networking sites because they have no utility. Once you've lost your fight, you've lost all hope.

Meanwhile, Europeans continue to riot in response to the devastation caused by the global banking cartel.

In total, trillions of dollars of bank and investment assets had to be guaranteed by the Federal Reserve, the FDIC and the U.S. Treasury. But still the Fed had not extinguished the fire it created. So Bernanke initiated quantitative easing to soak up toxic assets from the banks. This move has indirectly increased inflation. However, due to the significant deflationary environment present in late 2008 and early 2009, the inflationary effects of this program were largely muted.

As I predicted, when Q4 2008 earnings data was reported, the stock market continued to plunge. In response, Obama passed the American Recovery and Reinvestment Act of 2009 (ARRA) in February, dedicating nearly $800 billion into the economy. Most of these funds went to emergency relief rather than to retool America. Throughout that time the Fed continued to purchase toxic assets from members of the banking cartel.

But nothing could stop the stock market from collapsing. By the first few days of March, the Dow hit a 12-year low of 6447. I told investors to start buying at Dow 6500 on March 6, 2009...

"What should you do? If you are a long-term investor, you should gradually start buying into the market in small increments. Only the best names, companies with little or no debt and market leadership; companies that pay cash dividends; dividends that are relatively safe (check free cash flows, debt levels for starters."

Source: http://www.avaresearch.com/article_details-90.html

Soon after, Treasury Secretary Geithner initiated stress testing for several of the large banks in order to determine the remaining risk of failure. This was nothing more than a publicity stunt orchestrated to calm investor panic. [12] [13]

By spring of 2009, upon the advice of the Federal Reserve Bank, the Federal Reserve insider heading the Treasury Department (Geithner), and Obama’s Wall Street insiders heading his economic advisory team (Larry Summers and Robert Rubin) the FASB made significant revisions to mark-to-market accounting regulations. This allowed banks to inflate earnings and hide liabilities, ensuring the bankers received huge Christmas (Hanukah) bonuses.

Each of the responses to the financial crisis and economic depression has been ineffective and highly wasteful. Other than emergency assistance to states, Washington has done nothing to help consumers, homeowners or investors. In contrast, the unconstitutional use of tax payer funds for the TARP program has enriched the same culprits who were responsible for the global economic collapse.

Providing unemployment benefits for two years will only increase the severity of America’s debt woes. Americans need good jobs, not temporary paychecks. They need real change so they can see hope over the horizon rather than a dark cloud.

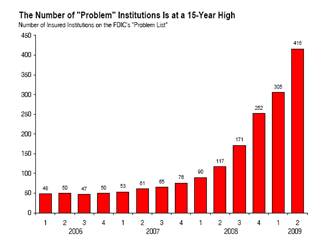

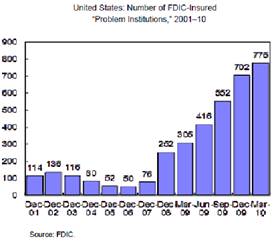

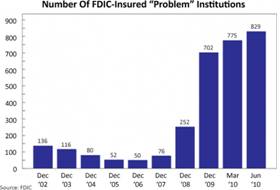

The U.S. continues to shed jobs, foreclosures are building by the millions and bankruptcies are soaring. Finally, more banks risk being shut down by the criminal FDIC headed by former Treasury insider Shelia Bair, despite the fact that the FDIC refuses to provide shareholders with proof of insolvency.

In total, since the official beginning of the first recession of America’s Second Great Depression, 316 U.S. banks have been seized.

Rather than the real perpetrators of the global collapse being held accountable, they have been rewarded for their crimes through tax payer bailouts, accounting trickery and a collapse in interest rates, all of which has allowed Wall Street to pay out higher bonuses than even prior to the collapse.

Instead of going after the real criminals, the FDIC has recently begun what is likely to become a wave of lawsuits against small regional banks in order to place the blame on them.

On Nov. 1, 2010 the FDIC sued 11 executives and directors of Heritage Community Bank. Charges include gross negligence. “The FDIC seeks to recover losses of at least $20 million that Heritage suffered because insiders "failed to properly manage" commercial real estate lending.”

Meanwhile, the FDIC is avoiding any scrutiny of the banking cartel. As always, scapegoats are being round up while the real criminals escape wealthier than ever.

The SEC is clearly no where to be found in this mess. This incredibly incompetent government agency continues to serve as an ally of Wall Street, permitting massive fraud. As an effort to lighten criticism of Goldman Sach’s generous campaign contribution to Obama, Goldman was sued by the SEC for a mere $500 million. This was a huge victory for Goldman, as several key executives should have received prison time in addition to a several year claw-back of all bonuses and a multi-billion dollar fine.

And the Department of Justice continues to sit on its ass because Obama’s cabinet of Wall Street insiders has told him to look the other way. It’s business as usual in the fascist regime of the United States.

Wall Street powerhouses such as Bear Stearns, Lehman Brothers, and Merrill Lynch were global icons of banking power and prestige. They survived everything…even the last Great Depression. But they were unable to survive this one. [14] [15] [16]

The other Wall Street firms, Goldman Sachs and Morgan Stanley have only been able to survive thus far due to conversion into commercial banks, enabling them complete access to the Fed’s endless printing presses along with the rest of the banking cartel.

Have you ever asked yourself why TARP funds are insufficient to fund smaller banks but they are sufficient to fund the largely insolvent banking cartel? As more banks fail or are seized (which does not necessarily indicate they have failed in my opinion) the number of problem banks continues to increase.

By now, you should understand what’s going on. Unfortunately, the vast majority of Americans have no idea what’s happening because the media continues to pump out lies, while distracting Americans using an onslaught of trash TV.

We are witnessing by far the most colossal level of fraud and theft in world history. The devastating effects from this heist will be felt for many decades. [17]

Here is an excerpt from my July 13, 2008 commentary of the IndyMac failure:

In the coming months, I expect to see several bank failures. Not Citigroup or Bank of America. The “Big 5” won't fail because the Fed would never permit it. You know the Fed – the entity that's owned and operated by the “Big 5.” It will be the small local and medium regional banks that fail. By the time the washout is finished we could see several hundred take a fall. If we include those destined for the auction block, I can almost guarantee you there will be hundreds of failures.

When the smaller banks fail, the “Big 5” will snatch them up at pennies on the dollar compliments of Bernanke's printing presses. Maybe now you can see why every nation wants to get as far away from the dollar as possible. They understand the worst is yet to come.

Bernanke's “Big 5” banking bailout is only ensuring the dollar crisis will continue. However, no nation will be able to completely escape the effects of the falling dollar since it remains the universal currency. It is deeply embedded within global commerce and has extensive reach throughout the global financial system.

I continue with Part 2, on July 14, 2008

After so much denial and deceit by Washington and the media, at some point you need wonder why this isn’t the kind of news that dominates the airwaves. You know, news you can actually use to your benefit. Let me solve this mystery. The job of the media establishment is not to warn consumers of anything that has not yet happened, especially during a crisis. They feel that it will only create a self-fulfilling prophecy. And you better believe Washington communicates with the heads of each television network to ensure they don’t let the cat out of the bag. Instead, their theme is denial. That is why it’s rare for investors to be warned in advance from anyone in the media.

When the smaller banks fail, the “Big 5” will snatch them up at pennies on the dollar compliments of Bernanke’s printing presses. Maybe now you can see why every nation wants to get as far away from the dollar as possible. They understand the worst is yet to come. Bernanke’s “Big 5” banking bailout is only ensuring the dollar crisis will continue. However, no nation will be able to completely escape the effects of the falling dollar since it remains the universal currency. It is deeply embedded within global commerce and has extensive reach throughout the global financial system.

Source: http://www.avaresearch.com/article_details-117.html

As we know, the media has been completely useless in reporting the realities of the financial crisis which has now progressed into America’s Second Great Depression. As a result, not a single Pulitzer Prize was awarded for coverage of the biggest financial crisis since at least the 1930s. And they wonder why their industry is going bankrupt. [18]

Washington continues to deny the full severity of America’s financial apocalypse, all while making sure to prevent the Justice Department from seeking criminal indictments for the Wall Street criminals that collapsed the global economy. And the corporate media has gone along with it, never bothering to ask why the criminals who committed securities fraud received billions of dollars in bonuses are still walking the streets.

Meanwhile, Wall Street insiders working at CNBC continue to engage in front running activities, all while leading their sheep into the slaughterhouse. [19] [20] [21] [22]

Then you have the fear-mongers who have exaggerated the economic picture as a way to please gold and silver coin dealers. You also have the deflationists and hyperinflationists pumping out al kinds of propaganda so as to fit their agendas. All of them are completely wrong. But that doesn’t matter to them. All they care about is creating fear and panic so that you will send them your money or pump up the price of gold and silver. [23] [24] [25] [26] [27] [28]

As it stands today, the U.S. media is just as useless and destructive to the U.S. as is the banking industry headed by the Federal Reserve. Thousands from both the media and financial industry belong in prison. Some would say they deserve a worse fate.

By now it should be clear to even the most naïve individuals that the banking cartel caused this global collapse. Meanwhile, its partner in crime, the corporate media kept consumers in the dark, while covering up the criminal activities of Wall Street. Yet some journalists still remain clueless. For instance, in a recent conversation I had with Shahien Nasiripour, the business reporter for the Huffington Post, he stated that he was not aware that Wall Street banks committed securities fraud. This was a few weeks after I sent him chapter 10 of America’s Financial Apocalypse and chapter 12 of Cashing in on the Real Estate Bubble. Brief excerpts from these chapters can be found here.

Even Greenspan recently admitted the financial collapse was due to Wall Street fraud. If Greenspan is willing to admit fraud caused the collapse, it implies that virtually everyone with a pulse is aware of it. If only he could take responsibility for his own actions which facilitated the fraud.

http://www.youtube.com/watch?v=731G71Sahok

Meanwhile, like all other media, Huffington Post continues to feature articles and blogs from Washington and Wall Street hacks, as well as extremists who claim to be chief economists, but are merely marketers. For the record, the Huffington Post has also banned me, as they are just as useless as all other forms of media in the U.S., so don’t be fooled by their “We’re on your side” BS.

Regardless who you turn to in the Huffington Post, New York Times, or any of the other members of America’s propaganda machine, you will find one of two things. Their so-called “experts” either have no idea what they are talking about, or they are lying in order to line their own pockets. Have you ever wondered why you see the same bozos throughout the media? It’s called the flooding approach. People will believe anything if it is repeated over and over.

I have a suggestion for all of you journalists out there. I would advise that you start a blog now, so your next job won’t be such a difficult transition.

Throughout this historical catastrophe, pundits and economists continue to make simpleton arguments, such as the current conditions are no way like the Great Depression. They claim that the government made many changes that would prevent the same thing from happening again. As usual, they are wrong. Understand that these are the same clowns that denied everything until it was obvious to children.

Let’s not forget how they denied that a real estate bubble was present or later after it began to implode how it would be contained and not affect the economy. And of course, we cannot forget how it took economists more than one year since the start of the recession to acknowledge it.

You need to document the track record of economists, pundits and those who claim to be experts. You need to keep a log book so that you can see who to trust. If you do this, you will realize that no on in the media has a clue what’s going on, whether they are the perma-bulls or the perma-bears.

As wrong as the Washington hacks have been, they have been right about one thing. The U.S. government did make many changes since the Great Depression. The only problem is that many of these changes were instrumental in causing America’s second Great Depression. [29]

Most economists claim that depressions are caused by deflation. They continue to make this statement as if it were a scientific fact. This presumption points to the ignorance of most U.S. economists who really don’t have a good understanding of the problems faced by the nation, so they certainly don’t have adequate solutions. Economics is not a real science of physical laws. It is a social science based largely on human behavior and interaction. [30] [31]

The primary reason for their incompetence is that they have been trained as robots to accept the “conventional wisdom of the establishment rather than to be inquisitive and think creatively. But this serves them well since most of America’s so-called leading economists are politicians.

Economists have been trained by professors, many of which are naive partners of America’s fascist regime. They are in a boy’s club. If you dissent from the ranks of America’s Ponzi scheme economics, you are cast aside as a nut case. This means you won’t get research grants and you won’t get tenure. You won’t get published and you won’t be heard. You will effectively be censored and your livelihood will be cut off if you dare deviate from the School of American Ponzi Scheme economics. [32] [33] [34] [35]

If things are so different now, why is the U.S. experiencing endless volumes of horrendous economic data not witnessed since the previous depression?

For instance, the data from the housing, employment and productivity has not been this miserable since the last depression.

If things are so different now, why did the Federal Reserve resort to measures not seen since the previous depression?

If things are so different now, why did the New Deal solution to the depression era real estate crisis (Fannie Mae) collapse?

The main differences between America’s First Great Depression and the current one are that vital parts of the depression-era Glass-Steagall Act were repealed by the Glass-Leach-Bliley Act in 1999, the gold standard no longer exists, and we now have a market for exotic derivatives which has no regulation or transparency. Add two common traits found throughout 20th century America, greed and lack of accountability, and these three fundamental differences are specifically why this depression began and why it will be heightened by inflation. [36] [37] [38]

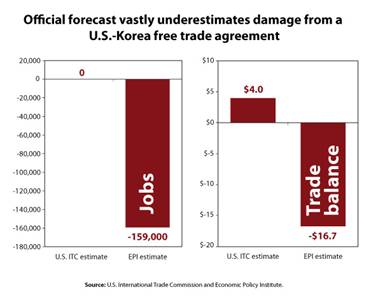

Unfortunately, after failing on Wall Street reform, Obama has ensured another catastrophic crisis down the road. Similar to many other issues Obama has attempted to address, Wall Street reform has been a joke. Instead of Wall Street reform, Obama established a weak reform for consumer finance. As you will recall, he did the same with healthcare reform, which was whittled down to address only health insurance. However, he even failed to even fix this industry. [39] [40] [41] [42] [43] [44] [45] [46] [47] [48]

On the other side of the spectrum, we have seen media hacks with political agendas, bought off politicians and other members of the media club state their highly misguided insights on the U.S. healthcare system despite the fact that they have no expertise in healthcare whatsoever. [49] [50] [51] [52]

Meanwhile, America’s inefficient, costly healthcare system remains as the nation’s number one long-term problem. [53]

I detailed the problems found within America’s complex healthcare system in a recent book, America’s Healthcare Solution. I also provide viable solutions that would for the first time in decades, create a system of affordable healthcare, accessible to all.

http://www.americashealthcaresolution.com

When we compare the causes of the depression of the 1930s to the current one, we also see additional similarities. For instance, in addition to greed and lack of accountability, reckless leadership, continuous denial, and misguided solutions.

Each depression shares four common features as well: massive chronic unemployment, a stock market collapse, a housing mess, and an acceleration of the wealth disparity.

The previous depression was characterized by several stock market collapses. Thus far, we have only witnessed one major stock market collapse. So it is likely (although not certain) that we will another.

We are not likely to see 25% unemployment like in the depression. Why?

Well for starters, Washington fudges all of the data. I have discussed this in detail in the past. [54]

As well, the bar for what are considered jobs has been lowered since the depression. Today, you can say you’re employed if you work part-time. Washington also considers you to be employed if work at McDonalds, as a valet, massage therapist or pet groomer, regardless whether or not you can survive in these wages or whether you just couldn’t find a suitable job with your engineering degree. Not to disrespect to anyone who might be employed in these occupations, but let’s face it; they don’t give you a pension plan or healthcare benefits. That means you’re getting the shaft, in addition to the low wages they’ve stuck you with.

Instead of the severity of unemployment seen during the first depression, this depression will be characterized by chronically high unemployment combined with massive underemployment. Thus, full devastation of the real unemployment picture will be masked.

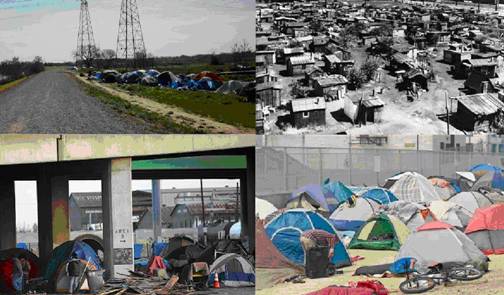

We won’t see bread lines as we did during the previous depression because Washington issues food stamps. But unless Washington decides to provide housing to the homeless, we will see tent cities similar to the Hoovervilles from the previous depression. We are already seeing this today.

As well, we won’t see banks close their doors because we have the FDIC which was created in response to the previous depression. But what good is money is its being printed continuously?

The inflationary forces building up will certainly create severe problems for the U.S. and the rest of the world since the dollar is the universal currency. All of this will put further downward pressure on U.S. living standards for many years to come.

The most harmful effects of America’s current depression won’t be due to a crisis. It will be only heightened by a crisis. The real devastation will be due to an accelerated transfer of wealth and jobs overseas. It will be a silent depression.

In a few years, the real estate and banking crisis will have cooled off and Washington will start reporting much improved numbers; numbers that will continue to be manipulated and boosted by deficit spending.

In reality, things will only get worse. Real wages won’t budge, inflation for basic necessities will continue to rise, and job quality will continue to decline. We are already seeing this now. It will be a silent depression because there will be no crisis. But the effects of this depression are likely to be more severe because they will persist for decades.

You won’t feel the full effects on any given day. If you’re in the lucky majority, you will go to work and carry out your life as usual. But you just won’t be able to make ends meet like in the past. Each year things will get worse so you’ll spend more on credit.

It will be more difficult for your children to move up in socioeconomic status because higher education is becoming an unaffordable luxury for the wealthy. Many younger Americans who are willing to take on the enormous debt burden required for higher education won’t be able to find jobs in their field. This will be true even for the most secure of majors like engineering, math and science.

Some Americans with math and science degrees will seek employment as high school teachers, due to lack of options. This will be an ironic fate, as America’s educational system has been designed to keep the people stupid, all while brainwashing them to accept America’s fascist philosophy. Some won’t have the skills of their counterparts in Asia.

Others will be pushed out of a career they prepared for due to the effects of unfair trade. Some will opt for a 1 or 2-year program in healthcare by one of the hundreds of for-profit colleges that understand America’s healthcare system is a gravy train. Others will work for Wall Street criminals and banking vultures; some naively, others not caring that they will be selling their souls to the Devil.

Millions will be stuck in slave labor, working for low wages and no benefits. But they won’t be working in factories churning out goods for the global economy. They will be working in service jobs, tailoring to the needs of America’s wealthy.

In fact, I predict in coming years we will see an ironic trend in the U.S. Instead of U.S. consumers speaking with Indians in Bombay for customer support from U.S. corporations, Indians will be speaking with U.S. citizens who will provide them with phone support.

Many Americans will never realize they lived through America’s Second Great Depression, because the effects will be spread gradually for many, many years. Most Americans will never be able to fully retire. They simply won’t have enough money to live on. Many will end up selling their home to pay for medical bills, even though they have health insurance. Others will have a much worse fate.

What the “experts” don’t get is that this depression will be much more difficult to reverse because it will be gradual. There will be no urgency. But the effects will be cumulative.

Many will wake up one day and realize that they just can’t make ends meet; they’ll have very little if any retirement assets. It will be a continuation of declining living standards to a point that could lead to some major permanent societal problems.

Economists have claimed that the depression in the 1930s was caused by the failure of the Federal Reserve to open up the currency printing presses. This is not at all true. You cannot print your way out of a recession and you cannot print your way out of a depression.

Although there were certainly numerous causes, America’s Second Great Depression was caused by use of a fiat currency, unfair trade policy, cronyism and years of mismanagement by Washington.

Today, the criminal Federal Reserve Bank continues to kick the can forward by printing trillions of dollars. This is having significant adverse effects, not only in the U.S. but throughout the globe. Instead of deleveraging, the global bubble has been reflated as discussed several months ago. We are now seeing global inflation begin to take off. [55]

Washington, Wall Street and their many hacks have even made preposterous claims that the recession ended in June 2009. Of course this is a complete fabrication.

I want to remind you that a recession is caused by an oscillation of the business cycle from peak to the trough. In contrast, a depression is a long period of social, economic and financial decline. Within a depression you are likely to see two or more recessions. But this merely accounts for the economic consequences of a depression.

The social consequences found within a depressive period are a reflection of the devastating effects of chronic economic catastrophe. But the useless media has used the term “Great Recession” in order to downplay the true severity of this period.

Haven’t you had enough lies, deception and hype from the media?

Despite what some of you may think, there is NO ONE in the media, not a single person that truly understands what is going on AND is committed to helping you. That includes all of the perma-bears and gold bugs who have been preaching doom for decades. If you think otherwise, then you haven’t been documenting their tack records.

The contrarian crowd is trying to scare people so they will buy gold so as to pump up the price. At the end of the day when these delusions of gold $10,000/ounce and hyperinflation have NOT materialized as salesmen and hacks like Peter Schiff, Marc Faber and others have insisted, the media knows that its audience will run back into the arms of Wall Street.

You will never win if you embrace extremes. Neither the perma-bear or perma-bull market extremists offer you anything other than a chance to lose more money. Never forget that. So if you are unable to navigate an up and down market, you might be best to remain on the sidelines because even many of the big boys have gotten thrashed over the past two years.

If you pay attention to the media, you are sending them money because they sell ads based on the size of their audience. And because Wall Street buys the ads, the media serves their interests by flooding you will extremists and other hacks. Thus, by paying attention to the media, you are serving as an accomplice in your own exploitation.

I leave you with my best piece of investment advice. It’s one of the rare exceptions of investment advice that never changes.

BAN THE MEDIA.

DON’T READ THEIR NEWSPAPERS AND MAGAZINES, AND DON’T TUNE INTO THEIR TV AND RADIO SHOWS.

If you don’t follow this advice you will be just as responsible for your demise as the media and Wall Street.

In Parts 2 and 3, I will present some key economic data from the first recession in America’s Second Great Depression.

Until then, I invite you to join other subscribers who wish to become great investors, as they learn how to navigate the financial landmines that promise to be commonplace for years to come. The best way to achieve this difficult task is to subscribe to the AVA Investment Analytics newsletter. There is simply no other investment newsletter like it in the world. www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2010. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

READ THIS LEGAL NOTIFICATION IF YOU INTEND TO REPUBLISH ANY PORTION OF THIS MATERIAL

Market Oracle has received permission rights to publish this article. Any republications of this article or any others by AVA Investment Analytics must be approved by authorized staff at AVA Investment Analytics. Failure to do so could result in legal actions due to copyright infringement.

Our attorneys have determined that the so-called “Fair Use” exemption as it applies to the Digital Millennium Copyright Act does not permit use by websites that have ads or any other commercial application.

In addition, fair use does not imply articles can be republished or reproduced. The distinction between fair use and infringement may be unclear and not easily defined. There is no specific number of words, lines, or notes that may safely be taken without permission. Acknowledging the source of the copyrighted material does not substitute for obtaining permission. Please see this statement from the U.S. Copyright office for more information. http://www.copyright.gov/fls/fl102.html

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.