Historic and Current Hyperinflation From Across the Globe

Economics / Inflation Oct 20, 2007 - 07:43 AM GMTBy: Mike_Hewitt

Angola (1991-1999)

Angola (1991-1999)

Angola went through the worst inflation from 1991 to 1995. In early 1991, the highest denomination was 50,000 kwanzas . By 1994, it was 500,000 kwanzas . In the 1995 currency reform, 1 kwanza reajustado was exchanged for 1,000 kwanzas . The highest denomination in 1995 was 5,000,000 kwanzas reajustados . In the 1999 currency reform, 1 new kwanza was exchanged for 1,000,000 kwanzas reajustados . The overall impact of hyperinflation: 1 new kwanza = 1,000,000,000 pre-1991 kwanzas .

Argentina (1975-1991)

Argentina went through steady inflation from 1975 to 1991. At the beginning of 1975, the highest denomination was 1,000 pesos . In late 1976, the highest denomination was 5,000 pesos . In early 1979, the highest denomination was 10,000 pesos . By the end of 1981, the highest denomination was 1,000,000 pesos . In the 1983 currency reform, 1 Peso Argentino was exchanged for 10,000 pesos. In the 1985 currency reform, 1 austral was exchanged for 1,000 pesos argentine .

Hyperinflation continued reaching a peak annualized rate of 4,923.3 percent in December 1989. At that time, government expenditure reached 35.6 percent of GDP and the fiscal deficit was 7.6 percent of GDP.

In 1990 the Argentine government announced a stabilization plan which included:

- Comprehensive liberalization of foreign trade and capital movements

- Privatization of public enterprises and the deregulation of the economy

- Reduction in the size of the public sector and reconstruction of the tax system

- Creation of a new monetary system, including the establishment of a Currency Board in April 1991.

Disinflation was gradual, with inflation falling from 1,344 percent in 1990, 84 percent in 1991. In the 1992 currency reform, 1 new peso was exchanged for 10,000 australes . The overall impact of hyperinflation: 1 new peso = 100,000,000,000 pre-1983 pesos . The inflation rate for 1992 was 17.5 percent, 7.4 percent in 1993, 3.9 percent in 1994 and 1.6 percent in 1995. By 1995, government expenditure represented 27 percent of Argentina's GDP.

Austria (1921-1922)

Austria became a republic after World War I. It continued to use the Krone as before in the Austria-Hungarian empire. However, post-war inflation, reaching a peak of 134 percent between 1921 and 1922, led to its collapse. The Krone was replaced by the Schilling at the rate of 10,000 Kronen equal 1 Schilling .

Belarus (1994-2002)

Belarus went through steady inflation from 1994 to 2002. In 1993, the highest denomination was 5,000 rublei . By 1999, it was 5,000,000 rublei. In the 2000 currency reform, the ruble was replaced by the new ruble at an exchange rate of 1 new ruble = 2,000 old rublei . The highest denomination in 2002 was 50,000 rublei , equal to 100,000,000 pre-2000 rublei .

Bolivia (1984-1986)

Before 1984, the highest denomination was 1,000 pesos bolivianos . By 1985, the highest denomination was 10 Million pesos bolivianos . In the 1987 currency reform, the peso boliviano was replaced by the boliviano which was pegged to US dollar.

Brazil (1986-1994)

For most of the early part of then 20th century, Brazil's money was called Reis , meaning "kings". By the 1930s the standard denomination was Mil Reis meaning a thousand kings. By 1942 the currency that devalued so much that the Vargas government instituted a monetary reform, changing the currency to cruzeiros (crosses) at a value of 1000 to 1. In 1967 the cruzeiro was renamed to cruzeiro novo (new cruzeiro), and three zeros were dropped from all denominations. In 1970 the cruzeiro novo was renamed, dropping the "novo" and once again being called simply the cruzeiro . During the 1970's while the Brazilian economy was growing at 10% a year, inflation was running anywhere between 15 to 300%.

By the mid 1980s inflation was out of control reaching a peak of 2000 percent. In 1986 three zeros were dropped and the cruzeiro became the cruzado (crusade). In 1989, another three zeroes are dropped and the cruzado becomes the cruzado novo .

A 500,000 Brazilian Cruzeiro bank note.

In order to avoid confusion and not associate the new currency with previous monetary policy, the cruzado novo is renamed the cruzeiro with no change in value in 1990. By 1993, three more zeros are dropped from the cruzeiro which becomes known as the cruzeiro real . In 1994 the cruzero real is replaced by the real (royal), worth 2.75 old cruzeiros reais .

A 1960s cruzeiro was, in 1994, worth less than one trillionth of a US cent, after adjusting for multiple devaluations and note changes. In 1994, the following measures were enacted:

- A constitutional amendment in 1994 which empowered the Central Bank not to finance the budget deficit

- The Central Bank made it illegal for regional banks to buy government-issued bonds

- Wages were frozen and a new currency -- the real -- was introduced as part of measures to de-index the economy.

As a result of these measures, prices dropped dramatically from July 1994 onwards and by 1997, inflation had been reduced to standard international levels. The overall impact of hyperinflation: 1 (1994) real = 2,700,000,000,000,000,000 pre-1930 reis .

Bosnia-Herzegovina (1993)

Bosnia-Hezegovina went through its worst inflation in 1993. In 1992, the highest denomination was 1,000 dinara . By 1993, the highest denomination was 100,000,000 dinara . In the Republika Srpska, the highest denomination was 10,000 dinara in 1992 and 10,000,000,000 dinara in 1993. 50,000,000,000 dinara notes were also printed in 1993 but never issued.

Chile (1971-1973)

Beginning in 1971, during the presidency of Salvador Allende, Chilean inflation began to rise and reached peaks of 508% in 1973. As a result of the hyperinflation, food became scarce and overpriced. The economic and social troubles culminated in the 1973 coup d'état that deposed the democratically-elected Allende and installed a military government led by Augusto Pinochet.

China (1939-1950)

China first started using paper money under the reign of Emporer Hien Tsung in 806-821 AD due to a shortage of copper for making coins. The Europeans would not know about paper money till Marco Polo account of it in his Travels some 450 years later. Paper was issued again in 910 A.D. and become regular after 960 A.D. By 1020, the quantity of Chinese paper money has reached excessive levels. In 1160, the paper issues have become so numerous that they have become worthless. Emporer Kao Tsung begins reforms with a new issue to replace the old. By 1166 China is experiencing hyperinflation. This occurs again in 1448 with the Ming note. Some years later around 1455, China abandons paper money after over 600 years of experience. Europe would not begin using bank notes till 1661 with the first issue from the Bank of Sweden.

China saw an extended period of hyperinflation shortly after the Central Bank of China took complete control of the money supply and began issuing fiat currency. In June 1937, 3.41 yuan traded for one US dollar. By May 1949, one US dollar fetched 23,280,000 yuan for anyone who cared to have some. For more information on the subject click here .

Free City of Danzig (1923)

Danzig went through the worst inflation in 1923. In 1922, the highest denomination was 1,000 mark . By 1923, the highest denomination was 10,000,000,000 mark .

Ecuador (2000)

Officially pegged its currency to the US dollar on September 2000 after a 75% drop in value in early January that same year.

England

Under Henry I, the quality of England's silver coins fall dramatically. In 1124, the right hands of the mint masters were cut off causing a temporary improvement in the quality. Henry II reformed the English coinage in 1158 thereby restoring the prestige of English money which was maintained for the next three centuries.

By the end of the War of the Roses (1455-1485), the English currency suffered badly from clipping and counterfeiting of coins. Henry VII tried to prohibit the use of foreign coins in 1498. The mainly European and Irish coins were also underweight but not to the extent of the English coins.

Henry VIII debased the coinage of England as a means of raising revenue from 1543 to 1551 in what is known as the "Great Debasement". In 1560, Elizabeth I and her advisors, foremost among them being Sir Thomas Gresham (of Gresham's Law ) brought about stability by establishing the pound sterling and began to recall the earlier debased coinage and reminting them to remove the base metal component. The pound sterling was valued as one troy pound of high purity sterling silver.

In 1696 England's silver coins, many of which are worn or clipped, were replaced with new. Full-weight silver coins.

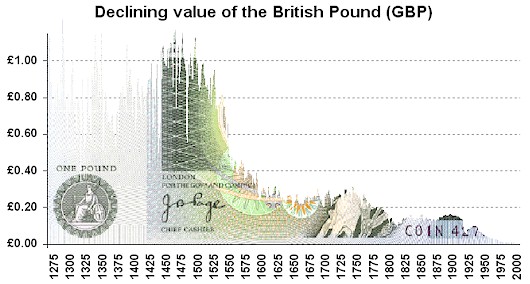

Britain suffered through a long period of moderate inflation from 1935 to 1970. Below is a chart showing the falling value of the current British currency since inception (Data from MeasuringWorth.com ).

Greece (1944-1953)

During the German occupation of Greece (1941 to 1944), the monthly inflation rate peaked at 8.55 billion percent in 1944. Prices doubled every 28 hours. In 1943, the highest denomination was 25,000 drachmai . By 1944, the highest denomination was 100,000,000,000,000 drachmai . In the 1944 currency reform, 1 new drachma was exchanged for 50,000,000,000 drachmai . Another currency reform in 1953 replaced the drachma at an exchange rate of 1 new drachma = 1,000 old drachma . The overall impact of hyperinflation: 1 (1953) drachma = 50,000,000,000,000 pre-1944 drachmai .

France (1789-1797)

France did not start using paper notes until much later than other European nations due in part to the Mississippi Company debacle of 1719-1720.

In the spring of 1789 the French Assemblee decreed the issuance of 400 million paper livres , known as assignats , secured by the properties that had been confiscated from the Church during the revolution. Over the following years, the Assemblee continued issuing greater quantities of assignats and in addition to price controls, dictated a death sentence on anyone selling the notes at a discount to gold and silver livres . By late-1795 the amount had reached 40 billion and a new currency was issued, the mandat , which promptly lost 97% of its value over the next two years. In 1797, both paper currencies were recalled and a new monetary system based upon gold was instituted.

France also suffered through a long period of moderate inflation from 1944 to 1960.

Georgia (1995)

Georgia went through the worst inflation in 1994. In 1993, the highest denomination was 100,000 laris . By 1994, the highest denomination was 1,000,000 laris . In the 1995 currency reform, 1 new lari was exchanged for 1,000,000 laris .

Germany (1923-1924, 1945-1948)

During WWI, Germany borrowed heavily expecting that they would win the war and have the losers repay the loans. In addition to these debts, Germany faced huge reparation payments. Together, these debts exceeded Germany's GDP. In 1923, when Germany could no longer pay reparations, French and Belgium troops moved in to occupy the Ruhr, Germany's main industrial area. Without this major source of income, the government took to printing money which resulted in hyperinflation took hold. At its most severe, the monthly rate of inflation reached 3.25 billion percent, equivalent to prices doubling every 49 hours. The U.S. dollar to Mark conversion rate peaked at 80 billion.

Inflation 1923-24: A German woman feeding a stove with currency notes, which burn longer than the amount of firewood they can buy.

Some countries eased off on Germany's war reparation burden and a new interim currency, the Rentenmark , secured on mortgages on land and industrial property restored stability. In 1924, the Reichmark , replaces the Rentenmark and has an equivalent to the pre-war gold mark.

Germany suffered high inflation again after WWII. In the official markets ration cards and permits are more important than currency while on the black market cigarettes, soap, tinned beef and chocolate serve as currency. In 1948, Germany replaced the Reichsmark with the Deutschemark and abolished the price and wage controls and most of the rationing system.

Greece (1944-1953)

During the German occupation of Greece (1941 to 1944), the monthly inflation rate peaked at 8.55 billion percent. Prices doubled every 28 hours. Two currency reforms, one in 1944 and another in 1953, saw the new drachma replace 50 trillion pre-1944 drachma .

Hungary (1922-1924, 1944-1946)

Hungary went through two hyperinflationary periods. From 1922 and 1924 the inflation in Hungary reached 98%. This seems quite timid when compared to the inflation rate of 41.9 quintillion percent reached in mid-1946 recorded as being the worst in modern history. At this rate prices doubled every 15 hours. By July 1946, the 1931 gold pengo is worth 130 trillion paper pengos .

The Hungarian National Bank has the dubious honour of circulating the largest denomination banknote - that being the 100 quintillion pengo .

A Hungarian man sweeps paper notes out of the gutter.

Israel (1979-1985)

Inflation accelerated in the 1970s, rising steadily from 13% in 1971 to 111% in 1979. From 133% in 1980, it leaped to 191% in 1983 and then to 445% in 1984. In 1985 Israel froze all prices by law. In 1985, inflation fell to 185% (less than half the rate in 1984). Within a few months, the authorities began to lift the price freeze on some items; in other cases it took almost a year. In 1986, inflation was down to just 19%.

Japan (1944-1948)

Japan first began printing paper money in the early part of the 14th century but was short lived.

In more recent times, Japan experienced post-WWII hyperinflation in which consumer prices rose by 5,300%. There is also the issuance of military yen (also known as banana money) to soldiers of both the Imperial Japanese Army and Navy. This currency was first issued during the Russo-Japanese War of 1904 and reached a crescendo during the Pacific War. During this time, military yen was forced upon the local population of occupied territories. Military yen was printed without regard for inflation, unbacked by gold and could not be exchanged for Japanese yen . When the Japanese occupied Hong Kong, military yen was forcibly exchanged with Hong Kong dollars at a ratio of 1 to 2. Anyone caught with Hong Kong dollar was to be tortured. After the exchange, the Japanese military purchased supplies and strategic goods from the neutral Portuguese port of Macau using Hong Kong dollars . On 6 September 1945, the Japanese Ministry of Finance announced that all military yen became void thereby leaving overseas holder of military yen with pieces of worthless paper.

Krajina (1993)

Krajina went through the worst inflation in 1993. In 1992, the highest denomination was 50,000 dinara . By 1993, the highest denomination was 50,000,000,000 dinara . This unrecognized country was reincorporated into Croatia in 1998.

Madagascar (2004)

The Madagascan franc lost nearly half its value in 2004. On 1 January 2005 the Madagascan ariary replaced the previous currency at a rate of 1 ariary for five Madagascan francs . In May 2005 there were riots over rising inflation suggesting the situation wasn't over.

Mexico (2004)

Mexico defaulted on its external debt in 1982, and experienced several years of inflation. On 1 January 1993, the Bank of Mexico introduced a new currency, the nuevo peso which was equal to 1,000 old pesos .

Since the Mexico Peso Crisis of 1994 the value of the Mexico peso has plummeted by almost 60%. The government contends that the devaluation was necessary to decrease the account deficit.

Mongolian Empire (13th and 14th Century AD)

Genghis Khan's empire went through two hyperinflationary periods. Kublai Khan, the grandson of Genghis and then emperor of China, circulated paper money to replace that of the Chinese provincial governments. This currency was known as The First Mongol Issue. It depreciated rapidly after its short-lived success from 1260 to 1263. Currency reform occurred in 1264, and The Second Mongol Issue, equally irredeemable, and unlimited in issue, replaced the earlier notes at a ratio of 1:5. This currency lasted for 1290 at which time it began falling in value till about 1310. It was replaced by a third issue at the same ratio of 1:5. Over-issue of these notes once again destroyed their value. During the final phase of the Mongol Dynasty in around 1350 huge efforts were unsuccessful in fixing the monetary situation.

"Population and trade had greatly increased, but the emissions of paper notes were suffered to largely outrun both, and the inevitable consequence was depreciation. All the beneficial effects of a currency which is allowed to expand with a growth of population and trade were now turned into those evil effects that flow from a currency emitted in excess of such growth. These effects were not slow to develop themselves. Excessive and too rapid augmentation of the currency, resulted in the entire subversion of the old order of society. The best families in the empire were ruined, a new set of men came into the control of public affairs, and the country became the scene of internecine warfare and confusion." Del Mar, History of Monetary Systems (1886)

The usurping Ming Dynasty issued yet more paper currency with the solemn legend "This paper money shall have currency, and be used in all respects as if it were copper money". There was no public confidence in the firmness of this declaration and at the outset the paper traded at 17:13 against copper coinage. Before long the ratio fell to 300:1.

Nicaragua (1987-1990)

Before 1987, the highest denomination was 1,000 cordobas . By 1987, it was 500,000 cordobas . Nicarauga went through a currency reform in 1988 which saw 1 new Cordoba replace 1,000 old cordobas . In the mid-1990 currency reform, 1 gold Cordoba equaled 5,000,000 new cordobas . Total impact of hyperinflation: 1 gold Cordoba = 5,000,000,000 pre-1987 cordobas .

Persian Empire (1294)

The city of Tabriz begins issuing paper money over a two month period with disastrous effects. Rashid al Din, prime minister of Persia describes both printing and paper money in his History of the World.

Peru (1984-1990)

Peru went through the worst inflation from 1984 to 1990. The highest denomination in 1984 was 50,000 soles de oro . By 1985, it was 500,000 soles de oro . In the 1985 currency reform, 1 intis was exchanged for 1000 soles de oro . In 1986, the highest denomination was 1,000 intis . It was 5,000,000 intis by 1990. In the 1991 currency reform, 1 nuevo sol was exchanged for 1,000,000 intis . The overall impact of hyperinflation: 1 nuevo sol = 1,000,000,000 pre 1985 soles de oro .

Poland (1922-1924, 1990-1993)

Poland suffered two bouts of hyperinflation. The first occurred from 1922 to 1924 when inflation rates reached 275%. After three years of hyperinflation, the 1994 currency reform saw 10,000 old zlotych exchanged for 1 new zloty .

Romania (2000-2005)

Romania is still working through steady inflation. The highest denomination in 1998 was 100,000 lei . By 2000 it was 500,000 lei . In early 2005 it was 1,000,000 lei . In July 2005 the leu was replaced by the new leu at 10,000 old lei = 1 new leu . Inflation in 2005 was about 10%. In 2006 the highest denomination is 500 lei (= 5,000,000 old lei ).

Ancient Rome

Early Roman coinage was entirely representative. It was copper and issued with a face value of about 3 times its commodity value. It was carefully made using the innovation of striking, rather than casting, and the dies used were of the highest quality and artistic complexity. They were extremely difficult to forge and the penalties were heavy. The Romans were probably the first to obey their own monetary laws limiting the supply of coins. As a result for 178 years there is no evidence of demonetization. On the contrary, the value of money increased in value as did the population and economy.

This changed during the Second Punic War. Hannibal and his legendary elephants conquered from Carthage in North America, through silver rich Spain, to the Roman copper mines in northern Italy (modern-day Tuscany) and threatened Rome from the north. In response, the Romans began to over-issue underweight and overvalued coinage to finance the massive military effort which was required to repulse the enemy.

What came out afterwards was a very different Rome. It was much more militarist and expansionist in order to support its large military. Within 100 years Rome's republican politics had subsided into what was effectively dictatorship.

By 270 AD, the precious metal content of Roman coins had fallen to only 4%. Emperor Diocletian issued vast amounts of debased copper coins which inevitably lead to price increases. Diocletian blamed the greed of merchants and in 301 AD issued the Edict of Prices declaring fixed prices with a death penalty for anyone selling above them. Merchants stopped selling goods but this led to penalties against hoarding. When merchants left their trade Diocletian countered with laws saying that every man had to pursue the occupation of their father. The penalty for not doing so was death.

In the words of Del Mar in his History of Monetary Systems , "for nearly two centuries, during which all that was admirable of Roman civilization saw its origin, its growth and its maturity. When the system fell Rome had lost its liberties. The state was to grow yet more powerful and dreaded, but that state and its people were no longer one."

The former republic of Rome descended into essentially what was serfdom.

Russia (1921-1922, 1992-1994)

Russia experienced 213% inflation during the Bolshevik Revolution and again during the first year of post-Soviet reform in 1992 when annual inflation peaked at 2520%. In 1993 the annual rate was 840%, and in 1994, 224%. The ruble devalued from about 100 r/$ in 1991 to about 30,000 r/$ in 1999.

Taiwan (late-1940's)

Severe inflation existed in the late 1940s due to factors such as corruption and the 2-2-8 Incident. Increasingly higher denominations were issued on the island, up to one million yuan . The new Taiwan dollar was issued in 1949 at a ratio of 40,000-to-1 against the old Taiwan yuan .

Turkey (1990's)

Throughout the 1990s Turkey dealt with severe inflation rates that finally crippled the economy into a recession in 2001. The highest denomination in 1995 was 1,000,000 lira . By 2000 it was 20,000,000 lira . Recently Turkey has achieved single digit inflation for the first time in decades, and in the 2005 currency reform, introduced the New Turkish Lira ; 1 was exchanged for 1,000,000 old lira .

A 1,000,000 lira banknote, issued by Turkey.

Ukraine (1993-1995)

Ukraine went through the worst inflation between 1993 and 1995 with inflation rates peaking at 1400% per month. Before 1993, the highest denomination was 1,000 karbovantsiv . By 1995, it was 1,000,000 karbovantsiv .

In 1996, the karbovantsiv was taken out of circulation, and was replaced by the hryvnya at an exchange rate of 100,000 karbovantsivi = 1 hryvnya (approx. US$0.20 at the time).

A 100,000 Ukrainian Karbovantsiv bank note

United States (1812-1814, 1861-1865)

The United States has experienced two currency collapses. The first was the Continental Currency ("Not worth a Continental") the American colonists used to finance the Revolutionary War. While the Americans won their independence, their currency was destroyed in the process.

The second were the Confederation notes. In an effort to finance the civil war with the north, the Confederate States of America issued vast amounts of money. At one point, the Secretary of the Treasury recommended that counterfeit money be utilized. Anyone holding a counterfeit bill was to exchange it for a government bond. The government would then stamp it "valid" and spend it.

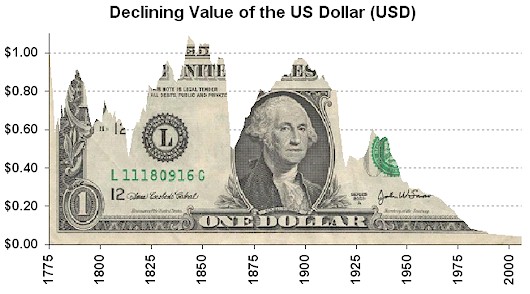

Below is a chart showing the falling value of the current American currency since inception (Data from MeasuringWorth.com ).

Yap (late 1800's)

The island of Yap in the Pacific Ocean used varying sized stones as money, of which the largest weighing several tons were the most valuable. The stones had been brought by sea from the Island of Palau 210 km away. The journey was very perilous given the length of the voyage and the rough seas between the islands of Palau and Yap. Many of the stones were lost at sea. The risk associated with procurement of the "money stones" initially made them highly valuable. The Yapese valued them because large stones were quite difficult to steal and were in relatively short supply. However, in 1874, an enterprising Irishman named David O'Keefe hit upon the idea of employing the Yapese to import more "money" in the form of shiploads of large stones, also from Palau. O'Keefe then traded these stones with the Yapese for other commodities such as sea cucumbers and copra. Over time, the Yapese brought thousands of new stones to the island, debasing the value of the old ones. Today they are almost worthless, except as a tourist curiosity.

A large (approximately 8 feet in height) example of Yapese stone money

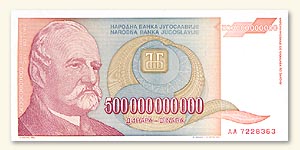

Yugoslavia (1989-1994)

Second worst hyperinflationary period in recent history with a monthly inflation rate of 5 quintillion percent. Between Oct 1, 1993 and January 24, 1994 prices doubled every sixteen hours on average. At the end of it, one novi dinar = 1,300,000,000,000,000,000,000,000,000 pre-1990 dinars . One account of the breakdown of the social structure is the example of a postman who waited a day to pay 780 phone bills with the equivalent of a few American pennies instead of trying to collect from the customers.

A 500,000,000,000 (500 billion) Yugoslav dinar banknote circa 1993, the largest nominal value ever officially printed in Yugoslavia, the final result of hyperinflation.

Zaire (1989-1996)

Zaire went through a period of inflation between 1989 and 1996. In 1988, the highest denomination was 5,000 zaires . By 1992, it was 5,000,000 zaires . In the 1993 currency reform, 1 nouveau zaire was exchanged for 3,000,000 old zaires . The highest denomination in 1996 was 1,000,000 nouveaux zaires . In 1997, Zaire was renamed the Congo Democratic Republic and changed its currency to francs . 1 franc was exchanged for 100,000 nouveaux zaires . The overall impact of hyperinflation: One 1997 franc = 300 billion pre-1989 dinars .

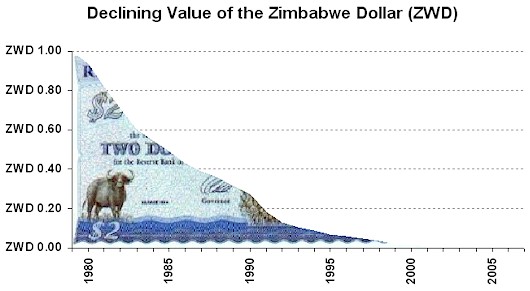

Zimbabwe (1999 - present)

The Rhodesian dollar (R$), adopted in 1970, following decimalization and the replacement of the pound as the currency, was set at a rate of 2 Rhodesian dollars = 1 pound (R$ 0.71 = USD $1.00). At the time of independence in 1980, one Zimbabwean dollar (of 100 cents) was worth US$1.50.

Since then, rampant inflation and the collapse of the economy have severely devalued the currency, with many organizations using the US dollar instead.

On 16 February 2006, the governor of the Reserve Bank of Zimbabwe, Dr Gideon Gono, announced that the government had printed ZWD 21 trillion in order to buy foreign currency to pay off IMF arrears.

In early May 2006, Zimbabwe's government began rolling the printing presses (once again) to produce about 60 trillion Zimbabwean dollars . The additional currency was required to finance the recent 300% increase in salaries for soldiers and policemen and 200% for other civil servants.

In August 2006, the Zimbabwean government issued new currency and asked citizens to turn in old notes; the new currency (issued by the central bank of Zimbabwe) had three zeroes slashed from it.

In February 2007, the central bank of Zimbabwe declared inflation "illegal" and outlawed any raise in prices on certain commodities between March 1 and June 30, 2007. Officials have arrested executives of some Zimbabwean companies for increasing prices on their products. ( NY Times )

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of www.DollarDaze.org , a website pertaining to commentary on the instability of the global fiat monetary system and investment strategies on mining companies.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.