Silver Long-Term Bull Market

Commodities / Gold and Silver 2010 Dec 17, 2010 - 07:35 AM GMT Unfortunately, due to millions of years of evolution, human beings make absolutely terrible investors. It appears that most investors seem to have a good memory for very long term trends and very short term trends but for some reason they seem to forget about the intermediate term trends. As a result of this they lose money!

Unfortunately, due to millions of years of evolution, human beings make absolutely terrible investors. It appears that most investors seem to have a good memory for very long term trends and very short term trends but for some reason they seem to forget about the intermediate term trends. As a result of this they lose money!

For example:

Long Term

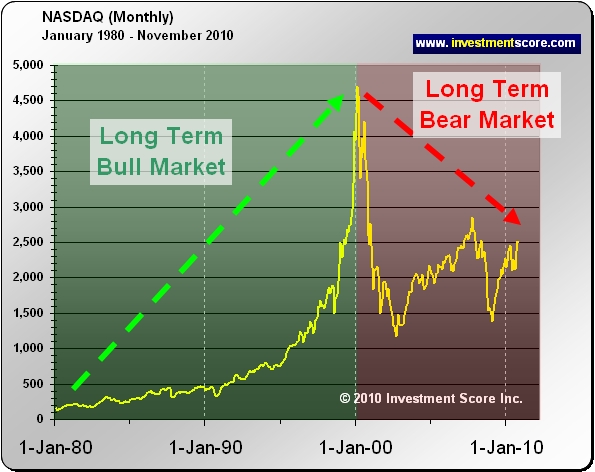

From 1980 to 2000 a long term trend in the stock market catapulted the general stock markets like the Dow Jones and NASDAQ to dizzying heights. The massive long term trend was powerful, profitable and hard to forget about. Ever since the NASDAQ bubble popped in 2000 many investors have been adding to their beloved tech stock positions trying to ‘dollar cost average’ for the next wave up. Eleven years later these investors continue to rationalize why their buy and hold strategy will be paying off any year now.

Real-estate and its bull market is yet another example of investors remembering a long term trend and expecting the market to go right back to “normal” any quarter now. The same psychology kept investors away from gold and silver in 2000 because it had been a poor performer for the previous 20 years. Although precious metals are in the lime light today, the same was not true even a few years ago.

Short Term

On the other extreme we get the short term, tunnel vision investor who seems to forget everything prior to a few days ago. In this case I am not talking about the very short term “Day Trader” but rather I am talking about the investor who loses sight over where they just came from. This investor will get so caught up in a profitable trade that they will continue to buy more and more until they eventually sell out from what inevitably becomes an unprofitable drop. In other words this investor will turn profitable trades into unprofitable trades because they lose perspective on the bigger picture and rarely take profits.

So why don’t investors remember and pay attention to the intermediate term trend? To be honest we aren’t really interested in why; the answer probably has something to do with evolution and survival. We are interested in recognizing the weakness so that we can profit from it and outperform the market.

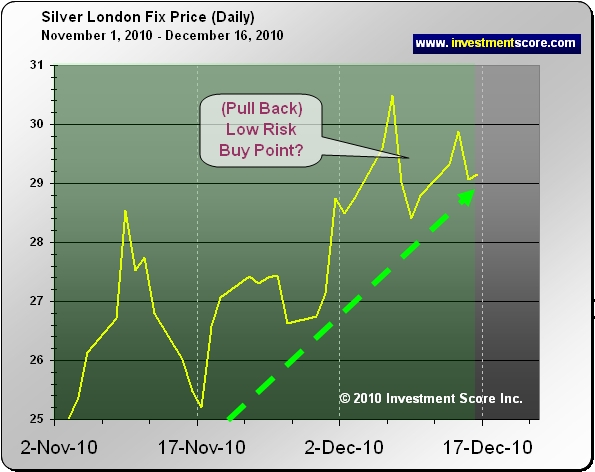

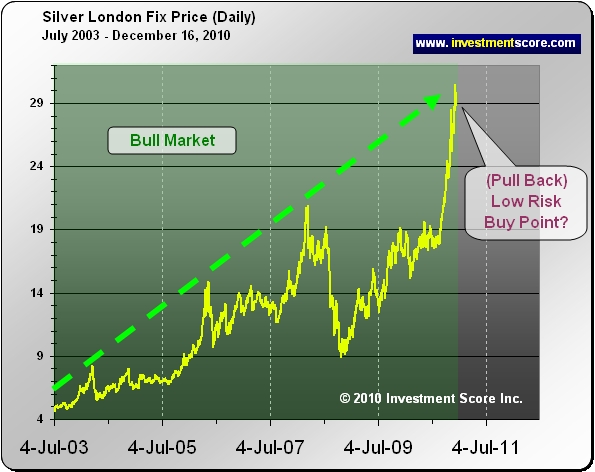

Take a look at the price of Silver from a daily perspective:

From a daily perspective silver really looks like it has pulled back. Perhaps this is a great low risk buying opportunity. These comments are being typed “Tongue- in-cheek” as we try to illustrate our point about perspective and market swings. The following charts will clarify what we mean by this.

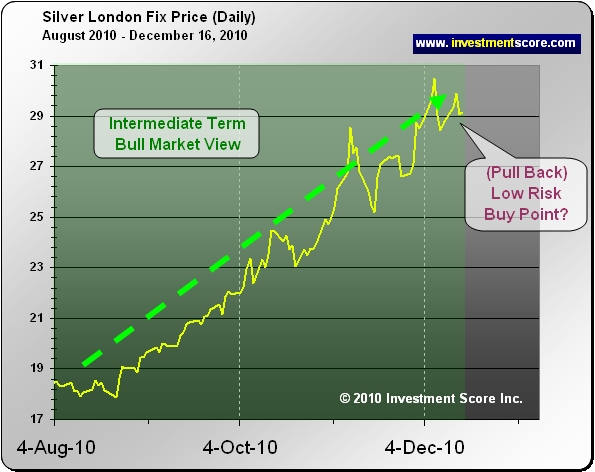

Let’s look at the price of silver and this same potential buy point from a little bit larger perspective:

As one can clearly see the pullback in the daily chart is nothing more than a tiny blip in the overall move.

Again we can see that the seemingly great buying opportunity from the up close view may actually be a little on the “not so low risk” side of things.

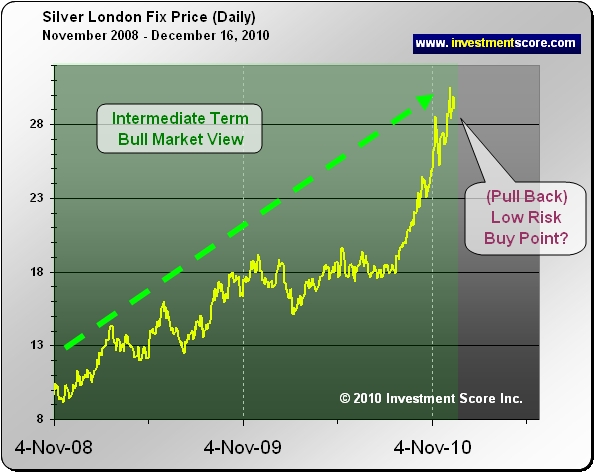

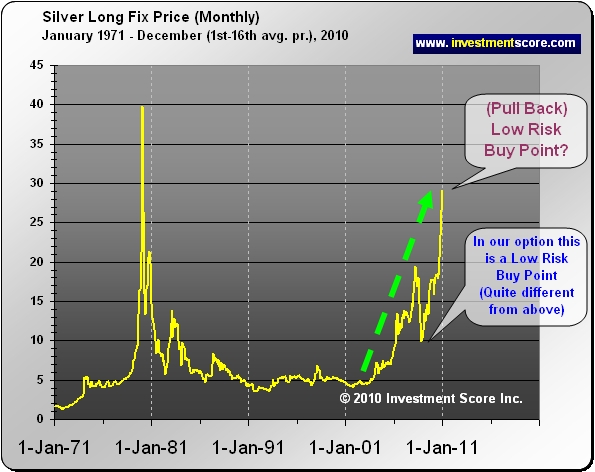

Now let’s look at the long term price of silver from a Monthly perspective.

This chart clearly illustrates how significant the recent move of silver has been compared to its historical price action. From a monthly perspective we can clearly see the parabolic spike action. This is much harder to see from the close up daily chart.

Before we continue we would like to be totally clear that we are extremely strong Gold and Silver bulls. It is our opinion that the price of Silver and Gold will be many multiples of their current prices in the future. We are by no means trying to suggest that the silver and gold bull market is over but we are trying to raise a point about intermediate term market swings.

We believe that investors should ask themselves:

- Do I find myself feeling like I am missing out and I should buy more positions in precious metals so that I don’t “miss the boat”?

- Is it becoming easier and easier to add to my positions because I am so certain these investments have to go higher?

- Am I starting to count how much money I will make in my precious metals investments without regard to how much money I may lose?

Recently we have observed a “professional” precious metals advisor explaining that investors should buy a position in silver and gold right now just so that they don’t “miss the boat” in this bull market. Interestingly we didn’t observe such a comment in November of 2008 when silver was at $9.00.

In our opinion the above observations are warning signs that things are getting a little over heated in this sector. We do not mean to suggest that investors should sell all of their precious metals positions because we are predicting a top in the market. Interestingly we believe that an even larger spike in the price of silver is a very real possibility. However, we are trying to bring to light a common investor mistake and the warning signs that we see in the current bull market. The warning signs are almost always there for those who are willing to pay attention to them.

At investmentscore.com we look at investments relative to various markets in order to gain a unique perspective to their “Value” instead of their “Price”. We believe it is a common mistake for investors to be misguided by “price movement” instead of by true value. At the end of the day understanding “Value” is where wealth can be created and stored as “Price” can be greatly distorted by the constant fluctuations of currencies. To learn more about our strategies and to sign up for our free newsletter please visit us at www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.