Who Bought the US Treasury Bonds ?

Interest-Rates / US Bonds Oct 19, 2007 - 01:24 PM GMTBy: Rob_Kirby

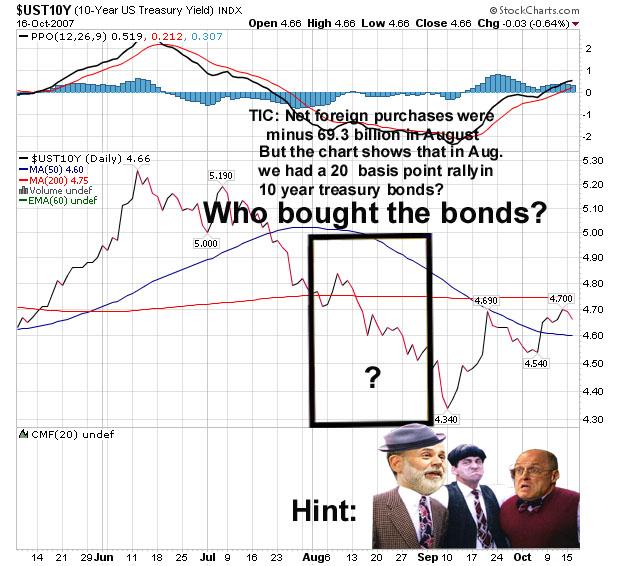

According to the U.S. Treasury – the latest TIC data [August] tells us the following:

Treasury International Capital (TIC) Data for August

Treasury International Capital (TIC) data for August are released today and posted on the U.S. Treasury web site ( www.treas.gov/tic ). The next release, which will report on data for September, is scheduled for November 16, 2007.

Net foreign purchases of long-term securities were minus $69.3 billion.

-

Net foreign purchases of long-term U.S. securities were minus $34.9 billion. Of this, net purchases by foreign official institutions were minus $24.2 billion, and net purchases by private foreign investors were minus $10.6 billion.

-

U.S. residents purchased a net $34.5 billion of long-term foreign securities.

Net foreign acquisition of long-term securities, taking into account adjustments, is estimated to have been minus $85.5 billion.

Foreign holdings of dollar-denominated short-term U.S. securities, including Treasury bills, and other custody liabilities increased $33.9 billion. Foreign holdings of Treasury bills increased $21.0 billion.

Banks' own net dollar-denominated liabilities to foreign residents decreased $111.4 billion.

Monthly net TIC flows were minus $163.0 billion. Of this, net foreign private flows were minus $141.9 billion, and net foreign official flows were minus $21.1 billion.

Who am I to argue with the U.S. Treasury?

Heck, Ambrose Pritchard even weighed in with this little nugget of an observation:

Asian investors dumped $52 billion worth of US Treasury bonds alone, led by Japan ($23 billion), China ($14.2 billion), and Taiwan ($5 billion). It is the first time since 1998 that foreigners have, on balance, sold Treasuries. [RK emphasis]

So perhaps someone could explain to me why the U.S. Treasury complex rallied like a bad thing in the month of August?

You see folks, I have a memory.

I recall quite vividly that the “line from officialdom” and widely reported in the main-stream-financial –press, was that August's rally in Treasury Yields was all about a ‘supposed flight to quality'.

It now seems that we were all sold a ‘bill of goods'.

In retrospect, with the knowledge provided by Tuesday's [Oct. 16/07] release of the August TIC report - it now seems more likely the flight we really witnessed was more akin to this:

By Rob Kirby

http://www.kirbya nalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html , and edited by Mary Puplava of http://www.financialsense.com

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.