Gold and Silver Firm Ahead of EU Summit on Debt Crisis

Commodities / Gold and Silver 2010 Dec 16, 2010 - 05:51 AM GMTBy: GoldCore

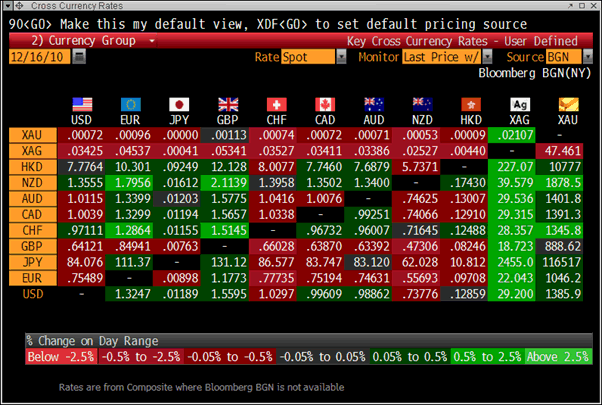

Gold and silver are higher this morning ahead of a crucial EU summit on the deepening euro zone debt crisis today. The euro firmed slightly in overnight trade but has since given up those gains and is trading at USD 1.322, and €1,047/oz. Given that the crisis shows no signs of abating any time soon, with concerns shifting from Ireland and Greece to Belgium, Portugal and Spain, gold will likely continue to receive safe haven demand for the foreseeable future.

Gold and silver are higher this morning ahead of a crucial EU summit on the deepening euro zone debt crisis today. The euro firmed slightly in overnight trade but has since given up those gains and is trading at USD 1.322, and €1,047/oz. Given that the crisis shows no signs of abating any time soon, with concerns shifting from Ireland and Greece to Belgium, Portugal and Spain, gold will likely continue to receive safe haven demand for the foreseeable future.

Gold is currently trading at $1,382.35/oz, €1,044.70/oz and £885.50/oz.

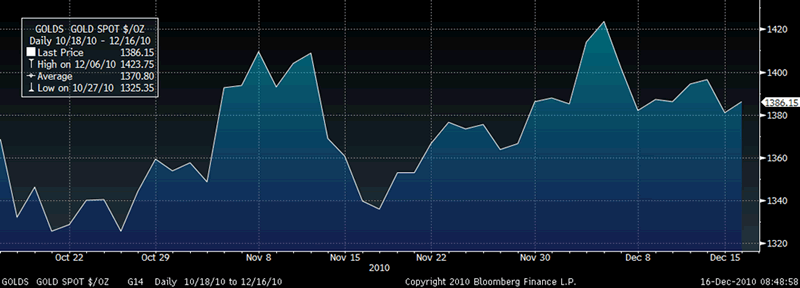

Gold in USD – Daily (60 days)

Gold appears to be consolidating between $1340/oz and $1425/oz and this consolidation is seen in the fact that it is less than 2% above its price of 2 months ago. Gold is not showing signs of a speculative bubble, which end in parabolic blow off tops. Rather, gold is again rising a sceptical "wall of worry" with an assumption by many that it is a bubble. The three steps forward, one step back action seen in the gold market in the last ten years and today is typical of a bull market.

Cross Currency Table at 1000 GMT

With gold up 26% year to date, end of year book squaring and profit taking is to be expected and could see a slight sell off prior to the Christmas holidays. Any selloff will likely be short lived due to the strong fundamentals. Therefore, after a correction, gold could rise again in the final days of the year as it has done in recent years.

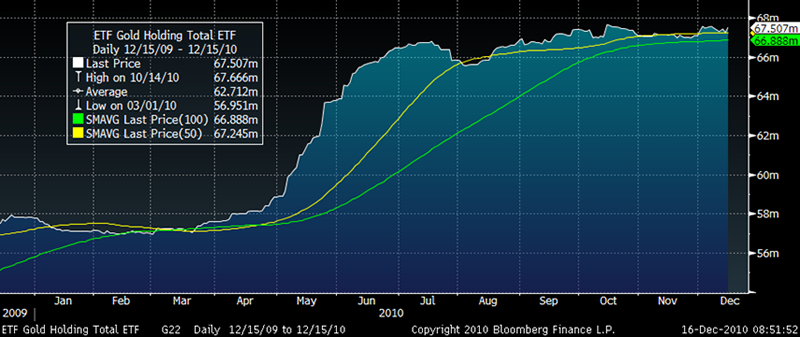

ETF Gold Holdings

Another indication that the man in the street or retail investors are not greedily and fearlessly piling into gold is the fact that the ETF gold holdings have remained constant since July. Meaning that there have been as many sellers and buyers of the gold ETFs.

This mirrors are own experience where we have seen steady constant demand in recent months. Also, we have seen many clients take profits on a portion of their precious metals portfolio and we have even see some clients sell. This contradicts sensationalist headlines about investors "piling" into gold and of a "gold rush".

The fact remains that the man and woman in the street have been net sellers of gold rather than net buyers due to the international cash for gold phenomenon. This has seen the public being enticed to sell their gold in return for depreciating fiat currencies at appalling prices. When Joe Kennedy's archetypal "shoeshine boy" and the majority of the public in the world believe that you cannot go wrong owning gold - as they did with property - there will be a real risk of a bubble. Indeed, there is no fever like gold fever and the speculative mania may dwarf that seen in the property market in recent years and could drive gold to thousands of dollars per ounce.

With most analysts forecasting gold to rise to over $1,600/oz in 2011, value buyers who buy below $1,400/oz will likely be rewarded in 2011 and in the coming years.

SILVER

Silver is currently trading $29.10/oz, €21.99/oz and £18.64/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,695.50, palladium at $755.00/oz and rhodium at $2,225/oz.

NEWS

(Bloomberg) -- China is "on track" to replace India as the largest gold consumer at a faster rate than the market had anticipated, UBS AG analyst Edel Tully said today on a conference call. By opening up the gold market, the country is "allowing Chinese civilians to increase their stock of gold," she said.

(People's Daily) -- China's gold reserves rank 6th worldwide. The latest rankings of gold reserves show that, as of mid-December, the United States remains the top country and Chinese mainland is ranked sixth with 1,054 tons of reserves, the World Gold Council announced recently. Russia climbed to eighth place because its gold reserves increased 167.5 tons since December 2009. The top ten in 2010 remains the same compared to the rankings of the same period of last year. And Saudi Arab squeezed to the top 20. Developing countries and regions, including Saudi Arab and South Africa, have become the main force driving the gold reserve increase. Among the top 100, 67 of them come from developing countries or regions, compared to 62 last year.

(Bloomberg) -- The U.S. Mint may produce American Eagle palladium coins if there is sufficient evidence that investors will buy them. The mint was authorized to produce the 1-ounce coins "if an independent marketing study demonstrates adequate demand to ensure that the coins could be minted and issued at no net cost to taxpayers," according to the American Eagle Palladium Bullion Coin Act of 2010 that President Barack Obama signed into law yesterday. Demand for precious-metal coins has soared this year as investors sought a haven from turmoil in global financial markets. The U.S. Mint currently sells 1-ounce American Eagle gold, silver and platinum coins. Last month, the agency sold a record 4,260,000 ounces of silver coins. The price of palladium, used in jewelry and in automobile pollution-control devices, has gained more than 80 percent this year and touched a nine-year high of $780 an ounce on the New York Mercantile Exchange on Dec. 3. Coin sales would generate about $500,000 a year in excess of production costs, according to a report by the Congressional Budget Office on Sept. 29.

(Bloomberg) -- Commodity Assets Rise to Record, Barclays Says (Update1)

Commodity assets under management rose $11 billion last month to a record $354 billion, led by demand for index-linked investments, Barclays Capital said.

Sugar Rises in N.Y. on Supply Concern; Cocoa, Coffee Advance

Sugar rallied for a fourth straight session on speculation that plans by India to resume exports may fail to boost supplies enough to meet rising global consumption. Cocoa and coffee also rose.

Wheat Futures Increase as Egypt, Jordan Buy Supplies From U.S.

Wheat futures rose for the second time in three days as demand increased for supplies from the U.S., the world's largest exporter.

Baltic Dry Index Extends Its Longest Retreat in Almost a Month

The Baltic Dry Index, a measure of commodity-shipping costs, extended its longest losing streak in almost a month on falling rates to hire smaller iron ore and coal transporters.

CFTC Urged to Curb Speculation as Wall Street Resists (Update3)

U.S. regulators this week are considering rules aimed at curbing speculation in commodities trading, as Wall Street firms call for delay and companies including Delta Airlines Inc. urge strict limits.

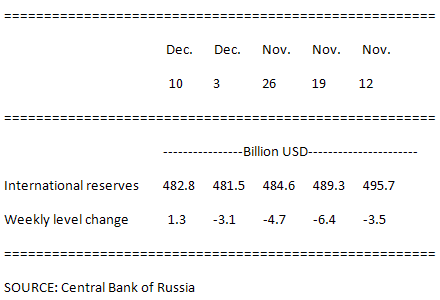

(Bloomberg) -- Following is a summary of international reserves held at the Central Bank of Russia:

GoldCore Product Update:

Temporary Suspension of 2011 Perth Mint 10oz and 5oz Silver Bullion Coins

Please note that demand for the 2011 Koala, Kookaburra and Lunar silver bullion coins from The Perth Mint has increased over the last month due to large demands on silver worldwide. In particular there has been a large increase in orders for very popular kilo coins which has outstripped the Perth Mint's manufacturing capacity. It has been decided that the mint will focus presses that make large coins on kilo coins only. As a result, the Perth Mint have decided to temporarily suspend production of 2011 dated 10oz and 5oz silver bullion coins until further notice.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.