Silver Price Forecast Rise to $40/oz in 2011 and $400/oz by 2015

Commodities / Gold and Silver 2011 Dec 15, 2010 - 06:14 AM GMTBy: GoldCore

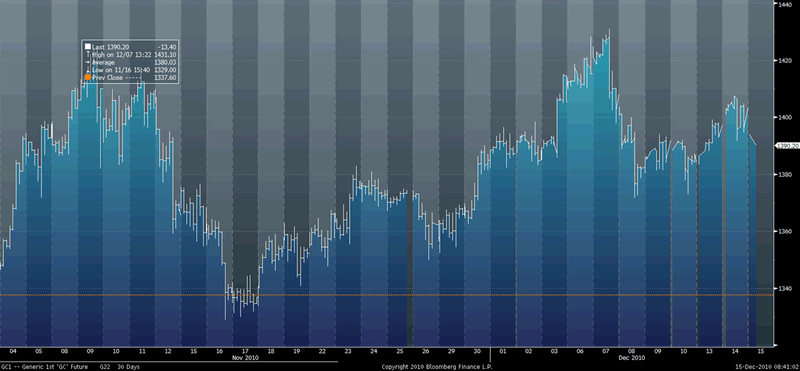

Gold has fallen in dollars but is flat in sterling and euros this morning. Moody's has cut Spain's debt rating on contagion concerns which has seen the euro fall. Germany's opposition to further government financed aid is leading to tensions with the ECB, which is itself now under financial pressure and may need an increase in capital if it is to continue buying sovereign European debt.

Gold has fallen in dollars but is flat in sterling and euros this morning. Moody's has cut Spain's debt rating on contagion concerns which has seen the euro fall. Germany's opposition to further government financed aid is leading to tensions with the ECB, which is itself now under financial pressure and may need an increase in capital if it is to continue buying sovereign European debt.

Gold is currently trading at $1,388.70/oz, €1,042.18/oz and £886.54/oz.

Gold in USD – 30 Day (Tick)

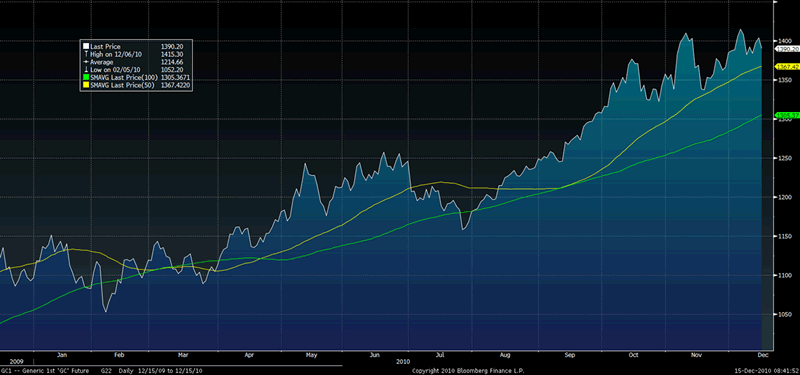

The risk of contagion is real and many analysts believe the crisis will escalate early in 2011. This will lead to continued safe haven demand for gold and should see gold once again perform well in 2011.

The growing threat of inflation due to significant increase in commodity prices will also support gold. Cotton soared by its daily limit yesterday and copper reached new record nominal highs. Sugar prices have reached a 30 year nominal high and Portugal is experiencing a sugar shortage - the first European country to do so in 30 years.

Food and energy prices are rising internationally and the much heralded "wave of inflation" warned of for months may be gradually coming to pass.

Gold in USD – 1 Year (Daily)

Last night, the Federal Reserve, in a policy statement, said the economic recovery was still too slow to bring down unemployment, and reaffirmed its commitment to buy $600 million in government bonds. This will not do anything to restore faith in the dollar and will likely lead to commodity and precious metals making further gains.

SILVER

Predictions of higher silver prices in 2011 and continuing into 2015 came overnight. Standard Bank Plc said that they see silver at over $40/oz due to new applications and increased industrial demand.

James Turk of Gold Money said that he believed silver would reach over $400/oz in 2015. Turk believes that this price will be reached due to massive investment demand in silver due to a possible crash in the dollar and the emergence of inflation and potentially hyperinflation. Turk also believes that the massive concentrated short positions on the COMEX held by JP Morgan as alleged by GATA and Ted Butler will propel silver prices higher in a huge short squeeze.

Silver is currently trading $28.99/oz, €21.76/oz and £18.51/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,689.75, palladium at $744.00/oz and rhodium at $2,225/oz.

NEWS

(Financial Times) -- At Beijing's largest gold shop, the queues to buy bullion mini bars have turned into scrums as customers jostle for one of the country's h...

(see News on www.goldcore.com )

(Bloomberg) -- Silver, the leading performer in metals this year, is likely to repeat its success in 2011, reaching $40 an ounce on new applications and industry demand, said the head of commodity trading in Japan at Standard Bank Plc.

(Bloomberg) -- UBS Raises 2011 Copper, Gold Estimates; Prefers Coal, Palladium UBS AG raised its copper estimate for next year to $4.15 a pound from $3.68 a pound and raised the gold forecast to $1,550 an ounce from $1,400 an ounce.

(Bloomberg) -- Cotton Jumps by Daily Limit as USDA Data Raises Supply Concerns

Cotton futures in New York soared by the daily limit for a second day, advancing to a one-month high after a government report estimated U.S. inventories will drop to a 14-year low.

(Bloomberg) -- Copper Rises to Record in London on Outlook for Stronger Growth.

Copper rose to a record for a second day in London before a U.S. report that may signal growth in the world’s biggest economy as the Federal Reserve prepares to discuss interest rates and bond purchases.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.