The One Reason You Have to Own Gold and Silver

Commodities / Gold and Silver 2010 Dec 15, 2010 - 05:49 AM GMTBy: Jordan_Roy_Byrne

Analysts and pundits provide various reasons for the bull market in Gold. This includes emerging market demand, low interest rates, money printing, central bank accumulation, central bank policies and falling gold production. These are all good reason but there is one reason which stands apart and will drive precious metals to amazing heights. It is the impending sovereign debt default of the west, led by the great USA.

Analysts and pundits provide various reasons for the bull market in Gold. This includes emerging market demand, low interest rates, money printing, central bank accumulation, central bank policies and falling gold production. These are all good reason but there is one reason which stands apart and will drive precious metals to amazing heights. It is the impending sovereign debt default of the west, led by the great USA.

Government finances have reached a point where default and/or bankruptcy is unavoidable. After all, we’ve already started to monetize the debt. The inflection point is when total debt reaches a point where the interest on the debt accumulates in an exponential fashion, engulfing the government’s budget. When this occurs at a time when the economy is already weak and running deficits, there essentially is no way out.

Significant runaway inflation and currency depreciation result from a government that essentially can no longer fund itself. It starts when the market sees the problem and moves rates higher. The government then has to monetize its debts to prevent interest rates from rising. Let me explain where we are and why severe inflation is unavoidable and likely coming in the next two to three years.

In FY2010, the government paid $414 Billion in interest expenses which equates to 17% of revenue. When you account for the $14 Trillion in total debt, that works out to be 2.96% in interest. In FY2007, total debt was $8.95 Trillion, but the interest expense was $430 Billion and 17% of revenue. That accounts for an interest rate of 4.80%. Luckily, rates have stayed low for the past two years.

However, in the next 24 months the situation could grow dire. At least $2 Trillion will be added to the national debt. At an interest rate of only 4.0%, the interest expense would be $600 Billion. Even if we assume 7% growth in tax revenue, the interest expense would total 22% of the budget. An interest rate of 4.5% would equate to 26% of the budget.

As far as what level of interest expense is the threshold for pain, RussWinterwrites:

Once interest payments take 30% of tax revenues, a country has an out of control debt trap issue. When you think clearly about it, this just makes sense, as the ability to dodge, weave and defer is pretty much removed, as is the logic that it will be repaid in a low-risk manner. The world is going to be a different place when the US is perceived to be in a debt trap.

Is there anyway out of this? Either the economy needs to start growing very fast or interest rates need to stay below 3% until the economy can recover. Clearly, neither is likely. As you can tell from the calculations, interest rates are now the most important variable. If rates stay above 4% or 4.5% for an extended period of time, then there is no turning back.

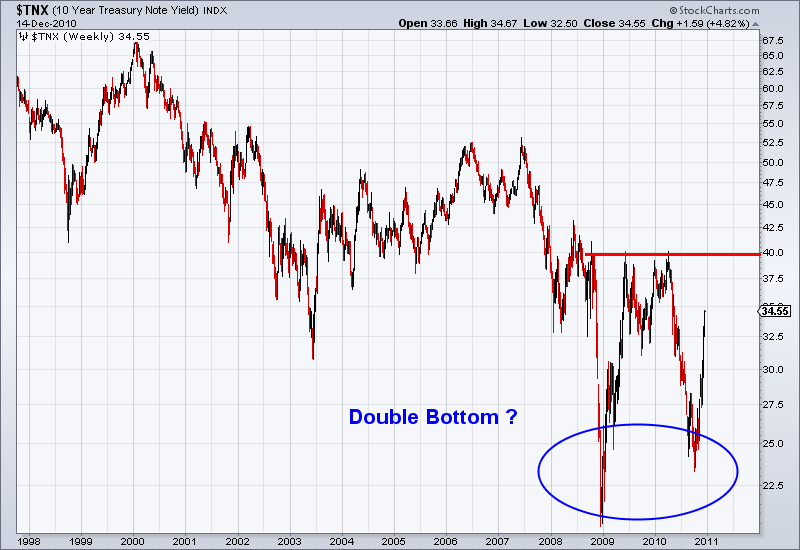

Judging from the chart below, the secular decline in interest rates is likely over. It is hard to argue with a double bottom, one of the most reliable reversal patterns.

In 2011 and 2012, the Fed will have two new problems on its hands. First, the Federal Reserve will be fighting a new bear market in bonds. They will be fighting the trend. They didn’t have that problem in 2008-2010. Furthermore, the interest on the debt will exceed 20% of revenue, so the Fed will have to monetize more as it is. Ironically, the greater monetization will only put more upward pressure on interest rates, the very thing Captain Ben and company will be fighting against.

As you can see, there is really no way out of this mess which also includes the states, Europe and Japan. This is why Gold and Silver are acting stronger than at any other point in this bull market. They’ve performed great when rates were low but are likely to perform even better when rates start to rise. This is why we implore you to at least consider Gold and Silver. We’ve created a service that offers professional guidance so that traders and investors can protect themselves and profit from this amazing bull market. Considerafree 14-daytrialtoourservice.

Good luck ahead!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.