Muni Bond Funds Blood Bath, Will it Continue?

Interest-Rates / US Bonds Dec 15, 2010 - 04:14 AM GMTBy: Mike_Shedlock

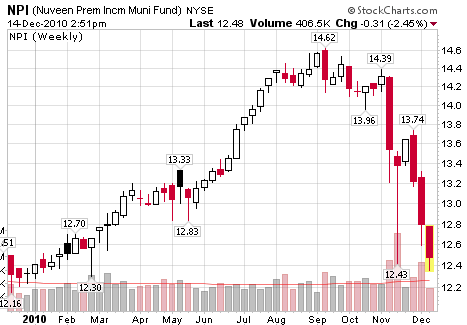

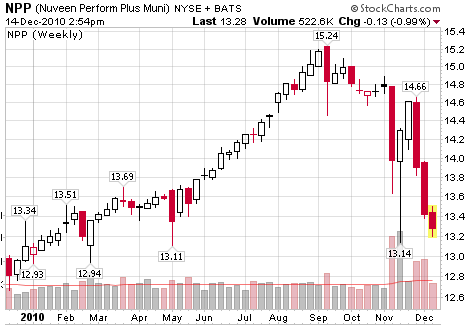

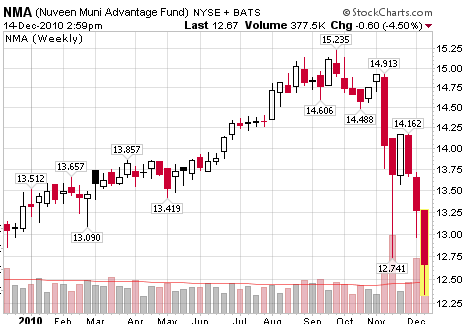

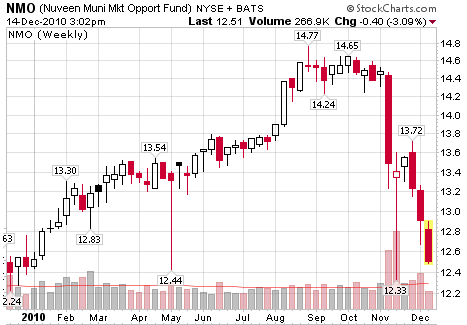

Inquiring minds are watching a huge selloff in Municipal Bond Funds. Here are a few charts.

Inquiring minds are watching a huge selloff in Municipal Bond Funds. Here are a few charts.

NPI Nuveen Premium Income Municipal Fund

NPP Nuveen Perform Plus Municipal Fund

NPP Nuveen Municipal Advantage Fund

NPP Nuveen Municipal Market Opportunity Fund

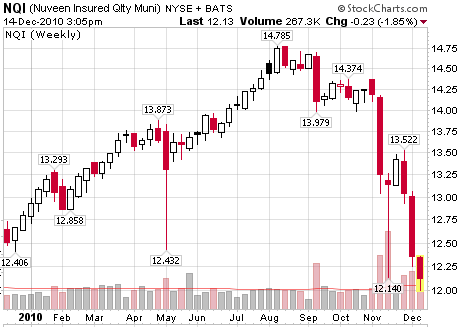

NQI Nuveen Insured Quality Opportunity Fund

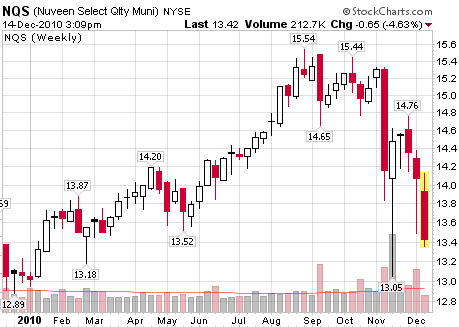

NQS Nuveen Select Quality Municipal Fund

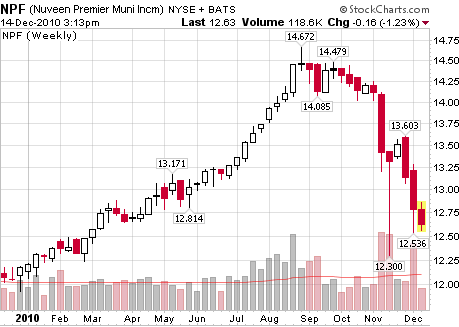

NPF Nuveen Premier Municipal Income Fund

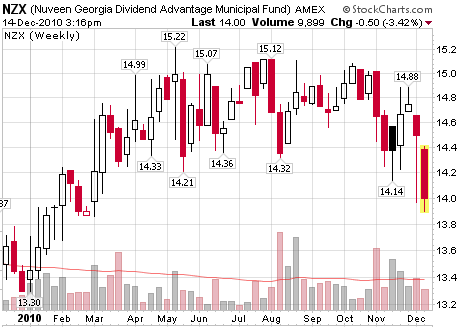

NZX Nuveen Georgia Dividend Advantage Municipal Fund

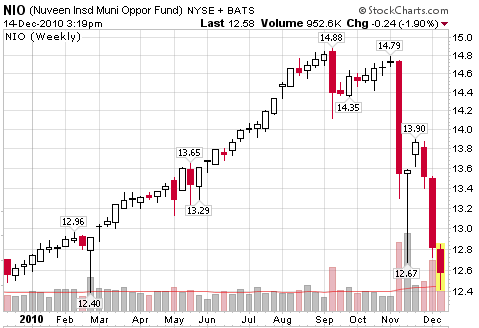

NIO Nuveen Insured Municipal Opportunity Fund

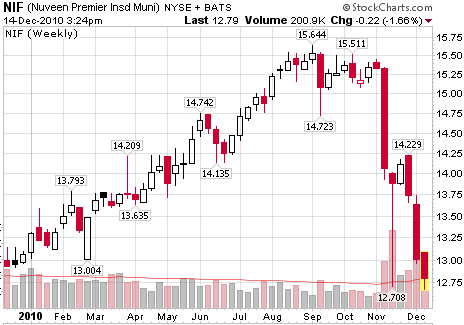

NPI Nuveen Premium Insured Municipal Fund

A tip of the hat to reader "Captain America" for all the symbols.

My first thought is good grief, how many freakin' muni funds does one need? Nuveen offers at least 10 different ways to invest in munis. That is just Nuveen. Is there a bubble in the number of muni funds?

Reasons for the Muni Selloff

1. Unwinding of the "sure-thing" Quantitative Easing trade

2. Selloff in bonds in general because of budget and inflation concerns

3. End of the Build America Bond program (BABs)

4. Increasing default risk

Of the above reasons, 3 and 4 are the most important on intermediate and ongoing basis.

BABs was excluded from Obama's compromise tax proposal. Hopefully it stays that way. I discussed why in Time to Kill Build America Bonds (BABs)

The short version is "Taxpayers are already on the hook for hundreds of billions of dollars of Fannie Mae and Freddie Mac debt. We should not extend the insanity to government guarantees of municipal bonds"

However, now that the government guarantee is gone, yields are poised to rise, especially with increased default risk rising.

Here are several examples of rising default risk:

- Detroit Mayor Plans to Halt Garbage Pickup, Police Patrols in 20% of City; Expect Bankruptcy, Massive Municipal Bond Turmoil in 2011

- Miami Commissioner Says Bankruptcy is City's Best Hope; Chris Christie Says New Jersey Careens Towards Becoming Greece

- Oakland California Bankrupt - Councilwoman Pat Kernighan Calls Rest of Council "Crazy and Irresponsible"

- L.A. Controller Says City Could Run Out of Cash by May 5

- Chicago's Mayor Daley Discusses Bankruptcy For City Pensions

All it takes is one brave municipality to lead the way and others will follow. When that happens, the baby will likely be thrown out with then bathwater. There is no reason to like Munis here.

By the way, bankruptcies are a very deflationary event.

Click Here To Scroll Thru My Recent Post ListBy Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.