December 14 FOMC Meeting, Interest Rate Surprises Are Unlikely

Interest-Rates / US Interest Rates Dec 13, 2010 - 02:42 PM GMTBy: Asha_Bangalore

The last FOMC meeting for 2010 is likely to end without any surprises. The Fed is expected to maintain the current band (0%-25%) for the federal funds rate. There has been significant criticism about the $600 billion purchase of Treasury securities to provide an extra lift to economic activity and bring about a lower unemployment rate. The Fed projected lower interest rates and a depreciation of the dollar as a result of the second round of purchases of securities, termed as QE2. However, yields have risen since the announcement of QE2 on November 3. The 10-year Treasury note yield closed at 3.32% on December 10, the highest since June 10, 2010 (see Chart 1). Mortgage rates have risen close to 40bps since November 3 (see Chart 1).

The last FOMC meeting for 2010 is likely to end without any surprises. The Fed is expected to maintain the current band (0%-25%) for the federal funds rate. There has been significant criticism about the $600 billion purchase of Treasury securities to provide an extra lift to economic activity and bring about a lower unemployment rate. The Fed projected lower interest rates and a depreciation of the dollar as a result of the second round of purchases of securities, termed as QE2. However, yields have risen since the announcement of QE2 on November 3. The 10-year Treasury note yield closed at 3.32% on December 10, the highest since June 10, 2010 (see Chart 1). Mortgage rates have risen close to 40bps since November 3 (see Chart 1).

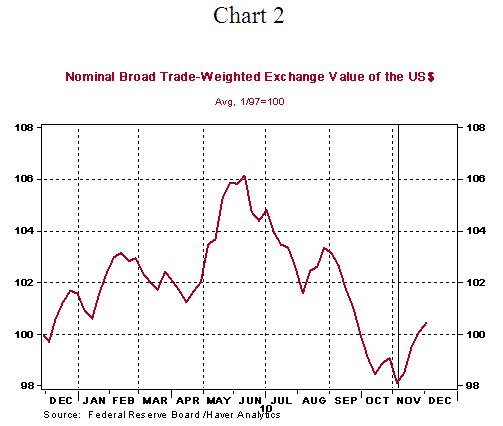

The trade weighted dollar has moved up 2.3% to 100.4 since the November 3 FOMC meeting (see Chart 2). In recent days, interest rates and the value of the dollar have shown gains that are contrary to expectations. The unanticipated turn of events is the main reason for a likely spirited debate about QE2 and its ramifications.

There are significant changes in economic conditions to consider when assessing the nature of the market response in recent weeks. The tone of recent economic reports is more bullish compared with data published in April-October months. The new tax deal being considered in Congress is a large fiscal stimulus package which should raise spending in the economy. A larger deficit than previously envisioned entails an increase in the supply of securities. Each of these factors has played a role in modifying the bond market's view of future economic conditions.

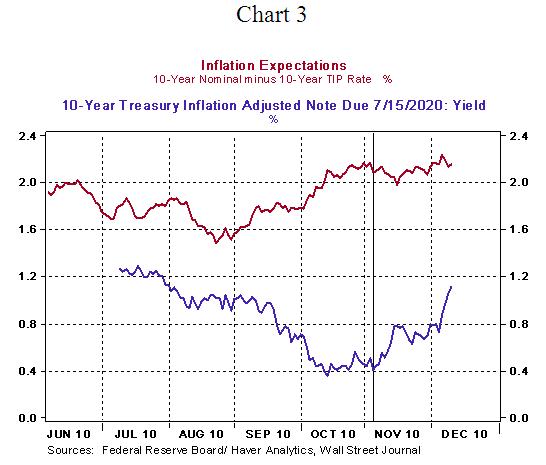

These bullish expectations about the economy are also reflected in the higher inflation expectations and higher real yields (see Chart 3). Markets tend to overshoot and a further revision is possible if economic data are soft in the weeks ahead. We will be tracking labor market conditions closely to ascertain the possibility of a change in current Fed policy. For now, the FOMC is likely to depict the current run up in interest rates as transitory and rule out considerations of reversing the QE2 program in the near term.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.