Stock Market Elliott Wave Analysis and Forecast for Week Starting 13th Dec

Stock-Markets / Stock Markets 2010 Dec 12, 2010 - 12:46 PM GMTBy: Tony_Caldaro

Another positive week for US equities as the SPX/NDX/NAZ all made new bull market highs. Economic reports were nearly all positive. The only negatives were an increase in the budget deficit and a downtick in the M1 multiplier. On the positive side, the trade deficit improved along with import/export prices and weekly mortgage applications. Consumer credit expanded, consumer sentiment improved; wholesale inventories, the monetary base and the WLEI all rose. Also weekly jobless claims and excess reserves declined. These reports continued the 2010 second half trend of an improving, not deteriorating, economy.

Another positive week for US equities as the SPX/NDX/NAZ all made new bull market highs. Economic reports were nearly all positive. The only negatives were an increase in the budget deficit and a downtick in the M1 multiplier. On the positive side, the trade deficit improved along with import/export prices and weekly mortgage applications. Consumer credit expanded, consumer sentiment improved; wholesale inventories, the monetary base and the WLEI all rose. Also weekly jobless claims and excess reserves declined. These reports continued the 2010 second half trend of an improving, not deteriorating, economy.

For the week the SPX/DOW were +0.8%, and the NDX/NAZ were +1.5%. Asian markets were -0.3%, Europe was +1.4%, the Commodity equity group was flat, and the DJ World index was +0.6%. Bonds were -2.0%, Crude was -1.4%, Gold was -2.0%, and the USD was +0.9%. Next week is another busy week highlighted by the FOMC meeting, Options expiration and Retail sales.

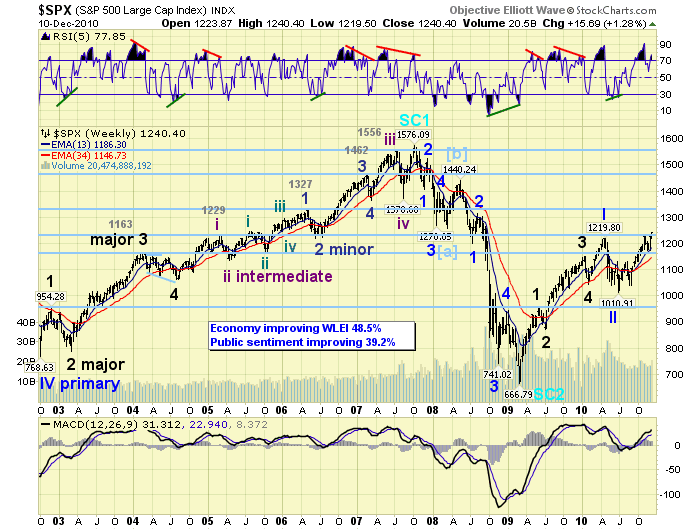

LONG TERM: bull market

In September, 2010 we combined all the technical facits of OEW and projected a potential scenario for the rest of the bull market:SPX Stocks Bull Market Projection. Thus far our first wave up, Major wave 1, remains on track to reach the OEW 1313 pivot by January 2011. This bull market projection approach is very similar to the one we used in August, 2006 which projected a bull market top around the OEW 1553 pivot near the end of 2007: http://caldaro.wordpress.com/2006/08/16/anniversary-special/. That projection worked quite well as the SPX topped at 1576 in October, 2007. We will continue to track our current projection into our estimated bull market top in early 2012.

Our current bull market is progressing nicely with new bull market highs just this week after the November pullback. The weekly RSI and MACD continue to rise and neither are close to getting overbought. This bull market continues to track the 2002-2007 bull market, to some degree, and you can observe the similar important resistance levels noted by the light blue lines.

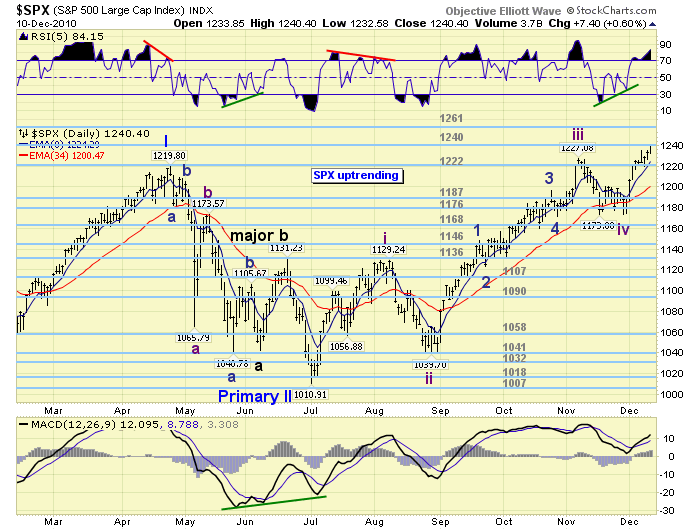

The daily chart provides a closeup of the current uptrend, Major wave 1, which began at the Primary wave II low at SPX 1011 in July. With new uptrend highs this week Intermediate wave five, of Major wave 1, was confirmed. Now the task is to identify the five Minor waves of Intermediate wave five as this multi-month uptrend nears its conclusion.

MEDIUM TERM: uptrend high reaches SPX 1240

When we examine this uptrend closely we had labeled the Intermediate wave one high in August at SPX 1129: Int. wave one rose 118 points (1011-1127). After an Int. wave two zigzag pullback Int. wave three hit SPX 1227 in early November: Int. wave three rose 187 points (1040-1227). Intermediate wave three had about a 1.618 fibonacci relationship to Int. wave one. Quite normal in EW terms. Then after an Int. wave four flat pullback in November Int. wave five is now underway.

The typical fibonacci price targets for this price/wave activity is as follows: @ SPX 1246 Int. five = 0.618 Int. one; @ SPX 1289 Int. five = 0.618 Int. three; @ SPX 1291 Int. five = Int. one; and @ SPX 1360 Int. five = Int. three. The minimum advance, SPX 1246 and the OEW 1240 pivot, was reached on friday. The normal advance SPX 1289-1291 and the OEW 1291 pivot is next. Then the extreme advance SPX 1360 and the 1363 pivot would be quite unusual, but possible. Once the OEW 1240 pivot range is cleared the next objective is the 1261 pivot, and then the 1291 pivot. If we observe five Minor waves into the 1291 pivot then we should be looking for an end to this multi-month uptrend at that point. Thus far, it appears Intermediate wave five is still in Minor wave 1.

SHORT TERM

Support for the SPX is now at 1240 and then 1222, with resistance at 1261 and then 1291. Short term momentum is getting quite overbought. Throughout this uptrend the minor pullbacks have been between 10 and 18 points. The more significant pullbacks, that help define more important waves, have been over 20 points. Thus far, since the Dec 1st SPX 1174 low, the only noteworthy pullback has been a minor 15 points.

During both Intermediate waves one and three there were at least four pullbacks of 20 points or more. We have yet to see one during the beginning of Int. wave five. Also noteworthy. Minor 1 of Int. one rose 88 points (1011-1099) and Minor 1 of Int. three rose 109 points (1040-1149) before either had a significant over 20 point pullback. Thus far, Minor wave 1 of Int. five has risen only 67 points (1173-1240) without a significant pullback. For this uptrend this is quite normal.

While the technicals look fine, eight of the nine SPX sectors in uptrends and nine of the fifteen world indices in uptrends, we remain objective. Support is now at the OEW 1222 pivot and then the SPX 1207 breakout level. Should this SPX 1207 level be broken, to the downside, this uptrend may be turning over. At no time, in the next several weeks, should the SPX reach the OEW 1176 pivot again. That would nearly certainly confirm a downtrend. On the upside, the SPX closed above the 1240 pivot for the first time in two years. The next objective is the 1261 pivot, then the 1291, 1303 and 1313 pivots. Best to your trading!

FOREIGN MARKETS

The Asian markets were mixed on the week for a net loss of 0.3%. China’s SSEC is in a downtrend, and India’s BSE is rising but still in a downtrend.

The European markets were all higher on the week for a net gain of 1.4%. England’s FTSE, Spain’s IBEX and the STOX50 are in downtrends but rising.

The Commodity equity group was mixed on the week and unchanged. Brazil’s BVSP remains in a downtrend.

The DJ World index remains in an uptrend and gained 0.6% on the week.

COMMODITIES

Bonds had one of their worse weeks in quite some time losing 2.0%. 10YR rates have risen from 2.33% in October to 3.30% this week, and probably will go somewhat higher.

Crude lost 1.4% on the week but remains in an uptrend.

Gold lost 2.0% on the week but both Silver and Gold remain in uptrends. There could be a short term diagonal triangle forming in Gold while Silver completes its uptrend.

The USD gained 0.9% on the week as its uptrend continues. The EURUSD lost 1.4% and the JPYUSD lost 1.5%, both remain in downtrends.

NEXT WEEK

A busy week ahead! Tuesday kicks off the week with the PPI, Retail sales and Business inventories, all before the FOMC statement in the afternoon. On wednesday, the CPI, NY FED, Industrial production and the NAHB housing price index. Then on thursday, the weekly Jobless claims, Housing starts, Building permits, the Current accound deficit and the Philly FED. On friday we have Options expiration and the BEA leading indicators. Nothing, other than the FOMC meeting, is on the FED’s schedule at this time. Best to you and yours this Holiday season!

CHARTS: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID1606987

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2010 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.