Euro Gold Consolidates and Targets EUR1,100/oz on Euro Survival Risk

Commodities / Gold and Silver 2010 Dec 10, 2010 - 07:10 AM GMTBy: GoldCore

Most currencies fell against gold yesterday and again today as the euro and dollar are under slight pressure this morning. Both gold and silver look set to finish the week slightly lower in dollars and most currencies (except the euro) which is a bearish short term omen. Especially as the end of the year approaches and there could be some year-end book balancing and profit taking.

Most currencies fell against gold yesterday and again today as the euro and dollar are under slight pressure this morning. Both gold and silver look set to finish the week slightly lower in dollars and most currencies (except the euro) which is a bearish short term omen. Especially as the end of the year approaches and there could be some year-end book balancing and profit taking.

Gold is currently trading at $1,391.19/oz, €1,049.56/oz and £878.35/oz.

Most bond markets recovered yesterday and saw yields fall slightly, except for those of Spain and Japan. Credit default swaps, the cost of insuring against sovereign debt default, widened in Ireland, Italy, Spain and Portugal. There is a continuing state of denial regarding the Eurozone sovereign debt crisis and the real and growing risk of contagion and of Eurozone members leaving the monetary union (see Euro Gold Chart and News below).

The dollar may come under pressure today as the US trade and federal budget balance data will remind market participants of the precarious US fiscal position. The consumer confidence number may also give guidance. The Chinese trade data showed a huge surplus of $22.9 billion showing again how undervalued the yuan is against the dollar.

The fundamental supply and demand picture for gold remains positive with anaemic supply and significant investment and monetary demand from a wide range of sources including retail investors, hedge funds, high net worths, pension funds and central banks. This demand is more than capable of compensating for the fall in jewellery demand.

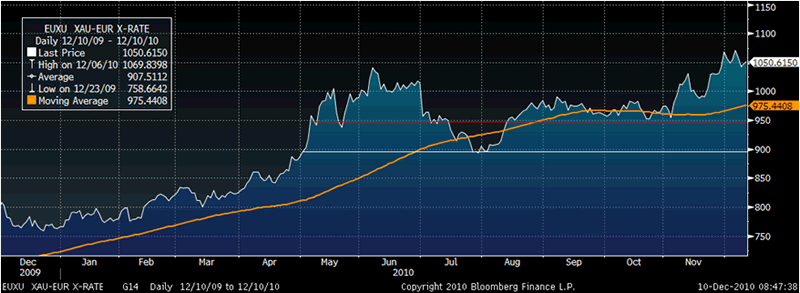

Technically, gold is looking particularly well in euros. After gains early in 2010, gold consolidated between €900/oz and €1050/oz since May. The 100 day moving average has risen to €975/oz and this or the recent level of support at €950/oz are likely to provide support if there is a pullback. However, given that there is an existential threat to the very survival of the euro, any pullback will likely be shallow and brief. Far more likely is a challenge of the €1,100/oz level in the coming weeks.

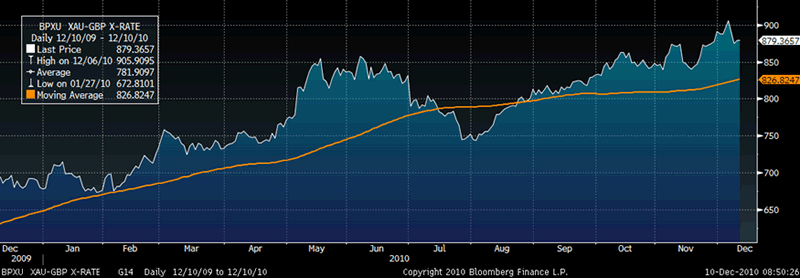

Similarly, sterling had been in a range and consolidated between £740/oz and £875/oz since last March. Gold recently broke above the range and rose to a new nominal high of £905/oz. The 100 day moving average is at £827/oz and this is now support. Resistance is at the recent nominal high of £905/oz and a close above this level could see us challenge £950/oz in short order.

SILVER

Silver is currently trading $28.83/oz, €21.75 /oz and £18.20/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,678.50/oz, palladium at $740.00/oz and rhodium at $2,225/oz.

NEWS

(AP) -- GOLD REBOUND: Gold ticked higher as investors were in a buying mood after prices slipped for two days. The precious metal settled at $1,392.80 an ounce Thursday.

(Bloomberg) -- Gold, which reached a record this week, may advance as investors seek an alternative to currencies, a survey found. Nine of 16 traders, investors and analysts surveyed by Bloomberg (including GoldCore), or 56 percent, said the metal will rise next week. Four predicted lower prices and three were neutral. Gold futures for February delivery were down 1.5 percent for this week at $1,384.80 an ounce at 11:30 a.m. yesterday on the Comex in New York. Futures reached a record $1,432.50 on Dec. 7.

(Bloomberg) -- The 5-ounce America the Beautiful silver coins will go on sale tomorrow, the U.S. Mint said. Authorized purchasers may charge consumers no more than 10 percent above the price at which they bought the coins from the Mint, the agency said today in a memo to dealers. The agency had delayed the sale for four days to investigate consumer complaints over price premiums. Only 33,000 coins are available in each of the five designs, and authorized dealers may sell only one coin to each household, the agency said. Silver futures in New York, up 71 percent this year, touched a 30-year high of $30.75 an ounce on Dec. 7.

(Bloomberg) -- Silver fabrication demand in China may account for 20 percent of global fabrication demand this year, New York-based research company CPM Group said in a statement. China's total silver demand has climbed almost 3.5 times in the past decade, from 40.8 million ounces in 2000 to 139.2 million ounces last year, CPM said in the statement e-mailed yesterday. "CPM's work indicates that silver use is roughly twice as large as had been suggested by commentators in the western market," CPM said.

This update can be found on the GoldCore blog here.

GOLDCORE LAUNCHES THE GOLDSAVER ACCOUNT

The GoldSaver Account allows anyone to buy and save gold online from just €150 per month.

GoldSaver gold holdings are purchased from the Perth Mint of Western Australia. It is stored in their secure vaults, insured and government guaranteed by the AAA rated Western Australian government. Deposits and gold holdings are also independently verified by our auditor on a monthly basis. Find out more about GoldSaver or sign up here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.