Long Term Interest Rate Rises Should Support Higher Gold Prices

Commodities / Gold and Silver 2010 Dec 09, 2010 - 10:25 AM GMTBy: GoldCore

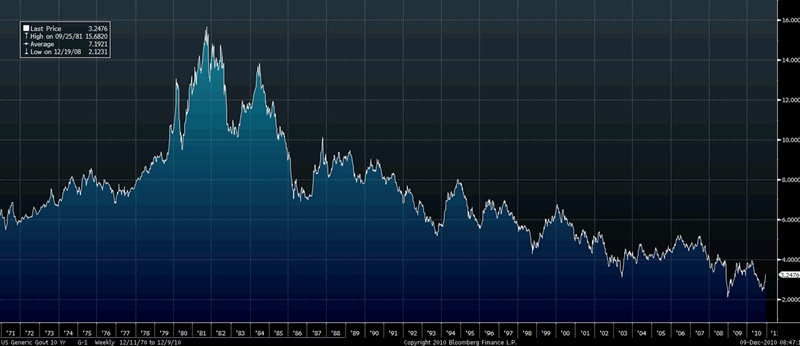

Market focus has shifted to the US bond market and concerns about ultra accommodative US monetary and fiscal policy and continuing quantitative easing. This has seen heavy selling of long term US government debt and long term interest rates have thus risen. The yield on US 10 year Treasuries (benchmark cost of capital internationally) has risen from below 2.4% to over 3.2% in just two months and from 2.95% to 3.23% since just last Monday and the speed of the rise is what is concerning.

Market focus has shifted to the US bond market and concerns about ultra accommodative US monetary and fiscal policy and continuing quantitative easing. This has seen heavy selling of long term US government debt and long term interest rates have thus risen. The yield on US 10 year Treasuries (benchmark cost of capital internationally) has risen from below 2.4% to over 3.2% in just two months and from 2.95% to 3.23% since just last Monday and the speed of the rise is what is concerning.

Gold is currently trading at $1,383.95/oz, €1,046.94/oz and £878.47/oz.

US Govt 10 Yr - Weekly - 1971 - Today

Talks of a bond market 'rout' are overdone but the rise of long term interest rates in the US is also taking place in other debt laden industrial nations including the Japan, the UK and Germany. Sovereign risk in the Eurozone debt market may be infecting German and other sovereign debt markets and the risk of contagion is real. What is most concerning is that - given the degree of uncertainty regarding the euro, the dollar and other currencies - long term interest rates will have to rise, if not in the very short term, certainly in the medium and long term.

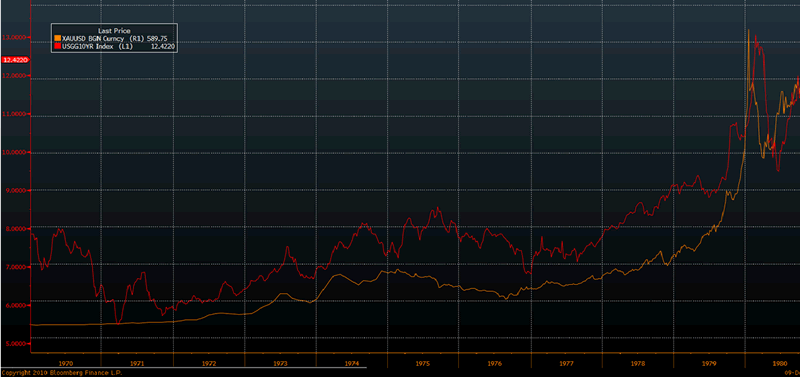

Gold and US Govt 10 Yr – Weekly - 1971- 1981

Showing Correlation Between Rising Interest Rates and Gold

There is some non-evidence-based analysis that asserts that gold prices will fall when interest rates rise. History and markets would suggest otherwise. Gold is correlated with interest rates - meaning that over the long term when gold prices rise, interest rates tend to rise also. Conversely, when gold falls, interest rates tend to fall.

This makes economic sense as gold prices and interest rates rise when there is challenging inflationary, monetary or systemic macroecnomic conditions and fall when these conditions are more benign.

As can be seen in the chart above (US Govt 10 Year), interest rates have seen two cycles since President Nixon closed the gold window, suspending US dollar convertibility to gold and the modern financial and monetary system of free floating fiat currencies came into being. Interest rates rose in the 1970s due to concerns about the new fiat dollar and inflation and then stagflation. This first cycle saw US interest rates (US Govt 10 Yr) more than double from near 6% to over 15%.

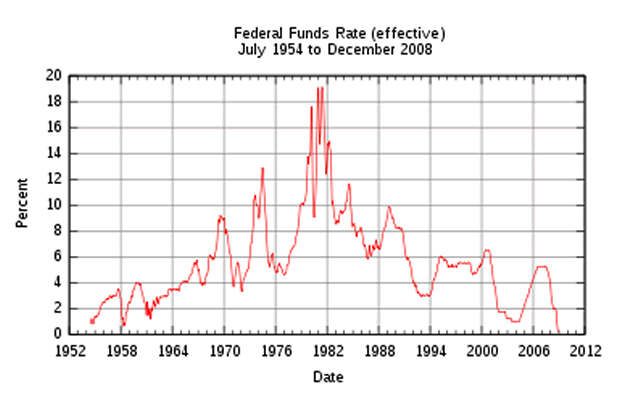

Rising interest rates were positive for gold and as interest rates went up so did the gold price and it was only at the end of Paul Volcker's interest rate tightening cycle with rates nearly at 20% that inflation was contained and investors began to sell gold and return to the safety of very high yielding US government bonds. The prudent monetary stewardship of Paul Volcker, the ex Federal Reserve Chairman who shunned the Keynesian orthodoxy of cheap money pananceas helped get inflation and the US economy back on track, restored confidence in the dollar and brought about the end of the gold bull market.

Subsequently interest rates gradually fell in the 1980s, 1990s and 2000s. The falling interest rates of the 1980s and 1990s saw gold prices come under pressure as there was a period of disinflation, faith in the dollar and a more benign geopolitical and macroeconomic conditions (collapse of Soviet Union and embrace of China, Russia etc of free market capitalism) and real interest rates rewarded investors looking for yield and savers.

As can be seen, gold rose in the rising interest environment of the 1970's and fell in the falling interest rate period subsequently. Gold's rise since 2000 is somewhat of an anomaly as the 10 year debt fell from over 6% to near 2%. However, this anomaly is likely due to the extraordinary geopoltical and macroeconomic backdrop which included September 11th, the 'War on Terror', the profligacy of the Bush adminstration, the near collapse of the western banking system, the sovereign debt crisis and the unprecedented uber Keynesian, ultra accomodative monetary and fiscal policies being pursued today.

US - World's Largest Debtor Nation Ever

Evidence and market history would suggest that gold prices will continue to rise until interest rates return to more normal levels. Real interest rates - the yields investors earn over the actual rate of inflation (not the artificially low numbers provided by government bureaucrats) - will have to be solidly positive. Which, of course, is a big problem given the sheer magnitude of the outstanding consumer, mortgage, municipal, state and Federal debt in the US and other debt laden major economies. Rising rates will see debt servicing costs increase and possibly more government debt, it will likely lead to property markets coming under severe pressure again and a snuffing out of the already fragile economic recovery.

Also, it is worth remembering that the US was the world's largest creditor nation in 1980. Today the US is the world's largest debtor nation with a national debt which is surging to nearly $14 Trillion. When President Bush took power in 2000, the US National Debt was only some $5.7 trillion - it has surged by some 145% in just 10 years. Meanwhile, since 2001, long-term unfunded liabilities to Medicare, Social Security Trust Fund and other long term commitments have ballooned from about $20 trillion to an unaffordable more than $54 trillion.

The fiscal problems facing the US today are far larger than those in the 1970s and this is why gold is extremely likely to at least surpass its adjusted for inflation high in 1980 of $2,300 per ounce and to comparitive price levels in other fiat currencies in the coming years.

SILVER

Silver is currently trading $28.45/oz, €21.52/oz and £18.07/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,682.75/oz, palladium at $740.00/oz and rhodium at $2,225/oz.

NEWS

(Financial Times) -- Gold and silver prices fell on Wednesday after investors took some profits following gains over the past four weeks and a rise in US bond yields.

(Bloomberg) -- Gold investors and jewelers are becoming more accustomed to higher prices and physical sales of the metal slowed compared with when bullion last climbed above $1,400 an ounce, according to Standard Bank Plc.

(Bloomberg) -- A majority of Americans are dissatisfied with the nation’s independent central bank, saying the U.S. Federal Reserve should either be brought under tighter political control or abolished outright, a poll shows. The Bloomberg National Poll underlines the extent to which the central bank’s standing has suffered as it has come under fire in Congress, first from Democrats for regulatory lapses before the financial crisis and then from Republicans for failing to revive an economy in which the jobless rate hovers near 10 percent. Voters from both parties have criticized the Fed’s $3.3 trillion in aid to the financial system.

(Bloomberg) -- Copper prices may jump 22 percent to $5 a pound within 24 months as supply dwindles amid rising demand, according to U.S. Global Investors Inc., which manages $3 billion in San Antonio.

GoldSaver gold holdings are purchased from the Perth Mint of Western Australia. It is stored in their secure vaults, insured and government guaranteed by the AAA rated Western Australian government. Deposits and gold holdings are also independently verified by our auditor on a monthly basis. Find out more about GoldSaver or sign up here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.