The Dollar, Failing Euro and Volatile Gold and Crude Oil

Stock-Markets / Financial Markets 2010 Dec 08, 2010 - 01:24 PM GMTBy: Bari_Baig

First we look at the Dollar index. The streets are cheering as the treasury yields have jumped in the past two days therefore giving the green back the boost it needed to snap out from last week’s losing streak but whenever you have extra hype which to us looks like a stampede we shy away from it for one reason, we aren’t strong enough to run with the stampede and more than often it serves us well. The hype is such that as if Green back is going to blow straight off the roof however, that hasn’t happened thus far. The Dollar index as we write is only marginally up 0.21% which hardly depicts anything but the hype.

First we look at the Dollar index. The streets are cheering as the treasury yields have jumped in the past two days therefore giving the green back the boost it needed to snap out from last week’s losing streak but whenever you have extra hype which to us looks like a stampede we shy away from it for one reason, we aren’t strong enough to run with the stampede and more than often it serves us well. The hype is such that as if Green back is going to blow straight off the roof however, that hasn’t happened thus far. The Dollar index as we write is only marginally up 0.21% which hardly depicts anything but the hype.

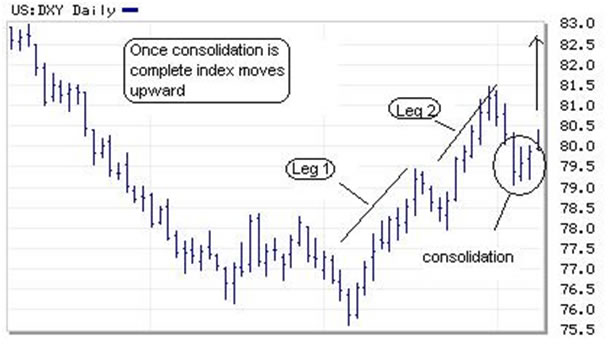

Optimism of the day turns into pessimism at night as the targets set in view of the hype “indicator aren’t met therefore the emotional graph moves from upper left to lower right and slowly the stops start firing away. We might be sounding bearish, let us mince no words here we aren’t bearish of Green back! Not at all! Before this hype or before the dollar index rose we wrote on the first of this month in our article [The Good Days] that “The U.S Dollar index has clearly finished its second leg from 79.6 to 81.6 and before prices move upward to low 83s it should first consolidate.”

We believe that proves our point that we are Bulls of Dollar index and not bears however; the consolidation to us has not been completed as yet. The consolidation still has two or more days left or more like by end of this week. The next leg up “third leg” for low 83s starts next week therefore curb the over enthusiasm and be patient.

Now, coming to Euro which regardless of Green back not being overly bullish is seeing a rather bad day and to make matters worse first the statement from Managing Director of IMF Mr. Dominique Strauss from Geneva didn’t do any good as Mr. Strauss said “The situation in Europe remains troubling, and the future is more uncertain than ever.” So, that is one negative which had to be priced in. The European Central Bank Governing Council member Nout Wellink said “It’s not up to the ECB to save countries where governments run the risk of becoming insolvent,” So, that is one more negative. Clearly the debt issues circling the Euro Zone are such which cannot be turned a blind eye too and that shall take its toll on the single European currency.

The downward channel that we have brought up time and time again seems to be holding up rather well. The pair might have managed to dent it day before and yesterday but is now safely back within the confines of the channel however, as they say “third time lucky” the Euro bulls might then try and push once more and likely they shall manage to push Euro past the downward line but that is where they run out of luck because as we expect that is the time when U.S Dollar shall start to near its consolidation thus it would weigh heavily on Euro. We maintain our bearish stance on Euro and nothing material has changed that we’d change our target of below 1.25s for that matter.

We won’t say we warned “ya” because the late Longs of not just crude but also Gold have now been clearly squeezed out. We saw crude topping out and yesterday’s API data was overly bearish for Crude in terms of crude products and that is why they say don’t bend the twig too much for it snaps eventually. Crude then did precisely that as we wrote day before in our article [How high can crude go and can gold out do itself] that “The downside to mid $85s is an open space waiting to be filled.” We further wrote we see crude trading 87s in two trading session. Today is the 2nd session then and crude has already traded a low of $87.3s with which we are content. We maintain the downside to just below $85 per barrel.

Keeping in view yesterday and today’s trade we can safely say that “No” Gold cannot even out do itself. We saw Gold trade past the previous high but we advocated that it should first consolidate first nevertheless the damage has been done now and as we write Gold is trading low $1380s. We see support for Gold at 1376 and after forming a proper bottom between high 1370s and low 1380s we should see Gold once again coming to life and gradually make its way up the ladder.

Two sessions have been very violent therefore we do not see Gold shooting up tomorrow. It should take a breather as not just Gold but the precious metal traders too are out of breath and they need a time out. It wasn’t just Gold which “surprised” everyone but silver, platinum and palladium the white precious metals did too. We do not talk much about white precious metals therefore we’d stay clear of them, we mentioned them only to give the magnitude of the selloff yesterday. Enjoy a calmer day tomorrow and on Friday get those order slips out for Long positions.

By Bari Baig

http://www.marketprojection.net

© 2010 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.