Hedge Funds and Investors Target Silver 1980 Record High

Commodities / Gold and Silver 2010 Dec 08, 2010 - 07:45 AM GMTBy: GoldCore

Gold and silver prices reached new record highs of $1,430.95/oz and 30 year highs of $30.68/oz respectively yesterday. It is important to remember that these are nominal highs of more than 30 years ago. Adjusted for inflation, the record highs are $2,300/oz and $130/oz (see silver charts below). Gold also reached new record nominal highs in sterling, euros and most major currencies yesterday on growing concerns about currency debasement.

Gold and silver prices reached new record highs of $1,430.95/oz and 30 year highs of $30.68/oz respectively yesterday. It is important to remember that these are nominal highs of more than 30 years ago. Adjusted for inflation, the record highs are $2,300/oz and $130/oz (see silver charts below). Gold also reached new record nominal highs in sterling, euros and most major currencies yesterday on growing concerns about currency debasement.

Gold is currently trading at $1,395.56/oz, €1,053.81/oz and £885.73/oz.

SILVER

Silver is currently trading $29.02/oz, €21.92/oz and £18.42/oz.

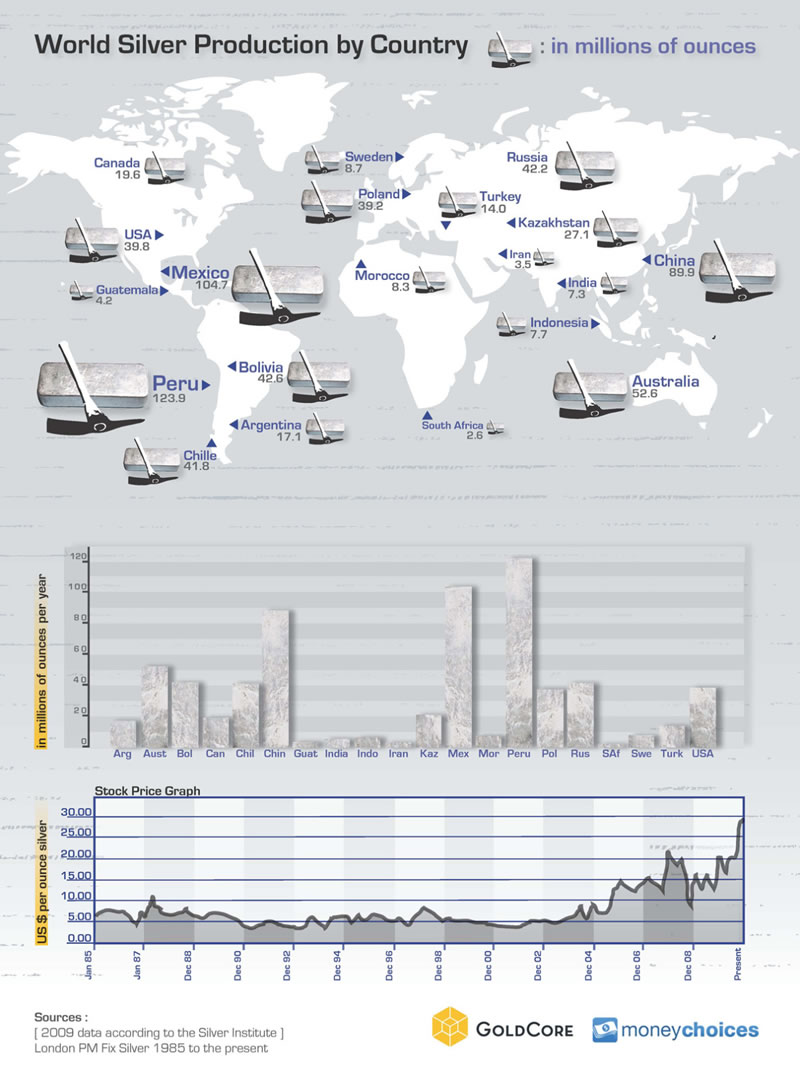

World silver production.

Silver continues to play catch up with gold which is resulting in the gold to silver ratio continuing to fall. The gold/silver ratio is now at 48.1 (1 ounce of gold will buy 48.1 ounces of silver) and the ratio looks set to target 40 which is the price seen in 1998 when Warren Buffett was accumulating silver.

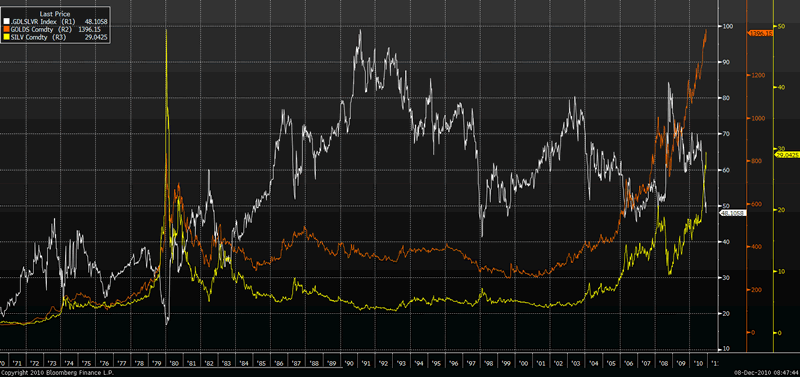

Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white) - 40 Years.

The gold/silver ratio at 48.1 is sustainable as in gold and silver's last bull market in the 1970s, the gold to silver ratio was between 18 and 48 and averaged around 30. In the last 40 years a very significant amount of silver has been consumed in consumer and industrial applications. Gold's consumption is tiny in comparison and this would suggest that the very high gold/silver ratio of the 1990s and up until recently may have been a historical anomaly. Smart money realises this and is positioning accordingly.

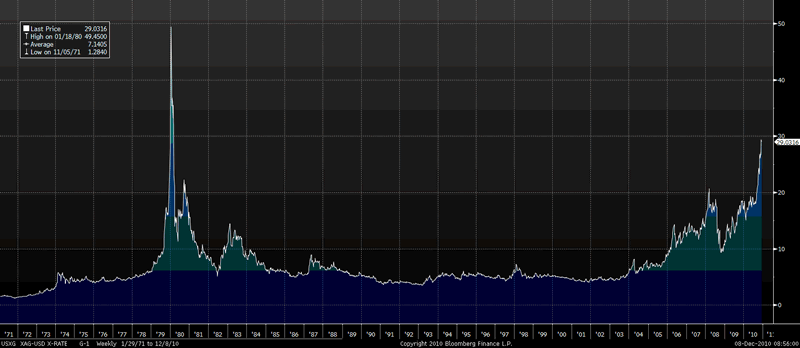

Silver - 1971 to Today (Weekly).

Silver remains undervalued vis-a-vis gold and remains a contrarian play with little or no media coverage, scepticism and continued bearish forecasts and few retail investors having any allocation to silver whatsoever.

Most Wall Street banks have been bearish on silver throughout the bull market including last year. They remain so (see News below) with only Bank of America bullish, saying that they expect silver to average $37.5/oz by 2013.

Silver reached a weekly closing nominal high of $49.45/oz briefly in 1980 (see chart above) when just one billionaire family, the Hunt Brothers (one of a handful of billionaires in the 1970s) attempted to corner the silver market causing the price to surge (in conjunction with many investors seeking to hedge themselves from the stagflation of the 1970s). Today there are hundreds of billionaires and hedge funds throughout the world - some of whom may be tempted to squeeze the large concentrated short positions of JP Morgan in particular. JP Morgan is now facing lawsuits and being sued for manipulation and suppression of silver prices. The internet campaign of Max Keiser to 'Buy silver and Crash JP Morgan' has gone viral and is now being picked up in the mainstream media.

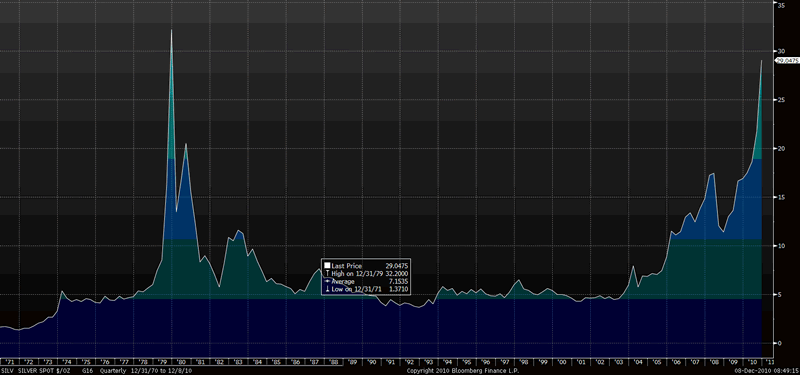

From a technical point of view, a close above yesterday’s highs at $30.68/oz could see silver quickly rise to challenge the resistance of the record quarterly nominal high at $32.20 per ounce seen on New Year's Eve 1979 - 12/31/79 (See Chart below).

Silver - 1971 to Today (Quarterly).

PLATINUM GROUP METALS

Platinum is currently trading at $1,682.75/oz, palladium at $733.00/oz and rhodium at $2,225/oz.

NEWS

(Reuters) -- REUTERS FACTBOX-Precious metals price forecasts.

The price of gold, which hit a record high on Tuesday above $1,425 an ounce, is expected to remain well supported next year as investors favour the metal as a safe store of value amid instability in the financial markets. Silver prices are also expected to extend their recent rally to 30-year highs on gold's coat-tails, though analysts warn the metal is more prone to volatility. Platinum and palladium are also expected to benefit from recovering economic growth. Gold was bid at just above $1,425 an ounce midmorning on Tuesday, while silver was near $30.40 an ounce, platinum was just above $1,720 an ounce and palladium was near $760 an ounce. Below are recent price forecasts for gold , silver , platinum and palladium . Please note dates given are those of the reports in which the forecasts appeared, which may differ from the dates on which they were made.

MORGAN STANLEY (DEC 5)

Morgan Stanley said it expects gold prices to average $1,203 an ounce in 2010, rising to $1,315 an ounce next year before easing back to $1,250 an ounce in 2011. It expects silver prices to average $18 an ounce this year and $20 an ounce in 2011 and 2012. The bank also said it sees platinum rising from $1,622 this year to $1,624 in 2011 and $1,783 in 2012. "Gold, despite hovering at record highs, is likely to edge higher on sovereign concern and growing inflation anxiety, particularly in the (emerging markets)," it said in a note.

GOLDMAN SACHS (DEC 1)

Goldman Sachs said in a research report it expects the gold rally to continue in 2011, with prices averaging $1,575 an ounce next year. The bank says it sees gold at $1,480 an ounce, $1,565 an ounce and $1,690 an ounce in three, six and 12 months respectively. "While we are introducing a 2012 average gold price forecast of $1,700 an ounce, we think it is prudent for gold investors to begin to prepare for gold prices to peak in 2012," it said in the report.

SOCIETE GENERALE (NOV 30)

Societe Generale expects gold prices to average $1,225 an ounce this year, rising to $1,485 an ounce in 2011 and easing off to $1,400 an ounce in 2012. The bank said it sees silver at $20.10 an ounce, $29.50 an ounce and $30 an ounce respectively in the same years. "The gold price should reach fresh all time highs in 2011 driven by mounting inflation fears fuelled by super lax U.S. and euro zone monetary policies," it said.

BNP PARIBAS (NOV 30)

BNP Paribas raised its 2011 gold forecast to $1,500 an ounce from $1,245 previously, and said the metal was likely to average $1,600 an ounce in 2012. The precious metal is likely to average $1,365 an ounce in the final quarter of 2010, rising to $1,415 in the first three months of 2011 and $1,500 in the second quarter. In the third quarter, it sees gold at $1,515 an ounce. "Investment demand is rebounding with euro zone motivated safe haven flows, the official sector continues to be an active buyer of gold, while demand from the jewellery sector entered its seasonally strong quarter in October," it said.

BARCLAYS CAPITAL (NOV 29)

Barcap said it expects gold to average $1,380 an ounce in the fourth quarter of 2010, rising to $1,410 an ounce in the first three months of next year, $1,450 in the second quarter of 2011 and $1,490 in the third quarter. In 2010 as a whole, it sees gold averaging $1,228 an ounce, rising to $1,445 an ounce next year and $1,300 in 2012. "We maintain a positive view across the complex given the gold-favourable backdrop of low interest rates, concerns about currency instability and sovereign debt set to drive prices into uncharted territory," the bank said.

BANK OF AMERICA-MERRILL LYNCH (NOV 11)

Boa-ML expects gold prices to average $1,233 an ounce in 2010, and silver to average $19.91. Next year, the bank sees gold at $1,425 an ounce and silver at $29.50. "Excess liquidity provided through QE2 is... positive for precious metals, which is one reason we have lifted our silver price forecast and anticipate the metal to average $37.5/oz by 2013," it said. "Gold also looks to be supported."

(Wall Street Journal) -- The U.S. Mint said it is delaying the sale of 2010 "America the Beautiful" five-ounce silver coins due to concerns about the high prices and premiums that were to be charged for the bullion coins by its network of authorized purchasers. A memo was sent to authorized purchasers at the end of the first day of sale on Monday. "No orders were processed," said U.S. Mint spokesman said Michael White.

(Bloomberg) -- The U.S. Mint delayed the sale of a five-ounce silver coin because of premiums charged by authorized sellers, the Wall Street Journal reported, citing U.S. Mint spokesman Michael White. A seller had priced a five-coin set at $1,395, $130 above the market value of the silver content, according to the Journal. The 2010 America the Beautiful five-ounce coin went on sale on Dec. 6 and "no orders were processed," White said, the Journal reported.

(Bloomberg) -- Gold demand is "very strong," fueled by jewelry purchases, Asia's economic growth and investors, according to Aram Shishmanian, the chief executive officer of the World Gold Council. The growth in Asia is "absolutely changing" the gold market, Shishmanian said today in an interview on CNBC, citing India and China. Demand also is coming from central banks that are committed to buying in a "very measured way," Shishmanian said. Investors are "driving the price" of gold, he said. The London-based council doesn't see any indications of a slowdown in momentum for the precious metal, which reached a record $1,432.50 a pound today in New York, he said. With the continued sovereign-debt crises and devaluation of the U.S. dollar, investors are looking for a haven, Shishmanian said. The outlook for supply is "really restricted," Shishmanian said. Few mining opportunities are being discovered, and supply is "pretty static," he said. Before today, gold gained 29 percent this year, heading for a 10th straight annual gain.

(Financial Times) -- Commodity prices soared yesterday, with gold reaching a new nominal record high, as investors snapped up hard assets on fears of weakening paper currencies.

This update can be found on the GoldCore blog here.

GOLDCORE LAUNCHES THE GOLDSAVER ACCOUNT

The GoldSaver Account allows anyone to buy and save gold online from just €150 per month.

GoldSaver gold holdings are purchased from the Perth Mint of Western Australia. It is stored in their secure vaults, insured and government guaranteed by the AAA rated Western Australian government. Deposits and gold holdings are also independently verified by our auditor on a monthly basis. Find out more about GoldSaver or sign up here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.