U.S. Economy Ends Third Quarter with a Whimper As Housing Slump Continues

Economics / US Economy Oct 17, 2007 - 02:17 PM GMTBy: Paul_L_Kasriel

The Federal Reserve reported today that industrial production (IP) in September increased by only 0.1% after being flat in August. The 3.9% annualized growth in Q3 IP (versus 3.6% in Q2) was "front-loaded" with the 0.6% month-to-month increase in July. Capacity utilization (CAPU) was unchanged in September from August at 82.1%. In this cycle, the peak CAPU occurred in July and August 2006 at 82.1%.

The Federal Reserve reported today that industrial production (IP) in September increased by only 0.1% after being flat in August. The 3.9% annualized growth in Q3 IP (versus 3.6% in Q2) was "front-loaded" with the 0.6% month-to-month increase in July. Capacity utilization (CAPU) was unchanged in September from August at 82.1%. In this cycle, the peak CAPU occurred in July and August 2006 at 82.1%.

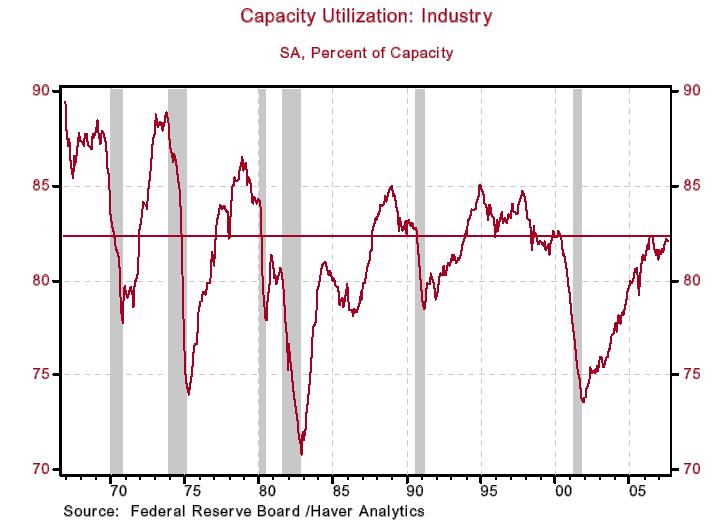

The average CAPU over the 1972 through 2006 period was 81.0%. As Chart 1 shows, the peak CAPU in this cycle was the lowest cyclical peak in the 1967 through 2007 period. There may be other reasons why corporations would want to embark on increased capital spending programs now, but constrained capacity is not one of them.

Chart 1

To rewind the tape to last Friday, consumer retail spending also ended the third quarter with a whimper. Unit motor vehicle sales were down 0.3% in September versus August. Nominal retail sales excluding motor vehicles, gasoline and food, the latter two affected a lot by price changes month-to-month, were up only 0.1% in September versus down 0.2% in August. This "core" concept of retail sales increased at an annual rate of 4.8% in the third quarter largely because of the month-to-month increase of 0.8% in July. So, much like IP growth, third-quarter core retail sales growth was "front-loaded" in July.

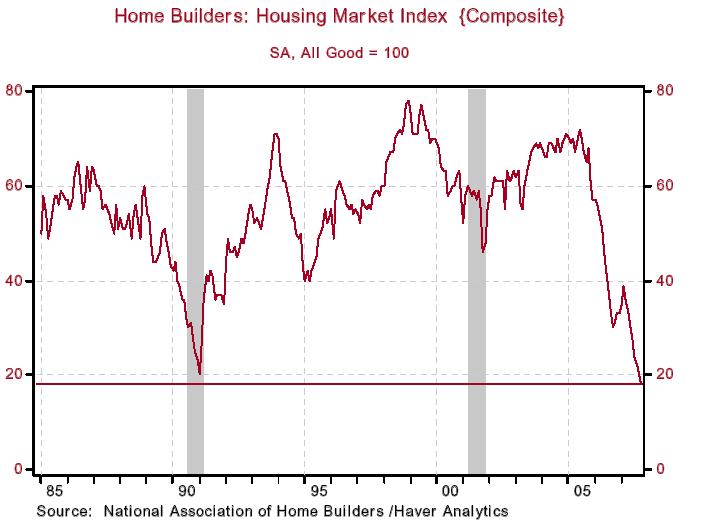

As for housing demand, that just continues to whimper. Today the National Association of Home Builders reported their index of housing demand conditions sank to its lowest level in the history of the series (see Chart 2). The overall index slipped to a reading of 18 in October (probably refers more to conditions in September) from 20 in September. To put an exclamation point on Home Builders report, the CEO of Caterpillar said the current downturn in the housing market was the worst since World War II and was likely to weaken further next year.

Chart 2

Although I still am leaning toward a no-change fed funds rate decision from the FOMC on October 31, the lack of momentum that the economy has going into the fourth quarter, the weak profit growth being reported for the third quarter and the skepticism being shown in the financial markets for the effectiveness of the M-LEC make it a close call.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.