Congress to Follow Fed to and Spend Money to Lift Economic Growth in 2011

Economics / Economic Stimulus Dec 08, 2010 - 06:03 AM GMTBy: Asha_Bangalore

The Fed's $600 billion purchase of Treasury securities, known as QE2, is the Fed's second chance to stimulate economic activity after the $1.725 trillion QE1 package expired in March 2010. Chairman Bernanke presented his case for the second package on "60 minutes" last Sunday. The Fed is focused on meeting its dual mandate of price stability and full-employment, both of which are not within the reach of the mandate at the present time.

The Fed's $600 billion purchase of Treasury securities, known as QE2, is the Fed's second chance to stimulate economic activity after the $1.725 trillion QE1 package expired in March 2010. Chairman Bernanke presented his case for the second package on "60 minutes" last Sunday. The Fed is focused on meeting its dual mandate of price stability and full-employment, both of which are not within the reach of the mandate at the present time.

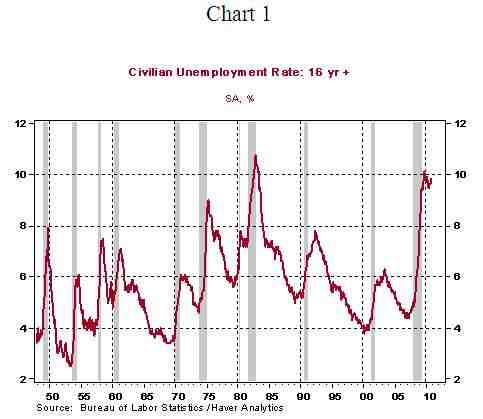

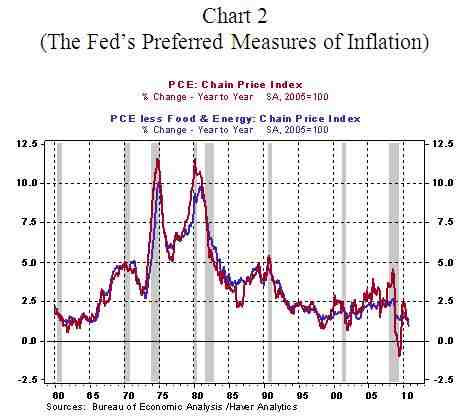

The 9.8% unemployment rate of October 2010 (see Chart 1) remains worrisome and projections of lackluster growth of real GDP in 2011 suggest that the elevated level of the jobless rate is unlikely to drop at a rapid clip in the near term. In addition, inflation measures (see Chart 2) are at levels that are below price stability, with a risk of deflation a legitimate possibility. Chairman Bernanke has also noted monetary policy cannot address all the economic ills at the moment.

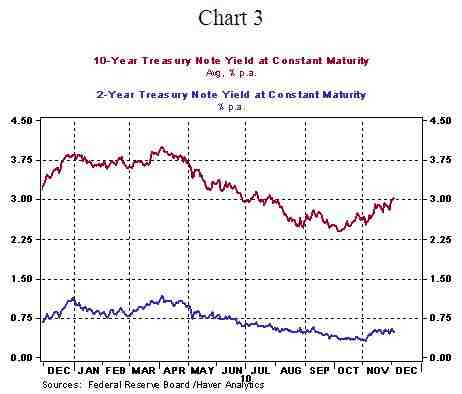

Against this backdrop of challenging economic issues, the new compromise President Obama has announced today should be viewed in the context of positive short-term macroeconomic implications rather than income distribution concerns. The extension of unemployment insurance, preservation of tax cuts for two years, 100% deduction for business investment, the 2.0% payroll tax holiday, and other provisions of the package are aimed at stimulating demand and raising the pace of economic growth in the short-term. The likelihood of securing adequate votes in Congress for these provisions is strong. The bullish implications of the second round of quantitative easing and fiscal policy actions are reflected in the recent upward trend of interest rates. The 10-year Treasury note yield has risen to 3.13% as of this writing from 2.95% on December 6, 2010 and the 2-year Treasury note yield has recorded a 10bps increase to 0.52% in the same period.

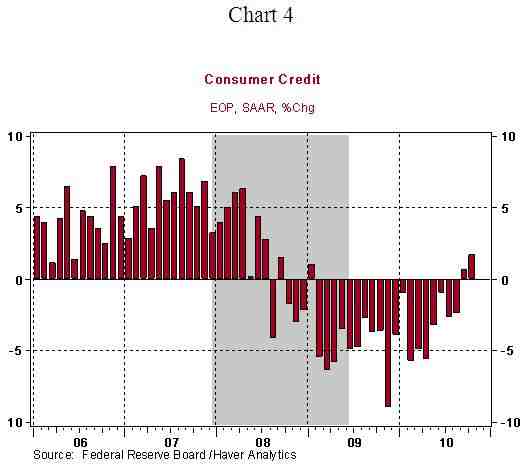

In related news, consumer credit increased at an annual rate of 1.7% in October after a 0.6% increase in the prior month, which marks the second monthly gain after posting consecutive monthly declines each month since February 2009 (see Chart 4). The willingness of consumers to borrow is a bullish signal of improving economic conditions.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.