Bernanke On the U.S. Economy, Fact, Fiction and Finally the Fix

Economics / US Economy Dec 07, 2010 - 03:32 AM GMTBy: D_Sherman_Okst

Fiction: In this 60 Minutes clip Bernanke tells Scott Pelley, “The other concern I should mention is that inflation is very, very low…”

Fiction: In this 60 Minutes clip Bernanke tells Scott Pelley, “The other concern I should mention is that inflation is very, very low…”

Fact: There is massive inflation!

Fiction: ‘Unemployment is 9.8%, if we didn’t take these drastic measures it would be 25% like it was during the Great Depression.’

Fact: Unemployment is, once again at “depressionary” levels - pushing 25%.

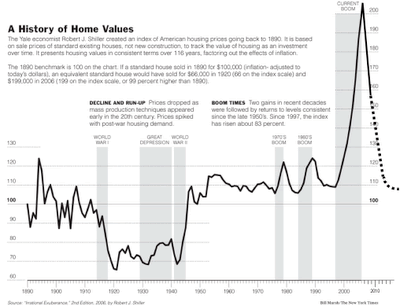

Fiction: In this video Bernanke says about the biggest bubble in the world (the housing bubble) which he never saw and still denies: “I guess I don’t buy your premise it’s a pretty unlikely possibility we’ve never had a decline in house prices on a nationwide basis.”

“…never had a decline in house prices on a nationwide basis.”

Fact: Housing prices have declined on a nationwide basis.

Hearing The Bernanke fiction that he is 100 percent certain he can stop hyperinflation was as reassuring as hearing his continued commitment to continue Quantitative Easing.

I know hyperinflation is ugly. I know stopping this train wreck years ago would have been the correct thing to do. The fact is – we are beyond any fix. Things like cutting government spending will only increase unemployment. We are bankrupt when: What we take in with taxes doesn’t pay the bills. When we borrow and that and the taxes still don’t pay the bills. Now we counterfeit so we don’t default.

Game over!

I know re-valuing the dollar would have been faster and less painful. But the facts are that we have a professor who studied the Great Depression and if he doesn’t know that housing prices declined, or that there is massive inflation now, or that unemployment is at “depressionary” levels - then we have to realize that correcting what he messed up isn’t going to happen.

The guy is either working for an elite few – or, more likely – he’s an economic imbecile.

Whatever the case is – I’m happy. The only way the economy is going to get fixed is if consumers (who make up 67% of GDP) consume. Right now consumers are either maxed out, working part time hours in their full time positions, or they are unemployed. Consumers have shed 600 billion in debt, 20 billion was of that was willingly. On a governmental level: Our debt – on and off balance sheet will choke the life out of any prosperity.

The clock MUST be reset. That is the ONLY fix.

The Bernanke just pulled the reset lever.

Gold and silver are still affordable. If you missed my read “Nobel Award in Darwin Economics” this chart should explain a lot.

If you think there will be deflation I’d encourage you to look at money as seashells and look at The Bernanke as the gold miners on pages 96 & 97 of “Mean Markets and Lizard Brains” book. Basically it explains that the habitants of the highlands of Papa New Guinea used seashells as a currency. Gold miners from Australia wanted to hire them to mine gold, the highlanders didn’t want paper money - they wanted shells. Plane loads of shells were flown in. Supply increased, their purchasing power crumbled, they experienced hyperinflation.

Our dollar will be re-valued vis-à-vis unstoppable hyperinflation. Old debt will be washed away. Consumers will once again be able to consume.

In Summary: My faith in the 5Gs: (G*(religious edit)d, Gold, Guns, Grub & The Government Will Continue to Screw It Up) remains strong.

By D. Sherman Okst

http://UnveilingTheEconomy.blogspot.com/

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2010 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.