Gold and Silver Ready to Break out on Chinese Demand, Korean Tension and Currency Risk

Commodities / Gold and Silver 2010 Dec 03, 2010 - 06:34 AM GMTBy: GoldCore

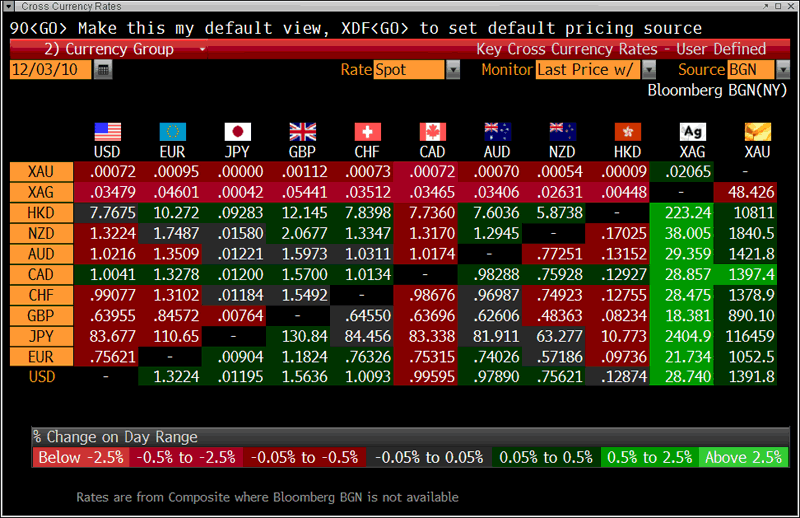

Gold is higher in all currencies again this morning (see Cross Currency Table below) and is heading for a second weekly gain in dollars (and other major currencies), as China's imports surged, geopolitical risk in the Korean peninsula remains elevated and uncertainty about the euro, currencies and paper assets in general is leading to continued safe haven demand.

Gold is higher in all currencies again this morning (see Cross Currency Table below) and is heading for a second weekly gain in dollars (and other major currencies), as China's imports surged, geopolitical risk in the Korean peninsula remains elevated and uncertainty about the euro, currencies and paper assets in general is leading to continued safe haven demand.

Gold is currently trading at $1,390.30/oz, €1,054.78/oz and £890.30/oz.

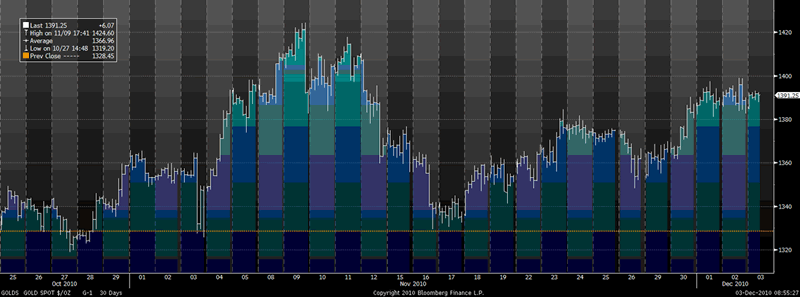

Gold in USD - 30 Day (Tick)

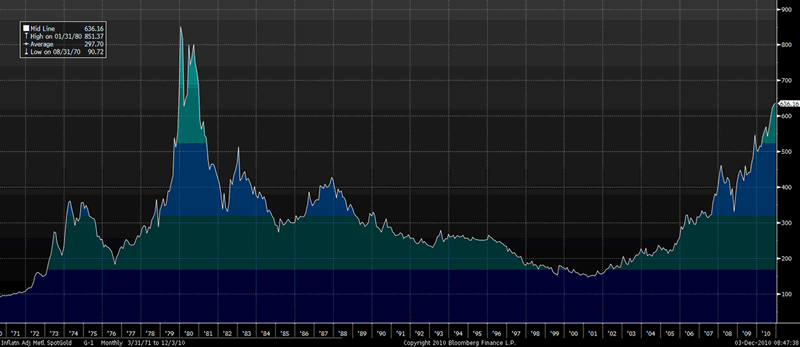

Gold has consolidated at these levels and there appears to be strong support at $1,320/oz. Resistance is at $1,400/oz and the nominal high of $1,424.60/oz. It is important to remember that gold remains more than 30% below its inflation adjusted high of $2,300/oz (US CPI) in 1980. (see Gold Inflation Adjusted Index below)

While equity and bond markets reacted positively to the ECB decision to intervene in bond markets, the concern is as ever that this is yet another short term panacea that will simply delay the day of reckoning. Asian indices were mixed as are European stock markets this morning. It is hard to see how the present global financial crisis can be resolved without massive debt restructuring, write offs and debt forgiveness. The alternative is competitive currency devaluations and debasement which will likely lead to stagflation and a remote but increasing chance of some form of hyperinflation.

Cross Currency Table

The level of ignorance regarding the fundamentals driving the gold market remains very high. So called experts continue to say that gold and silver are risky, overvalued and or a bubble based on selective information and assumptions. This is despite gold remaining well below the inflation adjusted high of 1980 and silver at under $30/oz remaining some 33% below its nominal price high of $50/oz 30 years ago.

The future price movement of all asset classes is unknowable - especially in the short term. Given the level of financial, economic and political uncertainty seen today, this is particularly the case. Therefore, real diversification and ownership of a range of quality assets through safe counter parties remains the only way to protect, preserve and grow wealth.

Gold Inflation Adjusted Index - 40 Year (Monthly)

The 'Bloomberg Composite Gold Inflation Adjusted Spot Price' is derived from the monthly U.S. Urban consumers price index.

SILVER

Silver is nearly 1% higher in dollar terms this morning and has risen in all major currencies (see Cross Currency Table). Most analysts have been wrong on silver in recent years and many remain bearish despite the very strong fundamentals.

Silver is currently trading $28.76/oz, €21.69/oz and £18.37/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,718.00/oz, palladium at $762.00/oz and rhodium at $2,200/oz.

NEWS

(Bloomberg) -- Eleven of 16 traders, investors and analysts surveyed by Bloomberg (including GoldCore), or 69 percent, said the metal will rise next week as concern about Europe's debt crisis and military tensions in the Korean peninsula boost demand for a protection of wealth.

(Bloomberg) -- Silver prices may peak near $35 an ounce next year and average close to $30 on strong investment demand and continuing growth in industrial consumption, Philip Klapwijk, chairman of GFMS Ltd., a London-based research company, said today in Shanghai. "Looking at next year, I think it's safe to say that the economic and financial factors will continue to provide significant support for global investment in silver," Klapwijk said.

(Bloomberg) -- Imports of gold by India, the world's biggest buyer, likely totaled about 20 metric tons to 25 tons in November, Prithviraj Kothari, president of the Bombay Bullion Association, said by telephone, citing provisional data. Purchases a year earlier were 30.7 tons, according to association figures. Imports fell in November after purchases in October almost doubled to 70 tons, Kothari said. October imports last year were 36.2 tons, according to the group.

(Bloomberg) -- Palladium for immediate delivery extended gains in London, rising as much as 4.6 percent to $767.92 an ounce by 4:20 p.m. local time. The metal climbed to the highest price since April 2001.

(Bloomberg) -- China should encourge investment in gold by the government and the private sector, Zhang Bingnan, vice chairman at the China Gold Association, said today in Shanghai. Interest could be increased through development of gold market trading and investing in the fabricating and mining sectors, Zhang said.

(Bloomberg) -- China should consider adding to its gold reserves as a long-term strategy to pave the way for the yuan's internationalization, central bank adviser Xia Bin wrote in the China Business News today. The country must revise its foreign-reserves management principle, Xia wrote. China is the world’s largest producer and second-biggest user of gold and has a world-record $2.65 trillion in foreign-exchange reserves.

(Vancouver Sun) -- The American Eagle Silver Bullion coinage program has already posted another record year, with over 32 million of the U.S. Mint's 1-ounce coins sold through today. Sales thus far in 2010 have surpassed last year’s record of 28 million coins sold. Should the current pace continue, sales will surpass 35 million coins by year’s end.

Silver coin minting globally is projected to rise a robust 23 percent this year, to an all-time record, according to data released last week by GFMS Ltd., the precious metals consultancy, at the Silver Institute's Annual Silver Industry Dinner in New York City.

Leading national mints are reporting exceptional growth this year. The Royal Canadian Mint has reported an increase of 50 percent in silver Maple Leaf bullion coin sales over 2009 figures. Similar strong growth is expected for the Australian Perth Mint’s silver Kookaburra bullion coin, and the silver Philharmonic bullion coin issued by the Austrian Mint.

U.S. Mint sales of American Eagle Silver Bullion coins have increased by 223% over the past five years.

Silver bullion coins provide investors with a convenient and affordable way to add physical silver to their investment portfolios. "While primarily purchased by investors, we expect to see continued growth in silver Eagle sales through the end of the year, especially with the holiday season approaching," stated Michael DiRienzo, Executive Director of the Silver Institute. "A leading silver bullion dealer has repeated to us that they have seen a nearly 40% increase in silver bullion demand this year for products ranging from 1-ounce coins to 100-ounce bars," DiRienzo added.

(Financial Times) - - Gold imports into China have soared this year, turning the country, already the largest bullion miner, into a major overseas buyer for the first time in recent memory.

The surge, which comes as Chinese investors look for insurance against rising inflation and currency appreciation, puts Beijing on track to overtake India as the world's largest consumer of gold and a significant force in global gold prices. "Investment is really driving demand for gold," said Cai Minggang, at the Beijing Precious Metals Exchange. "People don’t have any better investment options. Look at the stock market, or the property market - you could make huge losses there."

Beijing has encouraged retail consumption, with an announcement in August of measures to promote and regulate the local gold market, including expanding the number of banks allowed to import bullion. Shen Xiangrong, chairman of the Shanghai Gold Exchange, who disclosed the import numbers, said uncertainties about the Chinese and global economies, and inflationary expectations, had "made gold, as a hedging tool, very popular".

The rise in Chinese demand could further inflate gold prices. Bullion hit a nominal all-time high of $1,424.10 a troy ounce last month. But adjusted for inflation, prices are far from the 1980 peak of $2,300. "The trend is undeniable - gold demand in China is rising rapidly," said Walter de Wet, of Standard Bank in London. China surpassed South Africa three years ago as the world's largest producer.

The surge in gold imports to China bodes well for some of the world’s biggest hedge fund managers, including David Einhorn of Greenlight Capital and John Paulson of Paulson & Co, who have invested heavily in bullion, and top miners Barrick Gold of Canada, US-based Newmont Mining and AngloGold Ashanti of South Africa. The market upswing has prompted an increase in gold scams in Hong Kong, according to industry executives. The counterfeits have shocked the Chinese' territory's gold community not because of the amounts involved - between 200 and 2,000 ounces - but because of their sophistication.

In one case, executives discovered a coating advertised as pure gold that masked a complex alloy which included rare metals such as osmium, iridium, ruthenium and rhodium. Chinese total gold demand rose last year to nearly 450 tonnes, up from about 200 tonnes a decade ago, according to the World Gold Council, the lobby group of the mining industry. Analysts anticipate a further leap this year, putting the country whiting striking distance of India's total gold demand of 612 tonnes in 200.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.