China's Gold Imports Soar by Massive 500% on Investment Demand

Commodities / Gold and Silver 2010 Dec 02, 2010 - 06:45 AM GMTBy: GoldCore

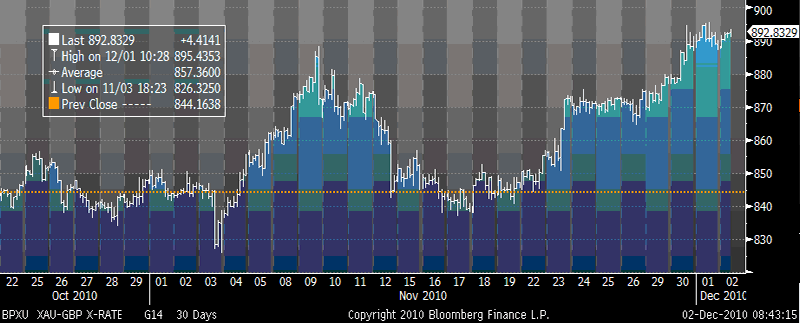

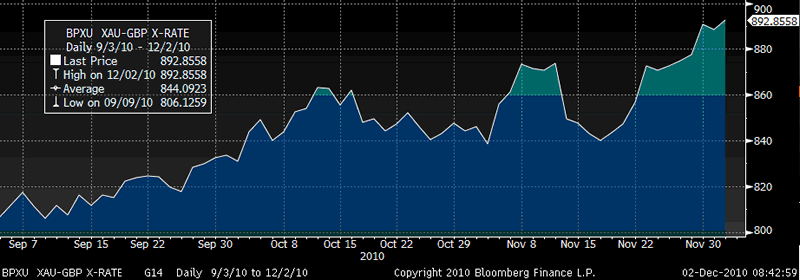

Gold and silver are higher again today in all currencies after eking out marginal gains yesterday, when gold rose to new record nominal highs in euros and in British pounds at £895.44/oz. The weakness of sterling against gold shows that the euro and the dollar are not the only currencies about which investors are concerned. Gold at $1,391/oz remains some 2% below its record nominal high seen on the 9th of November ($1,421/oz London PM Fix) and after the recent period of consolidation looks set to challenge this level again.

Gold and silver are higher again today in all currencies after eking out marginal gains yesterday, when gold rose to new record nominal highs in euros and in British pounds at £895.44/oz. The weakness of sterling against gold shows that the euro and the dollar are not the only currencies about which investors are concerned. Gold at $1,391/oz remains some 2% below its record nominal high seen on the 9th of November ($1,421/oz London PM Fix) and after the recent period of consolidation looks set to challenge this level again.

Gold is currently trading at $1,390.30/oz, €1,054.78/oz and £890.30/oz.

Gold in GBP – 30 Day (Tick)

The optimism seen in markets yesterday will be tested today if the hoped quantitative easing from the ECB does not materialise. Should it materialise, it will likely be another short term panacea which will buoy markets but create a real risk of an inflationary spiral and possibly stagflation in the eurozone. Further printing of money to buy government bonds is the debasement of currency and obviously bullish for gold. Goldman Sachs has forecast gold to rise to $1,690/oz in the next 12 months and $1,750/oz in 2012 (see News below).

Gold in GBP – 90 Day (Daily)

China's growing importance to the precious metal markets was underlined by the news that Chinese imports have surged by more than 500% due to increased investment demand. Incredibly, China's gold imports were five times higher in the first ten months than in the whole of last year. Imports hit 209 tonnes compared to 45 tonnes for all of 2009, according to the Shanghai Gold Exchange. Trading volume of gold on the exchange in the first 10 months rose 43 percent from a year earlier to 5,014.5 tonnes.

Chinese buyers are concerned about inflation and the depreciation of the fiat yuan/renminbi and looking to gold as a store of value. Chinese people do not have trust in paper currencies due to their experiences with authoritarian government and hyperinflation.

Most of the 1.3 billion people in China only began to acquire and own gold in 2003 as gold ownership was banned from 1945 to 2003. The gold market was liberalised in 2003 and their demand is increasing from a near zero base. This means that the increase in demand is very sustainable and will likely continue. Concerns of an overheating economy, inflation and a housing bubble will lead to further Chinese diversification into gold.

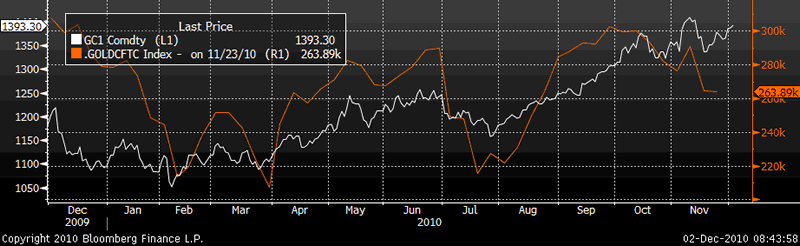

Gold in USD and COT Open Interest

Open interest levels as seen in the COT report (see chart above) show that open interest at 264,000 is well below the 300,000 levels seen at the start of October.

SILVER

Chinese demand for 'poor man's gold' silver is surging. 18,900 tonnes of silver went through the Shanghai Gold Exchange in November, higher than the total trading volume of 16,400 tonnes in 2009.

Silver is currently trading $28.51/oz, €21.63/oz and £18.26/oz.

The Shanghai Gold Exchange may trade 70,000 metric tons of silver this year, Shen Xiangrong, chairman of the bourse said today. The exchange traded 39,777 tons of silver in the January to October period, an increase of 290 percent from the same time last year, he said. The exchange traded 5,014.5 tons of gold in the first months, up 43 percent, he said.

PLATINUM GROUP METALS

Platinum is currently trading at $1,701.50/oz, palladium at $742.00/oz and rhodium at $2,200/oz.

NEWS

(Bloomberg) -- Turkish people keep about 5,000 tons of gold jewelry 'hoarded under pillows', Dunya reported, citing Osman Sarac, head of the Istanbul Gold Exchange. The amount is increasing as Turks see the metal as a savings tool because of rising global gold prices, he said, according to the newspaper. Trade volume on the Istanbul Gold Exchange is expected to rise to 150 tons in 2011 from 120 tons this year, he said.

(Bloomberg) -- Russia's ten-month gold output declined 1.6 percent to 168.4 metric tons from a year earlier, the country's Gold Producers' Union said in an e-mailed statement today.

(FT) - - Hong Kong goldsmiths have been sold hundreds of ounces of fake gold jewellery this year in one of the most sophisticated scams to hit the Chinese territory's gold market in decades.The counterfeits have shocked Hong Kong's gold community not because of the amount involved, but because of their sophistication. "It’s a very good fake," said Haywood Cheung, president of the Chinese Gold & Silver Exchange Society, Hong Kong's century-old gold exchange, highlighting how criminals are developing new techniques to commit an age-old fraud.

Mr Cheung said he was aware of at least 200 ounces - worth $280,000 - of the fake gold that had been discovered by jewellers and pawn shops. But he estimated that ten times that amount might have infiltrated the retail market. In comparison, the large gold bars held by central banks weigh 400 ounces and are worth nearly $560,000 each. In one case, executives discovered a pure gold coating that masked a complex alloy with similar properties to gold. The fake gold included a significant amount of bullion - about 51 per cent of the total - alloyed with seven other metals: osmium, iridium, ruthenium, copper, nickel, iron, and rhodium. The complex nature of the fakes suggest they were produced by a metalsmith with sophisticated equipment and extensive knowledge of metallurgical engineering. Even Luk Fook Group, one of Hong Kong's biggest jewellers, was tricked into buying $11,500 worth of fake gold this summer before putting its stores on alert. "This was the biggest hit ever," said Paul Law, executive director of the firm. In the past, counterfeit gold in Hong Kong and the rest of Asia was either rough and easy to detect, even to the naked eye, or involved gold-plated tungsten, a metal with a similar density to gold, but which traders and jewellers can easily identify.

The complexity of the latest batch of fake gold would have reduced the profitability of the scam, since it used a significant amount of bullion, and because iridium and osmium are expensive. In most cases, the fakes passed basic scrutiny, only to be revealed later by more sophisticated tests involving high temperatures and chemicals. Industry executives stressed that the scam targeted the street-level sale of scrap gold to jewellers. Mr Cheung said none of the fake gold had infiltrated the much more bigger market for gold bars, which as is protected by more rigorous controls.Industry executives say the scam - while not massive and hitting only the retail sector - uncloaks the increasingly elaborate gold swindles perpetrated by criminals in Asia as bullion prices soar to record highs of $1,400 a troy ounce.

(Bloomberg) -- China's gold imports jumped almost fivefold in the first 10 months from the entire amount shipped in last year as concern about rising inflation increased its appeal as a store of value, said the Shanghai Gold Exchange. Imports have gained to 209 metric tons compared with 45 tons for all of 2009, Shen Xiangrong, chairman of the bourse, told a conference in Shanghai today. The country is the world's largest producer and second-biggest user. Bullion soared 27 percent this year and is set for a 10th annual gain as the dollar dropped and investors sought a store of value on concern that the trillions of dollars governments are pumping into the global economy may debase the value of currencies.

China has pledged to use price controls and may raise interest rates a second time this year to slow inflation that rose in October to the highest level since 2008. "People there need to buy gold to hedge against inflation as the country's tightening monetary policy drives investors from stocks and properties to gold," said Hiroyuki Kikukawa, general manager of research at IDO Securities Co. in Tokyo. China's demand will continue to grow, making the country one of the top importers together with India, he said. Gold demand in China gained in the first half as government measures to cool the property market and falling equities spurred investment, the Shanghai Gold Exchange said July 7. About 70 percent to 80 percent the imports in the first 10 months were made into mini-gold bars, which Chinese investors like to hold, Shen said.

Inflation Expectations

China's consumer prices jumped 4.4 percent in October, the fastest pace in two years, and above the government's full-year target of 3 percent. China's central bank raised interest rates in October for the first time since 2007 and ordered banks on Nov. 10 and Nov. 19 to hold more money in reserve. "The expectation for higher inflation has fueled great interest among investors to hold physical gold, which led to higher imports," Shen said. Bullion for immediate delivery rose 0.4 percent to $1,393.40 an ounce at 3:10 p.m. in Shanghai after yesterday touching $1,397.50, the highest price since Nov. 12. The metal reached a record $1,424.60 an ounce on Nov. 9. China's investment gold demand may reach 150 tons this year, up from 105 tons last year, Albert Cheng, managing director of the World Gold Council's Far East department, told the conference in Shanghai. That compares with 3-4 tons 10 years ago, Cheng said.

Investment Demand

"The investment demand we estimate already reached 120 tons in the first three quarters, and it usually spikes in the fourth quarter," Cheng said. Global investment demand for gold of 1,901 tons last year exceeded jewelry consumption of 1,759 tons for the first time in three decades, according to London- based researcher GFMS Ltd. Sales of gold products such as bars by China National Gold Group Corp., owner of the country's largest deposit of the metal, jumped as much as 40 percent in the first half, Song Quanli, deputy party secretary at the company, said July 7. China's central bank in August said that it would let more banks import and export gold and allow overseas companies more access to trading. Gold demand growth in China will likely be supported by rising disposable income levels and the country could surpass India as the world's biggest bullion consumer, Deutsche Bank AG said Aug. 6. "A possible interest rate hike in China won't damp Chinese investor interest in gold," the Shanghai exchange's Shen said. "Even if China adds 50 basis points, it would still be a negative interest rate environment given inflation is running at more than 4 percent."

(Bloomberg) -- China's investment gold demand may reach 150 metric tons this year, up from 105 tons last year, Albert Cheng, managing director of the World Gold Council's Far East department, told a conference in Shanghai today. That's an even larger increase when compared with the 3-4 tons 10 years ago, Cheng said.

(Bloomberg) -- Gold may climb to $1,690 an ounce in the next 12 months as government asset purchases keep U.S. real interest rates low, Goldman Sachs Group Inc. said today in an e-mailed report. As interest rates begin to rise in 2011 and the U.S. economy grows, the metal may peak near $1,750 in 2012, Goldman said.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.