U.S. Dollar USD Index Deja-Vu from 52 Weeks Ago?

Currencies / US Dollar Dec 01, 2010 - 08:30 AM GMTBy: Ashraf_Laidi

US dollar stabilizes up as US bond yields push higher following the 93K increase in Nov ADP (highest since Nov 2007) and the October revision to +82K from +43K. US 10 year yields jump to 2.91% from 2.79% earlier, further boosting the "good-data-is positive-for-USD" reaction, which was not always apparent. Although the euro is holding firm, general FX dynamics are increasingly similar to exactly a year ago when USD strengthened in early December 2009 on a combination of strong US Nov jobs report (released on December 4, 2009 at -11k vs expectations of -130K) and the triple downgrades of Greece later in the month (Fitch, S&P and Moodys). Are we witnessing a Déjà vu from exactly 52 weeks ago? Such would be the case in the event of double positive surprise (strong NFP, falling unemployment rate) and possibly upside revisions.

US dollar stabilizes up as US bond yields push higher following the 93K increase in Nov ADP (highest since Nov 2007) and the October revision to +82K from +43K. US 10 year yields jump to 2.91% from 2.79% earlier, further boosting the "good-data-is positive-for-USD" reaction, which was not always apparent. Although the euro is holding firm, general FX dynamics are increasingly similar to exactly a year ago when USD strengthened in early December 2009 on a combination of strong US Nov jobs report (released on December 4, 2009 at -11k vs expectations of -130K) and the triple downgrades of Greece later in the month (Fitch, S&P and Moodys). Are we witnessing a Déjà vu from exactly 52 weeks ago? Such would be the case in the event of double positive surprise (strong NFP, falling unemployment rate) and possibly upside revisions.

Nov manuf ISM is expected at 56.5 from October's 5-month high of 56.9. The report requires an upside surprise (above 59) in order to extend bond yields above their 2.96% barrier reached on Nov 15, which was the highest in 3-months. The key resistance remains at 3.1%, coinciding with the 200-day MA, last broken since in May 13.

Gold hits new highs against EUR €1,070/oz), GBP (£894/oz) and even JPY (117, 015/oz) but has yet to regain its record against USD, AUD and CHF. Gold/EUR was the first to regain the highs amid surging Eurozone bond spreads and Tuesday's broad selloff in the single currency. This is a repeat of the Feb-June period when the gold broke to new highs due to uncertainty with Greece and Spain. The rally in Gold/EUR reflects European investors' refuge towards the safety of the yellow metal, which consequently leads its to rally against all other currencies, albeit at different degrees. The European worries of Ireland, Portugal and Spain are prompting a classic refuge to safety, whereby both gold and the Swiss franc are outperforming the majority of currencies.

Risk appetite improves as China's manuf PMI hits 8-month highs and UK's manuf PMI surges to 16-year highs. EURUSD eyes 1.3120 short term trend line resistance. $1.3180 stands as the next barrier. Gold breaks above the $1387 resistance in overnight Asia and could well extend towards $1400 in the event that it closes the Wednesday session above $1387. Markets await US figures on Nov ADP (exp +69K from +43K) and Nov ISM (exp +56.5 from 56.9). The shooting star on the monthly S&P500 suggests a possible decline towards 1130s but a daily close below 1170 is required first.

All eyes will be on Thursday's ECB meeting and the fate of the bond purchasing program. JC Trichet referred to bond purchases as "ongoing", which raises questions over whether the ECB will unleash its own version of quantitative easing. The €67 bln in purchased Ezone bonds has been dwarfed by the asset purchases of the Fed and the BoE. Recall the euro's initial positive reaction to the May announcement of bond purchases on relief about alleviating liquidity. But the subsequent reaction turned EUR-negative as purchases are a form of further easing, which is always negative for currencies--especially in the case of an about-turn by the ECB on the subject.

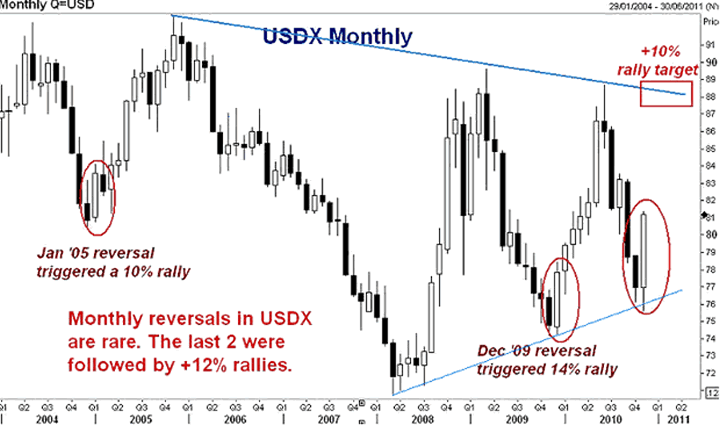

The significance of the monthly reversals in EUR (downward) and USDX (upward) bears historical proportions. The last time the USDX (see chart below) has shown a similar monthly rebound (+4% at the end of a multi-month decline) was in December 2009 (part of a +20% rally in USD) and January 2005 (part of a 14% rally in USD). EURUSD is seen remaining capped at $1.3180 before retreating gradually towards $1.2920 and $1.2770. GBPUSD faces $1.5640s as the intermediate resistance, a break of which could retest $1.5760. USDJPY regains 84 mainly on broadening JPY weakness as risk appetite improves across the board. Medium term outlook remains in favour of prolonged gains towards 87.20.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.