U.S. Household Debt Deleveraging - Largest Decline on Record

Economics / US Economy Nov 30, 2010 - 03:57 AM GMTBy: Asha_Bangalore

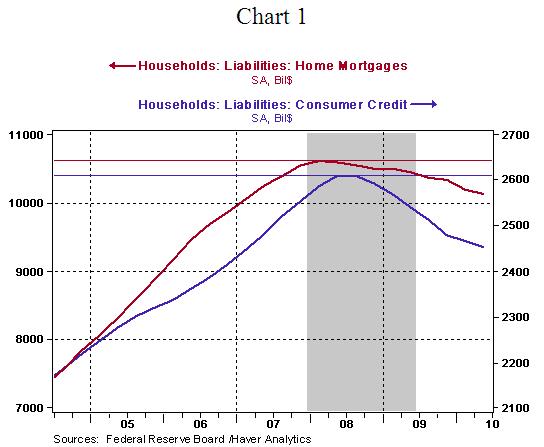

The soft trajectory of consumer spending and continued reduction in residential investment expenditures reflects the sharp reduction in household debt. Outstanding home mortgages have dropped from $10.606 trillion in the first quarter of 2008 to $10.126 trillion in the second quarter of 2010 (see Chart 1). Household credit card debt has fallen roughly $157 billion from the peak in the third quarter of 2008 to $2.41 trillion (see Chart 1).

The soft trajectory of consumer spending and continued reduction in residential investment expenditures reflects the sharp reduction in household debt. Outstanding home mortgages have dropped from $10.606 trillion in the first quarter of 2008 to $10.126 trillion in the second quarter of 2010 (see Chart 1). Household credit card debt has fallen roughly $157 billion from the peak in the third quarter of 2008 to $2.41 trillion (see Chart 1).

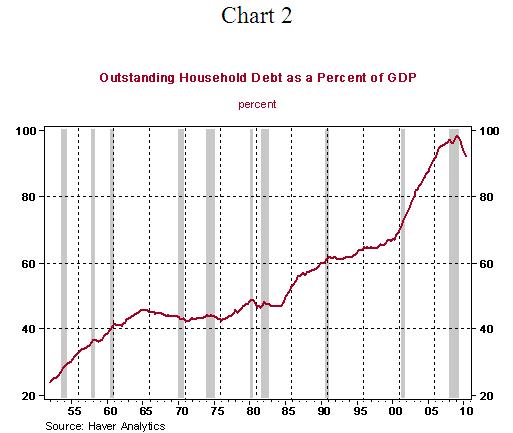

Total outstanding household debt as a percentage of GDP has fallen roughly six percentage points between 2009:Q1 and 2010:Q2 (see Chart 2). This decline is the largest on record in the post-war period. The drop of household debt as a percent of GDP in the early 1980s (48.95% in 1980:Q2 vs. 46.65% in 1981:Q3) was significant but smaller than the current occurrence and it was the result of credit controls imposed in the inflation battle of that period. The lifting of credit controls led to a sharp reversal in the mid 1980s (see Chart 2). The root cause of the current deleveraging is an entirely different story where severely indebted households are cutting back on borrowing to finance expenditures.

The reduction in total private sector debt (businesses and households) is also significant and compares closely with the situation after the 1990-91 recession (see Chart 3). Private sector debt as a percent of GDP peaked in the first quarter of 2009 (177.8%), with the second quarter reading at 167.9%. A similar reduction in the 1990s was spread over nearly four years. This sharp decline in consumer and business sector spending has resulted in the elevated jobless rate. These numbers are being tracked closely for an early confirmation of improving conditions. It is not a mere coincidence that economic growth gathered steam only after private sector credit growth was visible following the 1990-91 recession.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.