11 Statistics Show Just How Far the Economy Has Deteriorated

Economics / Great Depression II Nov 27, 2010 - 06:13 AM GMTBy: LewRockwell

Economic Collapse writes: Are you better off today than you were four years ago? Unfortunately, most Americans are not. Both political parties have controlled the White House during the last four years – Barack Obama has been in office for nearly two years and before him it was George W. Bush – and yet no matter what politicians we send to Washington D.C. things just seem to keep getting worse. We buy more than we produce, we spend more than we bring in, we have 18 times as many "problem banks" as we did 4 years ago, the number of Americans on food stamps continues to set a new all-time record every month and we are living in the greatest debt bubble in the history of the world. But at least the majority of Americans are still prosperous enough to enjoy a happy Thanksgiving inside a warm, comfortable home. Unfortunately, if things keep going the way they are going, we are going to experience a national economic nightmare that nobody will be thankful for.

Economic Collapse writes: Are you better off today than you were four years ago? Unfortunately, most Americans are not. Both political parties have controlled the White House during the last four years – Barack Obama has been in office for nearly two years and before him it was George W. Bush – and yet no matter what politicians we send to Washington D.C. things just seem to keep getting worse. We buy more than we produce, we spend more than we bring in, we have 18 times as many "problem banks" as we did 4 years ago, the number of Americans on food stamps continues to set a new all-time record every month and we are living in the greatest debt bubble in the history of the world. But at least the majority of Americans are still prosperous enough to enjoy a happy Thanksgiving inside a warm, comfortable home. Unfortunately, if things keep going the way they are going, we are going to experience a national economic nightmare that nobody will be thankful for.

If you watch the economic statistics from week to week and month to month, it will seem like sometimes they are getting worse and sometimes they are getting better. However, once you take a longer-term view of things, exactly what is happening to us starts to come clearly into focus. The truth is that the United States is in the midst of a long-term economic collapse, and many economic statistics just keep getting worse every single year.

The following are 11 statistics that reveal just how far the U.S. economy has fallen over the past four years....

#1 In November 2006, the "official" U.S. unemployment rate was 4.5 percent. Today, the "official" U.S. unemployment rate has been at 9.5 percent or greater for more than a year.

#2 At Thanksgiving back in 2006, 26 million Americans were on food stamps. Today, there are over 42 million Americans on food stamps and that number is climbing rapidly.

#3 According to the U.S. Census Bureau, median household income in the United States fell from $51,726 in 2008 to $50,221 in 2009. Median household income declined the year before that too. Meanwhile, prices have continued to rise throughout that period.

#4 At the end of the third quarter in 2006, 47 banks were on the FDIC "problem list". At the end of the third quarter in 2010, 860 banks were on the FDIC "problem list".

#5 California home builders began construction on 1,811 homes during the month of August, which was down 77% from August 2006.

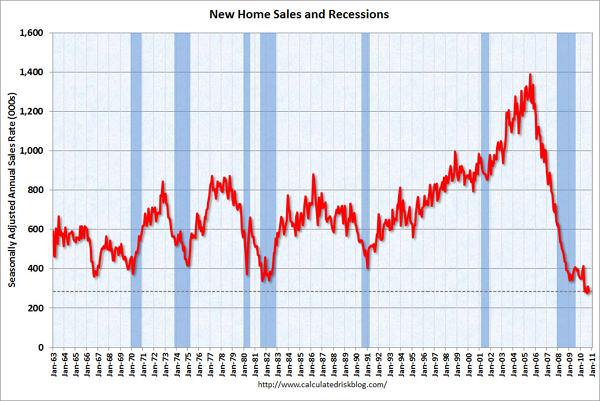

#6 In 2006, new home sales in the United States were near record highs. In 2010, new home sales in the United States are at record lows as the following graph from Calculated Risk demonstrates....

#7 A recent survey of last year's college graduates found that 80 percent moved right back home with their parents after graduation. That was up substantially from 63 percent in 2006.

#8 According to one analysis, the United States has lost a total of 10.5 million jobs since 2007.

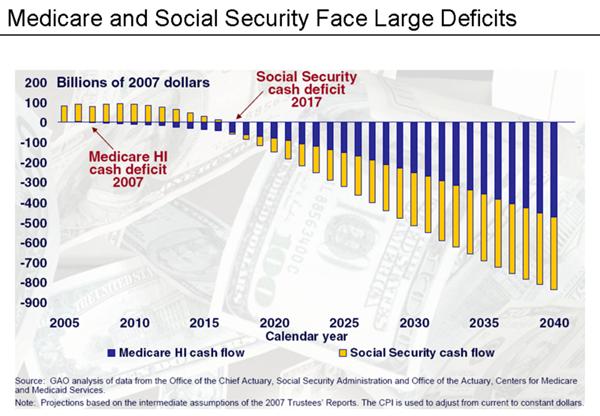

#9 In 2006, the Social Security program took in somewhere in the neighborhood of 100 billion more dollars than it paid out. Of course the U.S. government spent all that money instead of setting it aside. So now more U.S. retirees than ever are ready to start drawing on Social Security and a "tipping point" is rapidly coming. Social Security will pay out more in benefits in 2010 than it receives in payroll taxes. This was not supposed to happen until at least 2015, and the years ahead look very, very grim....

#10 The U.S. government's debt ceiling has been raised six times since the beginning of 2006.

#11 In 2006, the U.S. national debt was getting close to 9 trillion dollars. Today, the U.S. national debt is well past 13 trillion dollars and is rapidly closing in on 14 trillion dollars.

So is there much hope for an economic turnaround any time soon?

No, not really.

Even the Federal Reserve, usually one of the biggest cheerleaders for the U.S. economy, is not very optimistic right now. In fact, the Fed has just announced that they are projecting that unemployment will still be at about 8 percent when the next presidential election arrives in 2012.

Actually, if the official unemployment rate was to get that low by then that would really be something to celebrate. Many economists fear that unemployment will be even higher than it is now by then.

Several years ago, a very foolish politician (Dick Cheney) famously said that "deficits don't matter". That is kind of like saying that credit card balances don't matter. For decades, politicians from both political parties have been running up staggering amounts of government debt as if it would never catch up with us. For decades, Americans have been addicted to debt and have been buying more than they produce. We have enjoyed living beyond our means for so long that most of us simply have no idea that there are any consequences for doing so.

Living on debt is fun on the way up, but on the way down the pain can be excruciating. We are about to experience that on a national level, and it is going to be an absolute nightmare.

Did any of you actually believe that we were just going to go on living way, way, way beyond our means indefinitely?

America has piled up the biggest mountain of debt in the history of the world, and unfortunately we are all going to pay the price for that.

So enjoy your turkey while you can. In future years we may have a lot less to be thankful for.

© 2010 Copyright Economic Collapse Blog/ LewRockwell.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.