Benjamin Graham’s Investing Wisdom and Stock Market Cycle Formula Timing Plans

Stock-Markets / Stock Markets 2010 Nov 27, 2010 - 05:57 AM GMT

Most investors are aware that Benjamin Graham, author of The Intelligent Investor, the acclaimed investment book first published in 1949, is the father of value investing. The basics of value investing are that when you buy a financial asset like a stock or bond, the reason to buy is for the future cash flow that the underlying business is going to generate, and from which you will be compensated in dividends, interest or price appreciation.

Most investors are aware that Benjamin Graham, author of The Intelligent Investor, the acclaimed investment book first published in 1949, is the father of value investing. The basics of value investing are that when you buy a financial asset like a stock or bond, the reason to buy is for the future cash flow that the underlying business is going to generate, and from which you will be compensated in dividends, interest or price appreciation.

Graham’s work on value investing is of interest for a number of reasons. First, it has proven arguably to be the most successful method of investing over time since its publication. The most successful investors have been value investors, Peter Lynch, Sir John Templeton, John C. Bogle, and of course Warren Buffett, who is Graham’s most famous student.

The goal of the value investor is to purchase future cash flows at a discount in the present. What Graham recognized is that Mr. Market occasionally offers investors great companies and their future cash flows at a bargain. What is less appreciated is that Graham recognized that for additional safety and maximized returns, identifying the right overall market time for buying such value and in turn for selling should be an objective. In order to identify the right time to buy value, Graham suggested what he called formula timing plans. A worthwhile formula timing plan should identify when you ought to be a buyer and subsequently a seller.

What is also of particular interest to a student of global financial markets and investing is that the first edition of Graham’s book was published in 1949. Why is this important? The year 1949 was the inflation-adjusted nadir of the last global Kondratieff long wave cycle of boom and bust. Although Graham did not fully recognize the long wave forces at work, he is one of the greatest financial and investment minds of the last century. His book was in large part a product of his experiences of surviving as an investor on the front lines of Wall Street during the volatile financial markets of the great depression. The 1949 edition captured Graham’s remarkable investment insights from his experiences as the world was turning from a long wave bust to a long wave boom.

The global economy and financial markets are once again approaching the nadir of the global long wave cycle, making the perspective of Graham’s original work particularly interesting. The cover of the 1949 edition featuring a foreword by John C. Bogle is shown above on the right. Graham adjusted some of his views in the decades that followed, but his first edition uniquely captured his remarkably salient insights into global financial markets for investors caught between two great epochs in global financial history.

Graham’s notion of using a formula timing plan to identify when to buy and sell value was lost over the ensuing decades to the mantra of buy and hold, and the random walk down Wall Street. Investors still smarting from the pain of the current long wave winter and business cycle rollercoaster ride likely wish they had read of Graham’s wisdom regarding formula timing plans in the 1949 edition, where he wrote, “I am more and more impressed with the possibilities of history’s repeating itself on many different counts. You don’t get very far in Wall Street with the simple, convenient conclusion that a given level of prices is not too high… In recent years certain compromise methods have been devised by which the investor can take some advantage of the stock market’s cycles without running the risk of an unduly long wait or of ‘missing the market’ altogether. These are known as formula timing plans.”

The Wall Street financial product sales machine incorporated aspects of Graham’s value investing for decades. Those who diligently applied Graham’s value based approach knocked the socks off other investment approaches. Occasionally business cycles got in the way of returns, but for the large part the business cycle declines were short, offered buying opportunities, and the great bull market roared on for years. Then something happened along the random walk to perpetual investing nirvana. The Kondratieff long wave winter season arrived and knocked global markets and investors for a loop.

The impact of market cycles on investment strategy is getting attention once again. A formula timing plan based on global market cycles that helps identify market cycle highs and lows for position entry, exit, and stop losses belongs in the toolbox of all serious investors and traders. Whether you are a value, growth or momentum investor, or a trader seeking to indentify market turns, a formula timing plan can be highly beneficial.

Another piece of Graham wisdom is the need to recognize the difference between investors and traders, specifically as it relates to formula timing plans. This is what Graham had to say, “The most realistic distinction between the investor and the speculator (trader) is found in their attitude toward stock-market movements. The speculator’s primary interest lies in anticipating and profiting from market fluctuations. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.”

Many technical analysis methods can serve as formula timing plans to identify probable market highs for selling and lows for buying. Technical analysis can improve the returns of any investment approach, be it value, growth, momentum, or trading in any global market. Long Wave Dynamics is a formula timing plan developed after several decades of studying global market cycles, market-timing masters, and their methods.

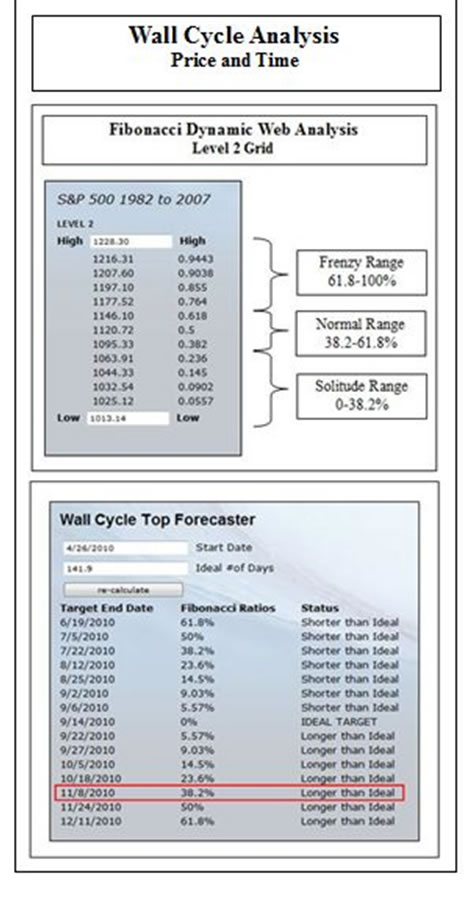

Long Wave Dynamics recognizes that market cycles occur on many levels of time and price. Essentially, there are small cycles and large cycles. The smaller cycles aggregate to form the larger cycles and there are mathematical and Fibonacci relationships between cycles. Investors have more interest in the time and price targets of the larger cycles, while traders are interested in the time and price targets of the smaller cycles.

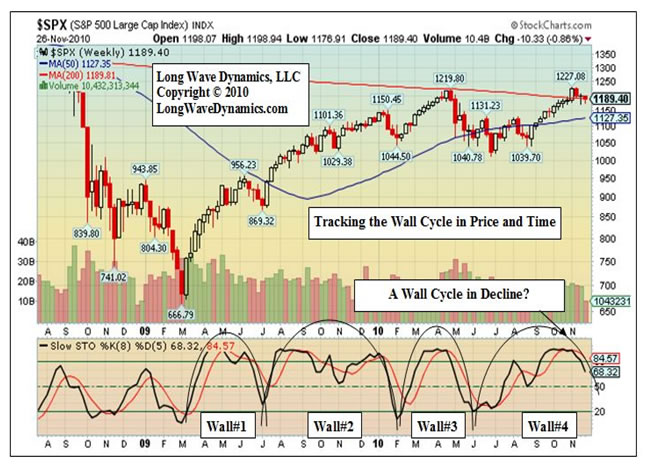

The Kitchin cycle, aka the business cycle, which began in March 2009, has primarily been an inventory build business cycle and not a capital investment cycle. However, the cycle that is of greatest interests at Long Wave Dynamics for investors and traders is the Wall cycle, aka the 20-week cycle. There are nine Wall cycles in every Kitchin cycle. The Wall cycle resides at the intersection between the cycles of interests to investors and traders. Investors are more interested in the highs and lows of the Wall cycle and the larger cycles. Traders are interested in the Wall cycle, but also the Quarter Wall cycle, the four smaller cycles in every Wall cycle.

The Long Wave Dynamics Letter tracks the Kitchin cycle, Wall cycle, Quarter Wall cycle and other cycles. Market cycle analysis combined with the right tools for Fibonacci targeting in price and time produces a cycle based formula timing plan with actionable market intelligence for investors and traders. These methods produced a target high on November 8 at 1228 in the S&P 500, and then a bottom target on November 16, which also turned the market. The November 24 high target also appears to have produced resistance in global markets.

Tracking the ebb and flow of the Wall cycle with the Long Wave Dynamics approach to market cycle analysis is a formula timing plan for investors and traders. The Long Wave Dynamics formula timing plan allows you to identify entry and exit opportunities in price and time that will complement the other investing and trading methods you utilize.

When incorporating a formula timing plan with a value investing strategy, the investor has purchased shares based on their cash flow value. If the formula timing plan misses the exact bottom of the market, the investor still owns solid enterprises and their cash flows. However, most shares have been overvalued recently, based on historic norms of basic value parameters such as dividend yield. Based on analysis of the larger market cycles, greater value based opportunities may be identified ahead, as the long wave winter reaches it nadir once again, but each Wall cycle offers potential buying opportunities for investors, if they are not interested in waiting on the buying opportunities of the larger cycles.

The last time global markets were at such an important juncture in the long wave, Benjamin Graham was working on the first edition of his famous book. That book recognized that investors and traders would benefit from a formula timing plan that tracks market cycles.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2010 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.