Netflix: Will This Movie Ever End?

Companies / Tech Stocks Nov 27, 2010 - 05:46 AM GMTBy: Dian_L_Chu

After driving Blockbuster out of business and taking a good chunk of subscribers from cable TVs, Netflix (NFLX) is now setting sight on the streaming video business. On Monday Nov. 22, Netflix announced a new subscription service--$7.99 a month for unlimited downloads of movies and television shows, while raising prices (by one dollar) on its existing DVD-related service plans.

After driving Blockbuster out of business and taking a good chunk of subscribers from cable TVs, Netflix (NFLX) is now setting sight on the streaming video business. On Monday Nov. 22, Netflix announced a new subscription service--$7.99 a month for unlimited downloads of movies and television shows, while raising prices (by one dollar) on its existing DVD-related service plans.

This officially moves the DVD rental king onto the turf of heavy weights like Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN), who are all competitors in video-on-demand (VOD) service.

This officially moves the DVD rental king onto the turf of heavy weights like Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN), who are all competitors in video-on-demand (VOD) service.

Smooth Sailing So Far

So far, it has been smooth sailing for the California-based company. Netflix went public in 2002, and its mail DVD rental with no late fees model essentially sent Blockbuster packing into Chapter 11 (albeit a lot has to do with Blockbuster’s inability to adapt to new trend and technology.)

In addition to the mail DVD rental business, Netflix also has morphed into a formidable internet content provider, setting itself apart of the competition by successfully rolling out a slick Internet video streaming service in 2008, directly to a subscriber’s TV set, bypassing the cable box.

Netflix stocks has really taken off since 2008 –up 800% in two years (see historic chart), as Netflix was probably one of the very few companies that were growing and profitable during the Great Recession.

Netflix Stock Chart by YCharts

Helped by the Great Recession

To many newly unemployed, or making less income, or just trying to save more, it is an easy choice among cable, movie theaters and Netflix. With Netflix, you basically pay a flat monthly fee (for as low as around $9 a month) and can watch as many DVDs (as fast as you can return them) plus unlimited streaming.

So, it is of no surprise that for the first time, cable TV subscriptions fell in the United States in the last two quarters, which many attributed to the rising of Netflix.

Netflix now boasts a large customer base of 16 million customers. A recent study by Sandvine, an Internet traffic consultancy, shows that Netflix’s peak viewing period is the same as TV’s prime time--8 p.m. to 10 p.m.--and accounts for more than 20% of non-mobile North American Internet use.

Growing Pains – Subs & Revenue

However, just like any business, Netflix seems to be approaching the peak of its cycle. That is, it is becoming more difficult to grow subscribers as well as revenue, which is probably a big part of the reason it is going digital right now.

Its average monthly revenue per user (ARPU)--$12.12 in the third quarter--has been declining due to the rapid growth of new subscribers at the lowest rate tier ($8.99/month). Now, with its new streaming service plan, the company expects more subscribers to increasingly shift to streaming digital content.

On the other hand, if there is a significant number of new and converted digital subscribers as expected, the new streaming service price—$7.99/month--would mean further deterioration of revenue per subscriber, which is one of the major revenue and growth metrics.

Growing Pains – Cost Control

Furthermore, Netflix already disclosed that it had $1.2 billion in commitments to pay for streaming content in Q3, up from just $115 million at the end of last year. And since its streaming library is still quite limited without the depth of its DVD content, Netflix will need to increase its streaming selection.

And inevitably, content will only get more and more expensive, which would suggest ever increasing fees putting margins under pressure.

In its Q3 earnings call, management guided long term gross margin between 30% and 35%, and expected to control costs partly by reallocating postal cost to content cost with more streaming only customers. While this still remains to be seen, the more likely scenario is that DVD and streaming will coexist side by side so long as each has enough differentiation serving different target audience. So, that would also suggest Netflix cost model could go up, e.g., on postage as well as on marketing.

Subs, Scale & Technology

One strength of Netflix is its ability to leverage technology to rapidly scale its business with 58 highly automated distribution centers that can serve 97% of the subscriber base with one-day turnaround. As such, it is hard to imagine any new entrants would cough up a sizable investment just for a match-up.

So, for now, Netflix’s large subscriber base, scale, distribution, content and technology lead may position the company as the first mover with a niche in the VOD sector.

Not in Kansas Any More

Nevertheless, streaming is not your brick & mortar video rental business. The sector is highly competitive with quite a few big players (with deep pocket) vying for a piece of the pie. With the tech sector today, it is just a matter of time before Apple, Microsoft, Google, or Amazon would come up with some kind of rivaling technology and deployment network.

Who Wins the Dog Fight?

Meanwhile, cable companies, aka crucial-for-streaming broadband providers, and movie studios, aka content owners--with some turned streaming service providers--are also likely to pose either as threat and/or obstacle to Netflix. And frankly, it is hard to say Netflix would come out as the winner if it has to lock horns with any or all of the big players over the movie and TV streaming business.

Valuation Assuming HBO 2.0

From a valuation standpoint, the stock has been on a huge tear with a current P/E of 72.86 (the average P/E of S&P 500 is around 22), and is clearly priced as the future "HBO 2.0". But from what we discussed here, Netflix ultimately could be heading towards low 30% gross margin area with around 10% net profit, which is a far cry from such a rich valuation.

A Momentum Stock

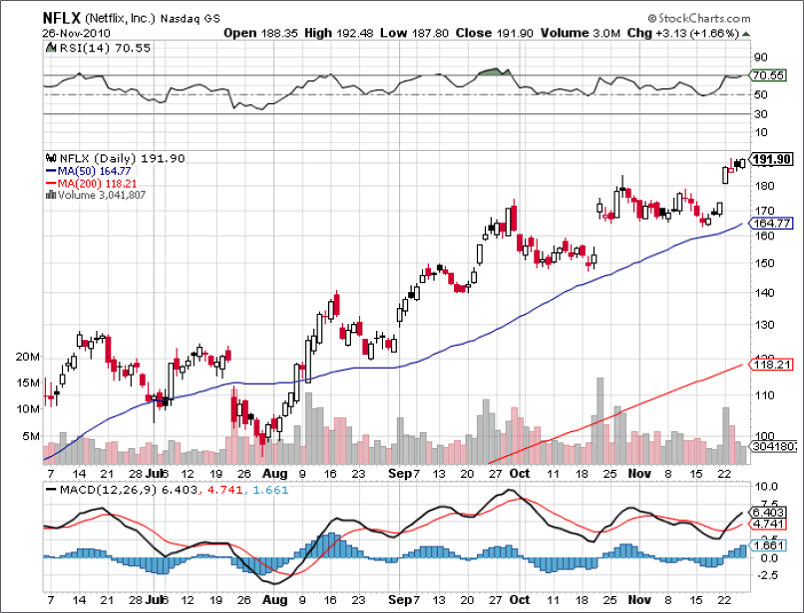

From a technical perspective (see technical chart), there are definitive indications that the stock is very overbought and prone to volatility, particularly around the earnings release time.

Source: Stockcharts.com

Current chart shows the next resistance level should be around $200, support at around $170, then $150 respectively, with major support at $120. If it breaks $120....look out below.

For long investors already in position, $170 would be the level to cash in on some profits.

Last but not least, bear in mind that this is one of the few classic momentum stocks, i.e., when the the current uptrend breaks, it tends to fall hard and fast.

Disclosure: a Netflix subscriber, but no positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.