Gold Holds Steady as Silver Targets $30 on Demand and Increasing Debt Contagion Risk

Commodities / Gold and Silver 2010 Nov 26, 2010 - 06:52 AM GMTBy: GoldCore

Gold is steady in dollars and pounds but has risen again in euros as the dollar has fallen in world markets. Gold is being supported by renewed concerns of contagion in eurozone debt markets and the risk that tensions in the Korean peninsula will escalate into a war. The hesitant risk appetite of recent days has dissipated again on these concerns. This is seeing falls in equity markets internationally and gold being supported – particularly in euro terms.

Gold is steady in dollars and pounds but has risen again in euros as the dollar has fallen in world markets. Gold is being supported by renewed concerns of contagion in eurozone debt markets and the risk that tensions in the Korean peninsula will escalate into a war. The hesitant risk appetite of recent days has dissipated again on these concerns. This is seeing falls in equity markets internationally and gold being supported – particularly in euro terms.

Gold is currently trading at $1,361.72/oz, €1,028.80/oz and £868.11/oz.

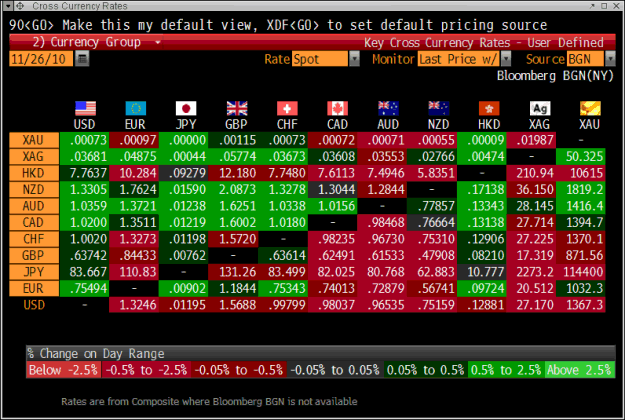

Cross Currency Table.

Eurozone peripheral sovereign bonds are little changed, with yields near record highs since joining the euro. There are reports that Portugal is being pushed towards a Ireland style bailout package. The Portuguese government said that reports it was being strong-armed into accepting a bailout, were untrue. The Spanish prime minister warned short sellers of Madrid’s debt that they were "mistaken" and ruled out the need for any bailout. This is very reminiscent of the protestations from Dublin by the Irish Prime Minister and Finance Minister some weeks ago.

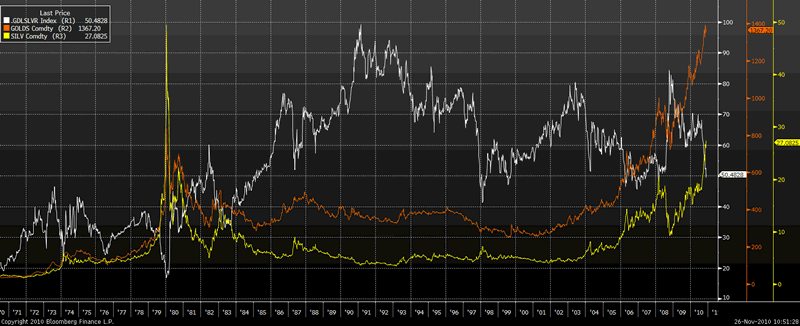

Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white) - 40 Years.

SILVER

Analysts from GFMS and elsewhere are forecasting that "poor man's gold" silver will reach over $30/oz in 2011. Given the favourable supply and demand equation and the significant increase in investment demand this seems likely and may happen early in 2011.

Silver is currently trading $26.67/oz, €20.15/oz and £17.00/oz.

Silver, unlike gold, remains well below its nominal high of just over $50/oz in 1980. Hedge funds and investors with a knowledge of the technicals are targeting this level and will likely continue buying and accumulating until the price level has been reached. Then, many may sell, take profits and/or reduce allocations.

Silver is in effect playing catch up with gold. It remains undervalued versus gold on a historical basis. The gold/silver ratio remains favourable to silver at 50.25 ($1,367/oz divided by $27.20/oz) and the ratio is falling.

Gold to Silver Ratio - 40 Years.

Silver could be the surprise outperformer in 2011 as it was in 2010. Silver's industrial uses should mean that the gold/silver ratio will likely gradually regress to the average in the last 100 hundred years - around 45:1. If the tiny silver market was to see real funds enter it, the ratio could return closer to the historical average of 15:1. This occurred as recently as in 1968 and in 1980 and this time around could result in silver surpassing its 1980 nominal high at $50/oz.

Silver reached $50/oz briefly in 1980 when just one billionaire family, the Hunts (one of a handful of billionaires in the 1970s) attempted to corner the silver market causing the price to surge (in conjunction with many investors seeking to hedge themselves from the stagflation of the 1970s). Today there are hundreds of billionaires and hedge funds throughout the world – some of whom may be tempted to squeeze the large concentrated short positions of JP Morgan in particular. JP Morgan is now facing lawsuits and being sued for manipulation and suppression of silver prices.

Silver is priced at some $27.20/oz today. The average nominal price of silver in 1979 and 1980 was $21.80/oz and $16.39/oz respectively. In today's dollars and adjusted for inflation (government CPI) that would equate to an inflation adjusted average price of some $60/oz and $44/oz. It is for this reason that we believe silver will be valued at over $50/oz in the next 2 to 3 years.

Silver remains undervalued vis-a-vis gold and remains a contrarian play with little or no media coverage and few retail investors having any allocation to silver whatsoever. A close above $28.50/oz could see silver quickly rise to $30 per ounce.

PLATINUM GROUP METALS

Platinum is currently trading at $1,636.00/oz, palladium at $667.00/oz and rhodium at $2,300/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.