Gold and Silver Precious Metals Perspective

Commodities / Gold and Silver 2010 Nov 26, 2010 - 04:38 AM GMTBy: Brian_Bloom

The following is just to remind us all that the recent silver price and gold price spurts are probably not “structural”. More likely, they are a knee jerk (emotional) reaction to the disintegration of what was once thought to be indestructible – the supremacy of the Anglo-American economic system of egocentric free enterprise and of the Anglo-American political system of bicameral democracy. A “way of life” is dying. Free enterprise has been smothered by the power of the global oligopolies and by greed and corruption now running feral; and the bicameral political system has been finessed by special interests

It matters not what the president of the World Bank may or may not want the role of gold to be. The numbers are these:

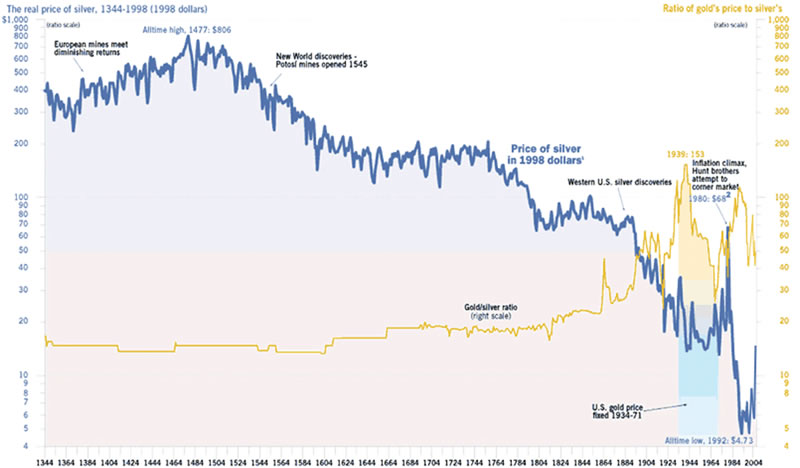

For gold to become money it will have to rise to something like US$16,000 - US$20,000 an ounce and the ratio of gold:silver will have to fall to around 16 – in order to realign the US Dollar prices of precious metals with a pure gold standard and for the precious metals to realign with one another as per history. The price of silver as at last night was US$27 an ounce. Have a look at where US$27 is on the chart below. It sits well below a > 500 year trend line even before we start to adjust for inflation.

In this context it cannot be argued objectively that silver is entering a new phase of monetization. And those who are arguing for a gold standard should remember that, historically, gold and silver were joined at the hip when precious metals were regarded as “money”.

All this talk about a gold standard is not addressing the underlying question: Where to now for the human race? I am not predisposed to want to pop anyone’s bubbles but gold will never again be a medium of exchange. There are too many people and there is not enough gold. It really is that simple. The numbers cannot be made to work. (As an aside, this doesn’t mean that, therefore, one should not be invested in gold)

Can gold form a partial basis of a fractional reserve monetary system backed by gold? Of course it can. But that’s like arguing what colour your new car is going to be when you haven’t even started thinking about whether your new car is going to be powered by an internal combustion, electric, hybrid, hydrogen or other engine.

The decision of Russia and China to move away from the dollar is about as important as a piece of old paint flaking off the wall of a derelict building. The core economic issue is not money. The core economic issue is “energy output per capita”. By an extension of logic, the core social issue is “resource availability per capita”.

There are only two possible ways forward:

- Increase the amount of energy/resources available (Dig deeper, mine the oceans, look beyond the planet – all within the context of an environment under stress)

- Reduce the number of people (Either deliberately or by wilful neglect or through lack of resources)

Brian Bloom

Author, Beyond Neanderthal

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.