Fed’s Bearish Outlook Justifies QE2

Economics / Quantitative Easing Nov 24, 2010 - 03:53 AM GMTBy: Asha_Bangalore

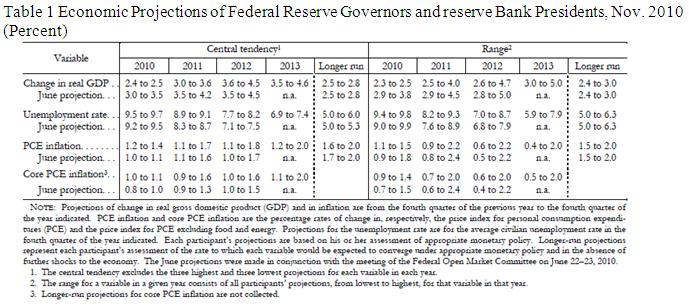

The minutes of the November 2-3 FOMC meeting include forecasts about real GDP, inflation, and employment from members of the FOMC. The main conclusion from the new forecast is that the Fed is less sanguine about the pace of economic activity in the final three months of 2010 and 2011 compared with the previous forecast (see table below). The downward revision of growth and an upward revision of employment entirely justifies the announcement of the second round of quantitative easing of $600 billion.

The minutes of the November 2-3 FOMC meeting include forecasts about real GDP, inflation, and employment from members of the FOMC. The main conclusion from the new forecast is that the Fed is less sanguine about the pace of economic activity in the final three months of 2010 and 2011 compared with the previous forecast (see table below). The downward revision of growth and an upward revision of employment entirely justifies the announcement of the second round of quantitative easing of $600 billion.

Source: http://www.federalreserve.gov/monetarypolicy/fomcminutes20101103.htm

The following excerpt indicates that the level of concern within the FOMC which prompted the November 3 action:

Though the economic recovery was continuing, members considered progress toward meeting the Committee's dual mandate of maximum employment and price stability as having been disappointingly slow. Moreover, members generally thought that progress was likely to remain slow. Accordingly, most members judged it appropriate to take action to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with the Committee's mandate.

The Fed cited several factors that have brought about the current economic situation of high unemployment and sub-par growth: "low level of business and household confidence, concerns about the durability of economic recovery, continuing uncertainty about future tax and regulatory environment, depressed housing market, waning fiscal stimulus, and still-weak financial conditions of some households and small businesses."

The minutes indicate differences of opinion within the Fed. First, a range of views prevailed about the magnitude of structural unemployment in the economy. Many held the opinion that the "unemployment rate was well above levels that could be explained by structural factors alone, noting for example, reports from business contacts indicating that weak growth in demand for their firms' products remained a key reason why they were reluctant to add employees." Second, FOMC members shared different views about the outlook of the economy, with most members seeing the risks to growth as balanced, but many held that it was "tilted to the downside."

Third, most members view the large scale purchases of Treasuries as leading to lower interest rates and higher asset prices, while some indicated that it would mean a depreciation of the dollar. The ultimate impact of this action was seen to result as higher output and lower unemployment. However, a few others viewed the exercise as likely to have a limited impact on output and employment. A significant decline in the price of the dollar and undesirably high inflation were seen as the downsides of this action by a few others.

The Fed held a videoconference on October 15, the whereabouts of which were only published today. The costs and benefits of targeting an interest rate were discussed. Two schools of thought emerged, with one seeing the upside of reducing a longer-term rate and providing stimulus to the economy, while the other side was focused on the possibility of the Fed having to buy large amounts of securities to accomplish this feat. The need to modify Fed communication to the public and whether Mr. Bernanke should hold periodic news conferences were also discussed.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.