Geithner Politicizes the Fed, Warns Congress to Not do the Same, Inflation Targeting Parabolic Curve

Politics / Central Banks Nov 23, 2010 - 04:57 AM GMTBy: Mike_Shedlock

The hypocrisy of treasury secretary Tim Geithner would be stunning except for the fact hypocrisy from Geithner is pretty much an every day occurrence.

The hypocrisy of treasury secretary Tim Geithner would be stunning except for the fact hypocrisy from Geithner is pretty much an every day occurrence.

Geithner is blasting Congress for politicizing the Fed, while doing the same thing himself. To top it off, the Fed itself is politicizing the Fed by interfering and commenting on Fiscal policy while bitching about Congress commenting on monetary policy.

Please consider Geithner Warns Republicans Against Politicizing Fed.

U.S. Treasury Secretary Timothy F. Geithner warned Republicans against politicizing the Federal Reserve and said the Obama administration would oppose any effort to strip the central bank of its mandate to pursue full employment.

“It is very important to keep politics out of monetary policy,” Geithner said in an interview airing on Bloomberg Television’s “Political Capital with Al Hunt” this weekend. “You want to be very careful not to take steps that hurt our credibility.”

Fed Chairman Ben S. Bernanke defended the monetary stimulus in a speech in Frankfurt today and in a meeting with U.S. senators earlier this week.

The best way to underpin the dollar and support the global recovery “is through policies that lead to a resumption of robust growth in a context of price stability in the United States,” Bernanke said in his speech.

The asset purchases will be used in a way that’s “measured and responsive to economic conditions,” Bernanke said. Fed officials are “unwaveringly committed to price stability” and don’t seek inflation higher than the level of “2 percent or a bit less” that most policy makers see as consistent with the Fed’s legislative mandate, he said.Bernanke Comments on Fiscal Policy

Flashback, October 4, 2010: MarketWatch reports Bernanke calls for tougher budget rules

In a speech delivered at the annual meeting of the Rhode Island Public Expenditure Council and devoid of comments on monetary policy, Bernanke said that fiscal rules might be a way to impose discipline, particularly if those rules are transparent, ambitious, focused on what the legislature can control directly, and are embraced by the public.

“A fiscal rule does not guarantee improved budget outcomes; after all, any rule imposed by a legislature can be revoked or circumvented by the same legislature,” Bernanke said, according to a copy of prepared remarks made available in Washington.

The current pay-as-you-go rule “at its best” prevents new tax cuts and mandatory spending increases from making budget deficits worse but doesn’t force Congress to reduce the deficits that are already built into current law.

Bernanke said current spending plans are “unsustainable” and pointed out the ratio of federal debt-to-national income has climbed to a level not seen since the aftermath of World War II.

Though the budget deficit should narrow over the next few years so long as the economy and financial markets continue to recover, it will swell over the medium and long term if current policy settings are maintained.

“Expectations of large and increasing deficits in the future could inhibit current household and business spending -- for example, by reducing confidence in the longer-term prospects for the economy or by increasing uncertainty about future tax burdens and government spending -- and thus restrain the recovery,” Bernanke said.Hypocrisy In Action

1. It's OK for Bernanke to comment on Fiscal Policy

2. It is not OK for Congress to comment on Monetary Policy

My Position

The Fed should welcome discussion of monetary policy and Congress should welcome discussion of fiscal policy.

I happen to believe it is high time EVERYONE question the beliefs of Ben Bernanke AND the fiscal irresponsibility of Congress as well.

It is appropriate for everyone to be concerned. We need more debate, not less. Then we need action to do something about the deficit.

Bernanke Defends Position

Please consider this snip from Bernanke Defends Fed as Republican Criticism Rises

James Galbraith, an economist at the University of Texas at Austin, said the ultimate loser of a single-mandate Fed would be Congress, which would no longer be able to engage the central bank on such critical issues as growth and jobs.

“To say that you should focus on inflation and not unemployment is a little strange,” said Galbraith, who helped write the Humphrey-Hawkins Full Employment Act of 1978, which enshrined the Fed’s dual mandate to seek stable prices and full employment. “This is a warning shot by a couple of senators who know very well that they are not going to get a bill entertained.”Idiocies and Ironies

The irony is the Fed and Geithner are already bitching about Congress commenting on Fed policy yet James Galbraith says a under a "single-mandate Fed Congress would no longer be able to engage the central bank on such critical issues as growth and jobs."

The Fed clearly does not want to be engaged right now.

Fed's Dual Mandate Is Mission Impossible

The primary reason Galbraith is wrong is that dual mandates are sheer madness.

Here's the deal.

1. The Fed can control money supply but it will have no control over interest rates (or anything else).

2. The Fed can control short-term interest rates, but then it would have no control over money supply (or anything else).

That is the full and complete extent of the Fed's "control". Note that neither price stability nor unemployment is in either equation. The reason is the Fed controls neither.

Sure, the Fed can increase money supply but all those who thought it would necessarily cause prices to rise sure got it wrong.

The simple truth of the matter is the Fed can print money, but it cannot control where it goes, or even if it goes anywhere at all. Indeed the Fed can encourage but not force banks to lend, and encourage but not force consumers to borrow.

The Fed certainly cannot control jobs and in fact in a global economy it can at best, struggle to influence consumer prices.

That last statement should be obvious given Bernanke's inability to affect the CPI like he wants. Yet Galbraith not only want the Fed to promote price stability, he also wants the Fed to promote full employment (whatever the hell that means).

That Galbraith is still proud of the misguided legislation he helped write confirms he is unfit to teach.

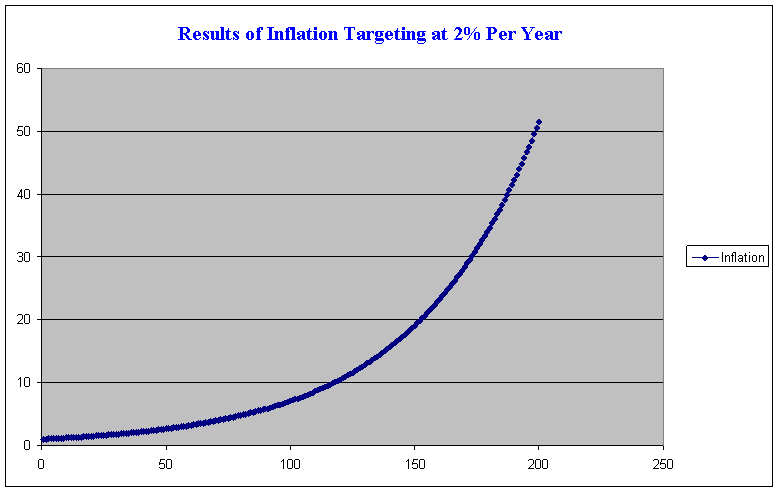

Inflation Targeting at 2% a Year

Of course the idea that "stability" means prices rising at 2% annually is stupidity in and of itself. Does this look stable to you?

Bear in mind Bernanke does not consider asset bubbles, housing prices, taxes, food, or energy in his measure of "stable" prices.

Is it any wonder we have had nothing but serial bubbles from the Fed?

Kill Dual-Mandate Idiocy

I encourage Congress to kill dual-mandate idiocy.

Heck, I encourage Congress to abolish the Fed altogether. The Fed clearly cannot even get price stability right, let alone full employment AND price stability. All the Fed has done is blow serial bubble after bubble with the help and encouragement of those like James Galbraith.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.